Domestic Equities have not been the only asset class with relative improvement this week.

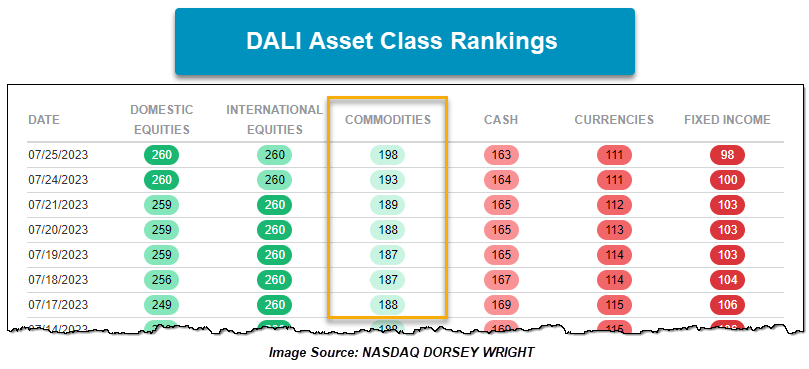

Although Domestic Equities may have garnered the primary focus this week within DALI as the asset class overtook International Equities for the top spot. Domestic Equities have not been the only asset class with relative improvement this week as Commodities are technically the most improved for the week with the addition of nine tally signals since Friday’s close. The increase in tally signals for Commodities puts further separation between the asset class and Cash and provides a notably offensive posture to the DALI Asset Class rankings. We will look at recent action within two areas of the Commodities space driving positive developments.

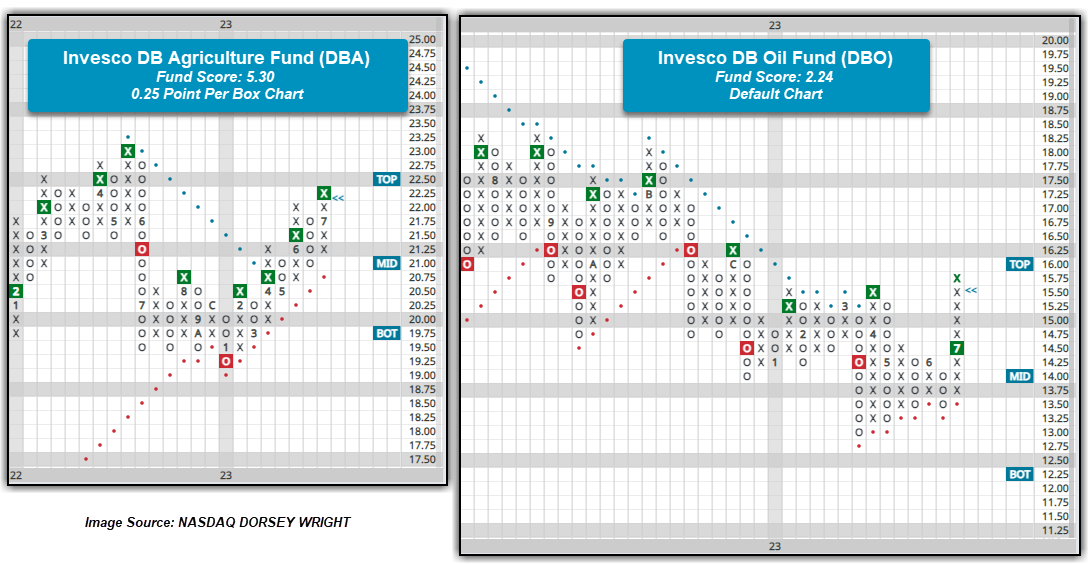

Agriculture commodity prices have advanced due to news about notable decreases in the global wheat and rice supply over the past week with the Invesco DB Agriculture Fund DBA adding 2.85% (7/18 to 7/25). This action led DBA to break a double top at $22.25 on its 0.25 point per box chart for a fourth buy signal since February. The fund possesses a fund score of 5.30, well above the average score for a fund within the space at 3.35, and weekly momentum is back positive for the fund. Those who may seek exposure could look to add on a reversal back into Os at $21.50. From here, resistance on the 0.25 point per box chart for DBA lies at $23, the May 2022 rally high, while support lies at $21 and $20.75, the bullish support line.

Meanwhile, Crude Oil CL/ advanced 5.25% to give a second buy signal on its default chart at $78 and brought the Invesco DB Oil Fund DBO to $15.75, the fund’s 2023 chart high. Unlike the Crude Oil chart, DBO has maintained a buy signal and a positive trend since the middle of April. The rally this month brought a second buy signal with the double top break at $14.50 and brought monthly momentum for the fund back to positive for the first time in eleven months. DBO now resides in overbought territory and the technical picture is still one that needs improvement as the fund score is below the acceptable 3 threshold, so we would pause before looking to add exposure to DBO. As the RS charts below will exhibit though, DBO has begun to show improvement from an RS standpoint not just a trending one.

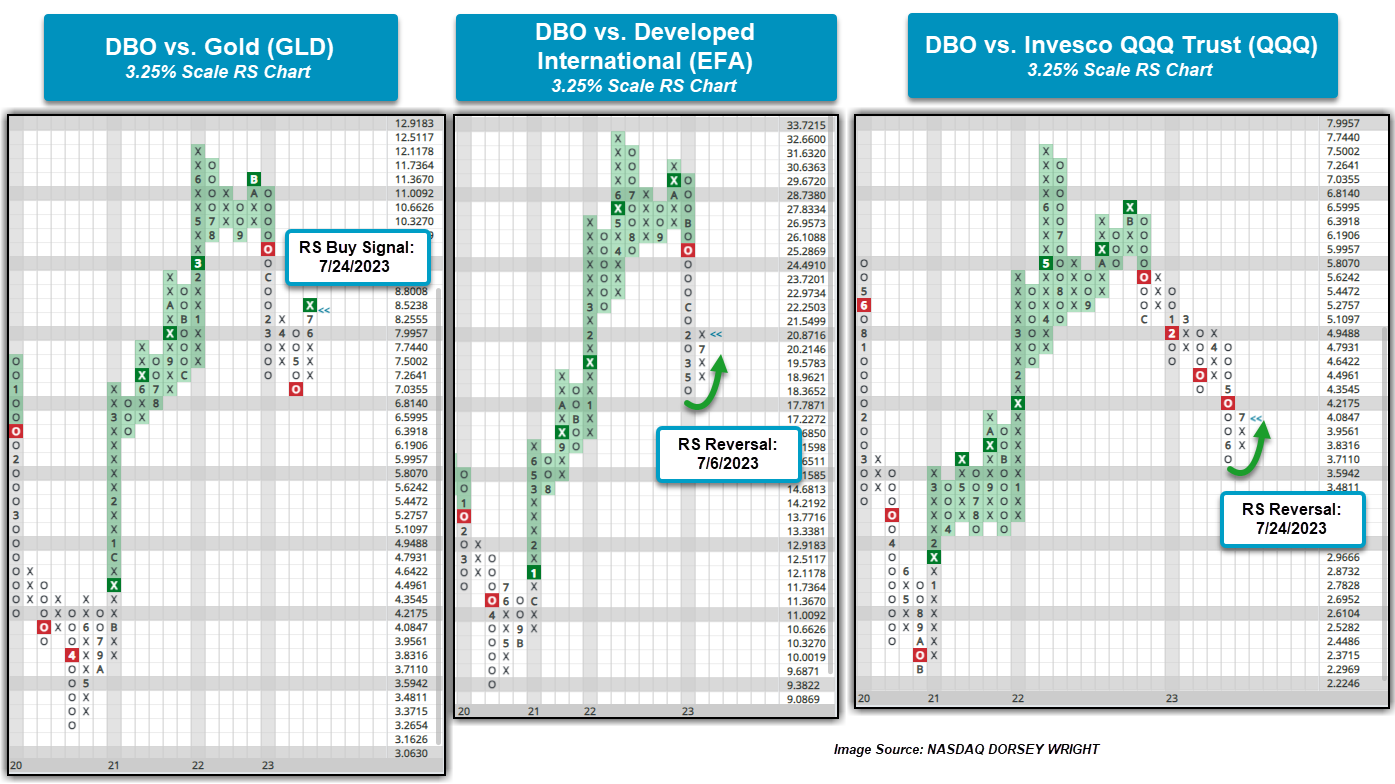

The three RS charts below compare the Invesco DB Oil Fund DBO to Gold (GLD), Developed International EFA, and the QQQ’s, on a 3.25% scale.

Gold GLD had a notable start to the year through the latter part of May when the precious metal began to move lower. This roughly coincides with the time Crude Oil began to perk up, which can be seen on the DBO chart above. Oil has outpaced Gold since that time, which led to the reversal into Xs on the RS chart, and ultimately the switch to an RS buy signal, favoring Oil, following Monday’s action. Most of the buy signals Commodities have picked up this week have been primarily due to the Oil and Energy space showing positive long-term RS versus low RS representatives from Fixed Income and Currencies.

Although not a change in long-term RS, the charts of DBO versus EFA and QQQ have moved back into X’s this month indicating positive short-term RS for the commodity over leaders within the International and Domestic Equities. Granted there have been multiple reversals into Xs this year on the RS chart of DBO versus QQQ that have ultimately not led to a long-term change in relative strength. This serves as a great example that funds from all asset classes can go through brief periods of out- or underperformance, but that the long-term RS signal dictates where a long-term trend of out- or underperformance lies. From here, Oil would need to see continued improvement along with a potential downside movement from International and Domestic Equities to ultimately see the middle and left-hand RS charts switch to favor DBO over the long term. Investors should continue to monitor action on the chart of Crude for a potential breakout of the trading range at $84 as this would indicate a potential for further upside out of the commodity. Continued trading within the current range for Crude would confirm this recent rally being short-term in nature.