While international equities moved down into the second-ranked position in DALI, we continued to see areas of sustained improvement underneath the hood of the asset class.

International equities moved out of the top-ranked position in the DALI asset class rankings over the past week, as domestic equities advanced into the top spot. While the two asset classes are technically tied in RS buy signals at 260 a piece, domestic equities get the top position by nature of the tie-breaker rules, as we covered in yesterday’s report. Even though international equities may not be in the top position anymore, the downtick in the ranking was not due to weakness in the asset class, but rather simply a result of the consistent improvement in domestic stocks. The 260 tally signal count for international equities is right at the multi-year tally high seen in January 2021 and has continued to gain steadily since the end of May, advancing 12 signals in June. We have seen international equities garner higher buy signal counts on just two other occasions since 2002, from mid-2009 to mid-2010, and from mid-2017 to mid-2018. The last period of sustained strength for international equities came from late 2004 into 2007. During that time, the international equities asset class did not surpass the same buy signal count where it currently resides. Therefore, the movement of international equities down into the second-ranked position should not be considered a negative for the asset class, as most broad representatives still show resilient technical pictures.

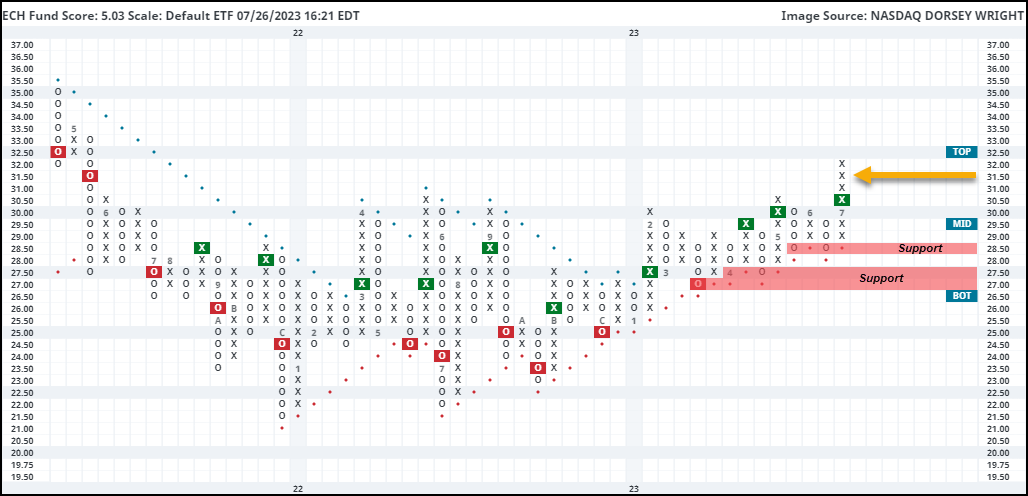

One area that has continued to demonstrate strength in foreign equities has been Latin America, which still sits as the highest-ranked group on the Asset Class Group Scores (ACGS) page at a recent average score posting of 5.12. Chile has been one of the more recent areas of improvement, as the country just moved back into the top quartile of our NDW Country Index Matrix Rankings over the past week at the current position of 10th out of the 42 names. This improvement can also be seen through the iShares MSCI Chile ETF ECH, which pushed higher earlier this month to break a spread triple top at $31 before reaching $32. This breaks the fund out of an extended consolidation range, seeing the highest price levels since May 2021. ECH has a strong 5.01 fund score and has maintained a positive trend since January, speaking to the long-term technical strength. Weekly and monthly momentum each recently flipped positive as well, suggesting the potential for further upside from here. Initial support is offered at $28.50 with further support potentially seen at $27.50 and $27.