It was a poor (but also relatively muted) week for the broad crypto space. Only three coins within the Nasdaq Crypto Index ([NCI]) outpaced the market, led by $XLM

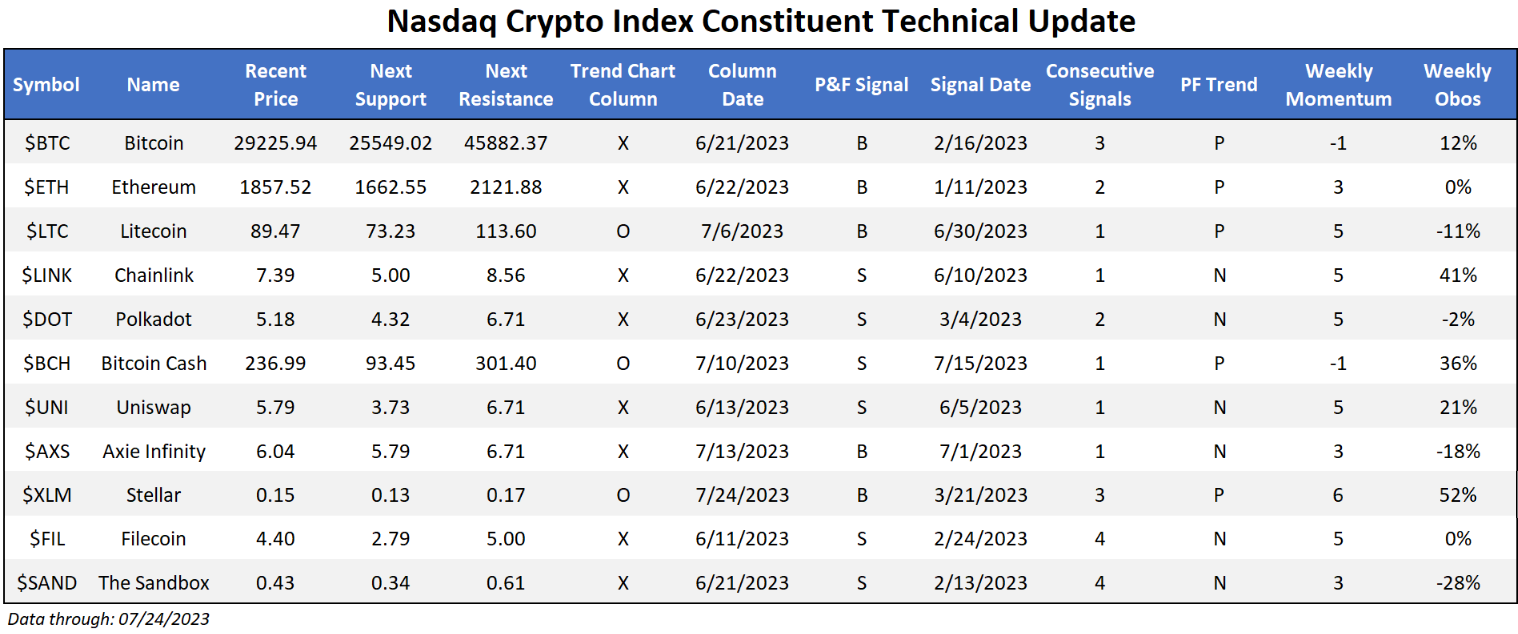

It was a poor (but also relatively muted) week for the broad crypto space. Only three coins within the Nasdaq Crypto Index (NCI) outpaced the market, led by Stellar ($XLM) which has come alive in July. Fueling this near 40% gain throughout the month was recent developments within the Stellar Ecosystem and partnerships to provide payment solutions to some generally unbanked African nations. With this fundamental catalyst in mind, the technical picture for the coin has improved as well, having broken past a stringent bearish resistance line that led the coin lower over the last 24 months. It now sits on a string of three consecutive buy signals and looks to be forming a triangle pattern towards the top of the trading band. Saying that we typically consider triangle formations to be a kind of “continuation” pattern, the recent move could provide a strong base for action if it continues to participate in upside action.

On the other side of the performance table for the last seven days comes Axie Infinity ($AXS), which fell just under 5% for the week. While the coin has returned to a buy signal to start the month of July, recent action has brought it to a somewhat pivotal position on its point and figure chart. $AXS is challenging a strong bearish resistance line, and while it maintains its column of X’s at the time of this writing, it does sit within one box of moving back into a column of O’s. From there, support is found in between $5.50- $5.80. If you do have exposure to the name, consider using the alert manager to keep track of this reversal (or possible positive trend break) by clicking the alarm clock icon above the chart.