The Fed wrapped up it July meeting Wednesday and raised the Fed funds rate by 25 bps as had widely been expected.

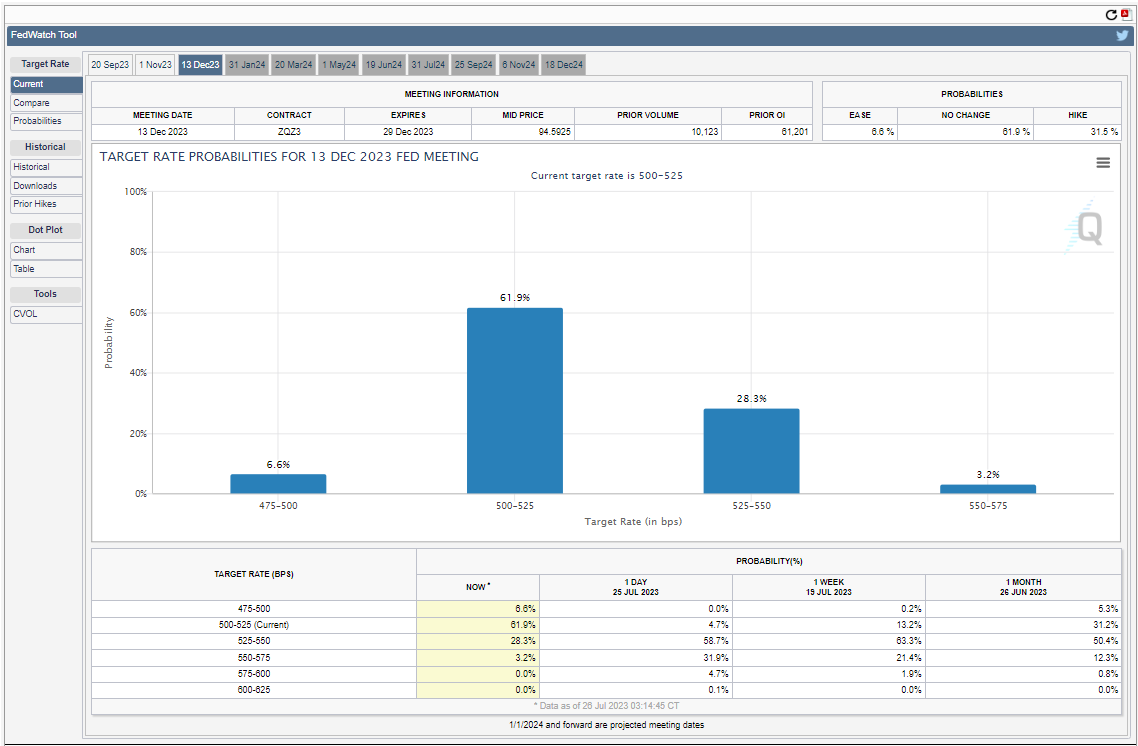

The Fed wrapped up its July meeting on Wednesday. The FOMC raised the target for the fed funds by 25 bps to 525 – 550 bps as had been widely expected. In comments following the meeting Chair Powell said the committee’s decisions regarding future rate hikes would continue to be data-driven, leaving open the possibility that we could be at the end of the tightening cycle if inflation continues to moderate. The fed futures market shifted following the meeting and by the end of the day was pricing in a 25 bps cut from the new 525-550 bps target by the end of the year. US Treasury yields fell with the US Treasury 10-year Yield Index (TNX) closing just above 3.85%.

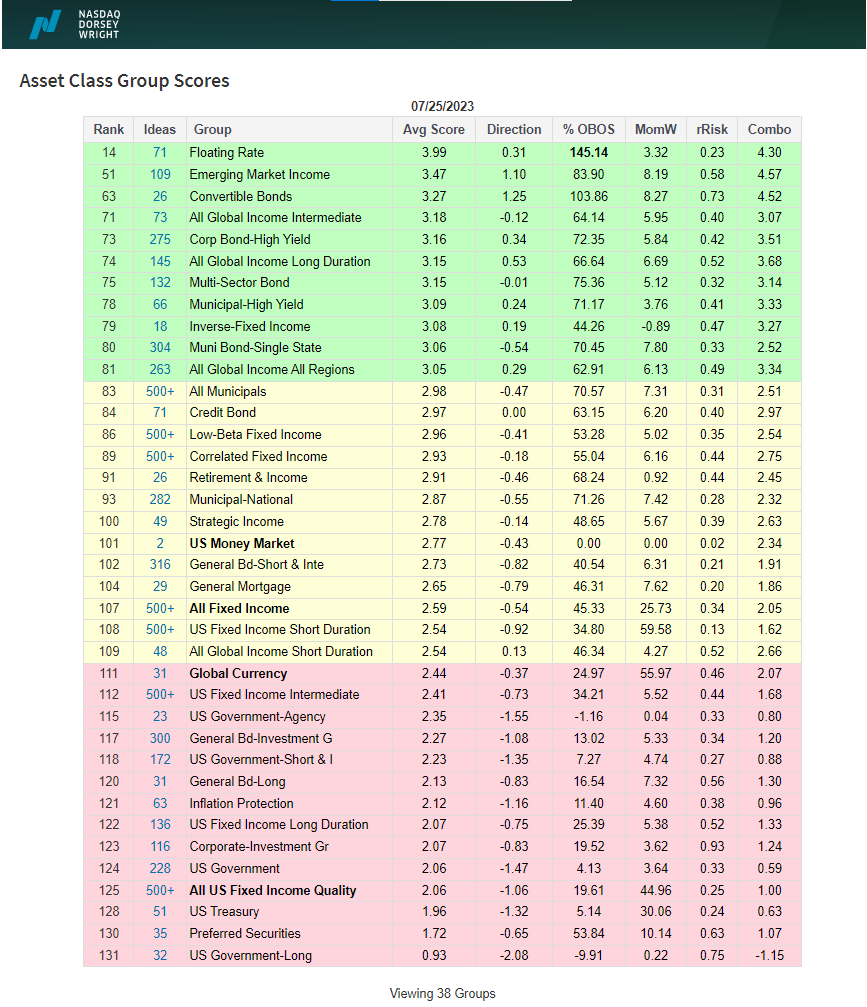

The fixed income rankings in the Asset Class Group Scores (ACGS) look largely the same as they have for the last few weeks. The bulk of strength in the market is concentrated in groups outside the US core. Floating rates remain atop the rankings with an average group score of 3.99, while emerging market income, convertible bonds, and high-yield corporates all sit in the green zone with scores north of 3.0. Meanwhile, most of the core groups like US Treasuries, US Government, and investment grade corporates, remain in the red zone with scores below 2.5. If the market’s view is correct and we have reached the end of the tightening cycle and the Fed begins cutting rates this year, we could expect to see the core US groups strengthen, but at this point, they remain a clear area of weakness.