Domestic Equities overtook International for the number 1 ranking in DALI following Monday's action.

Domestic Equities climbed to 260 tally signals following Monday’s action, tying International Equities in signal count. With the signal tie, DALI resorts to X rank as the tiebreaker which favors Domestic Equities due to its recent strength. Domestic Equities is in the first position of DALI for the first time since early-February 2022. This ends a period of 361 trading days that Domestic Equities ranked outside of the top spot, making it the second longest occurrence going back to the early 2000s. The longest period Domestic Equities ranked out of the number one spot was from August 2003 to May 2010.

Much of the gain in signal strength began around mid-May, with most of the signals coming in June (31) and July (25) – making the asset class the most improved for 2023. Since the end of May, U.S. indices have slightly outpaced International with the S&P 500 SPX adding 8.97% compared to 6.59% for MSCI ACWI ex-US Index MSCIACWIXUS. With International still maintaining positive trending and RS characteristics, U.S. Equities have had quite the uphill climb to overtake International for the top spot.

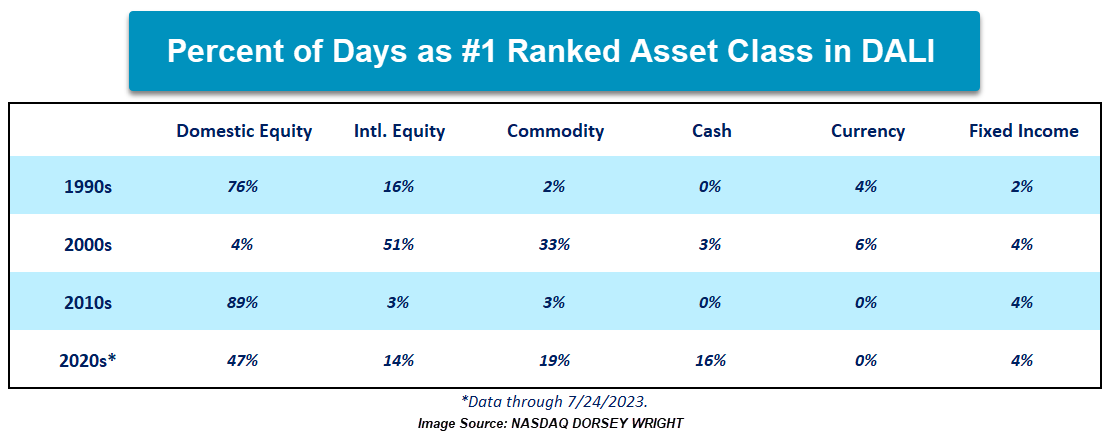

With Domestic Equities moving into the top spot, the table below shows the updated percent of days a particular asset class has held the number 1 ranking within DALI. International Equities have now possessed the top spot in DALI for 14% of the total trading days this decade, and no asset class has held the number 1 ranking for more than half the decade so far. U.S. and International have ranked either 1 or 2 since the latter part of May, giving DALI an offensive tilt. The clear separation by the two equity asset classes confirms that offense tilt as U.S. and International combined possess more tally signals than the remaining four asset classes evaluated. With DALI Tactical Tilt strategies, the change in DALI will likely bring about an increase in Domestic Equities up to their maximum allocation bounds within Moderate and Aggressive strategies. Conversationally, communication to clients that this change is confirming strength within both Equity asset classes, and not a weakness from International, should provide confidence as equity allocations may change or increase. With the recent uptick in Commodities, especially within the agriculture and energy spaces (see the feature below), the asset class has separated itself from Cash and provided an overall offensive tilt to DALI.