Inflation, the market’s biggest worry in 2022, has steadily fallen since its peak led most notably by a major fall in energy prices. Recent developments have put this steady decline in jeopardy, and it appears inflation will not go down without a fight.

Inflation, the market’s biggest worry in 2022, has steadily fallen since its peak led most notably by a major fall in energy prices. Recent developments have put this steady decline in jeopardy, and it appears inflation will not go down without a fight. OPEC+ seems resolute in its defense against crude oil staying below the $70 mark while high temperatures have stoked natural gas demand. On the agricultural front, two major changes have had an impact on food prices. The first is the dissolution of the Black Sea Grain deal between Russia and Ukraine which was highlighted by the destruction of nearly 60k tons of wheat at the Ukrainian port city of Odesa (CNBC). Second, India, a nation that accounts for more than 40% of world rice exports, ordered a major cutback on rice exports that will result in a halving of rice shipments abroad (Reuters). While prices are still well below their peaks from 2022, the recent uptick across many of the major commodities shows that inflation is still putting up a fight.

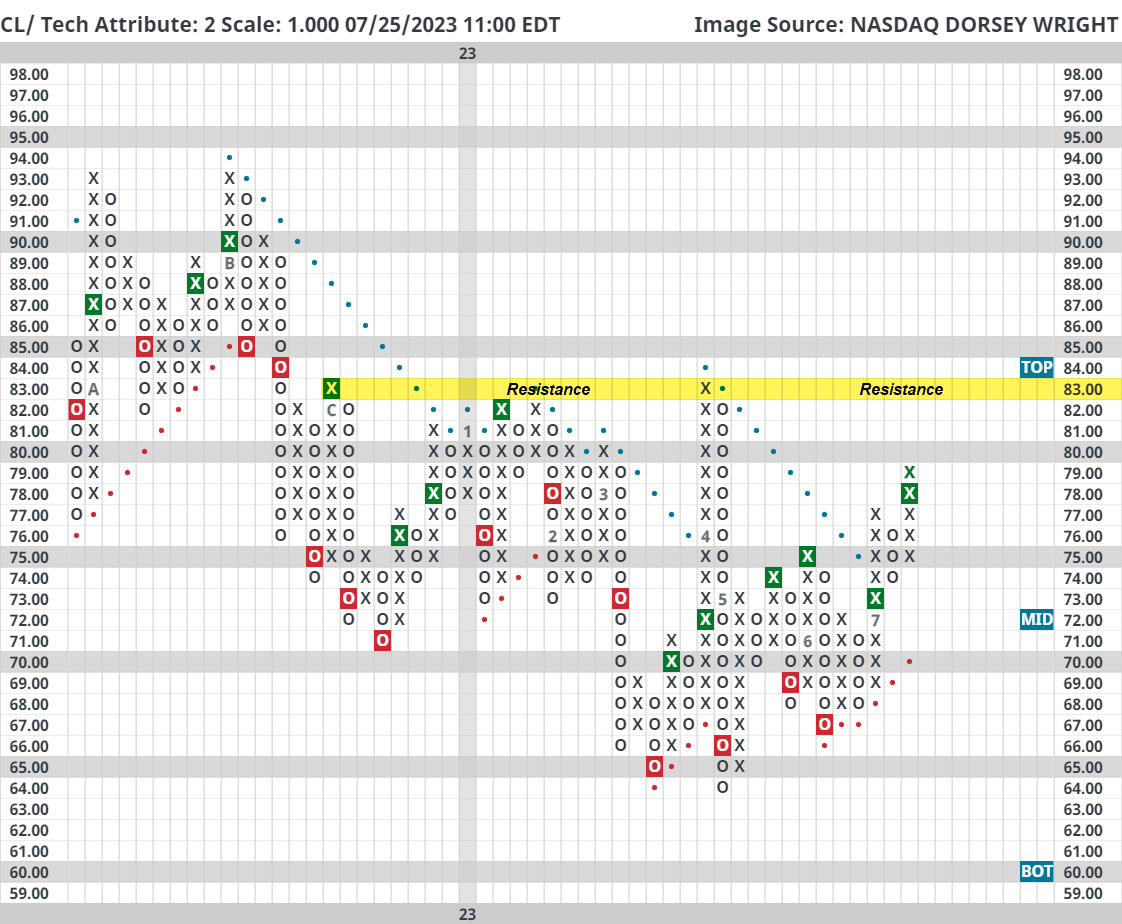

Focusing on energy-related commodities, crude oil (CL/) and gasoline (UJ/) are each up more than 10% in July. Crude returned to a positive trend earlier this month and now trades on two consecutive buy signals. However, crude is approaching major resistance in the low-80s and a move above that area would mark a shift in the energy space and open the door for a test of the low-90s, a range crude last traded in in September and October of last year. While crude has yet to reclaim its 2023 highs, gasoline prices exceeded their April highs and are $0.08 away from testing the October 2022 high. Other than a blip in May, gasoline prices have steadily risen since bottoming in December. Lastly, natural gas (NG/) experienced the most precipitous fall in the energy space until finding a bottom in April. While it is slightly down since the end of May, natural gas is up roughly 27% since bottoming a little over three months ago. None of the three commodities mentioned have strong sustained uptrends but there has been general technical improvement over the last few months. All three have well-established support with stout overhead resistance which has led to large ranges being formed over the last six months. A breakout in either direction would likely lead to a large move. Recently, prices have trended higher with a likely test of the top of each’s respective range looking more likely by the day. The fall in energy prices has been the biggest contributor to falling inflation numbers, so a reversal of that trend would likely have a key effect on inflation data.

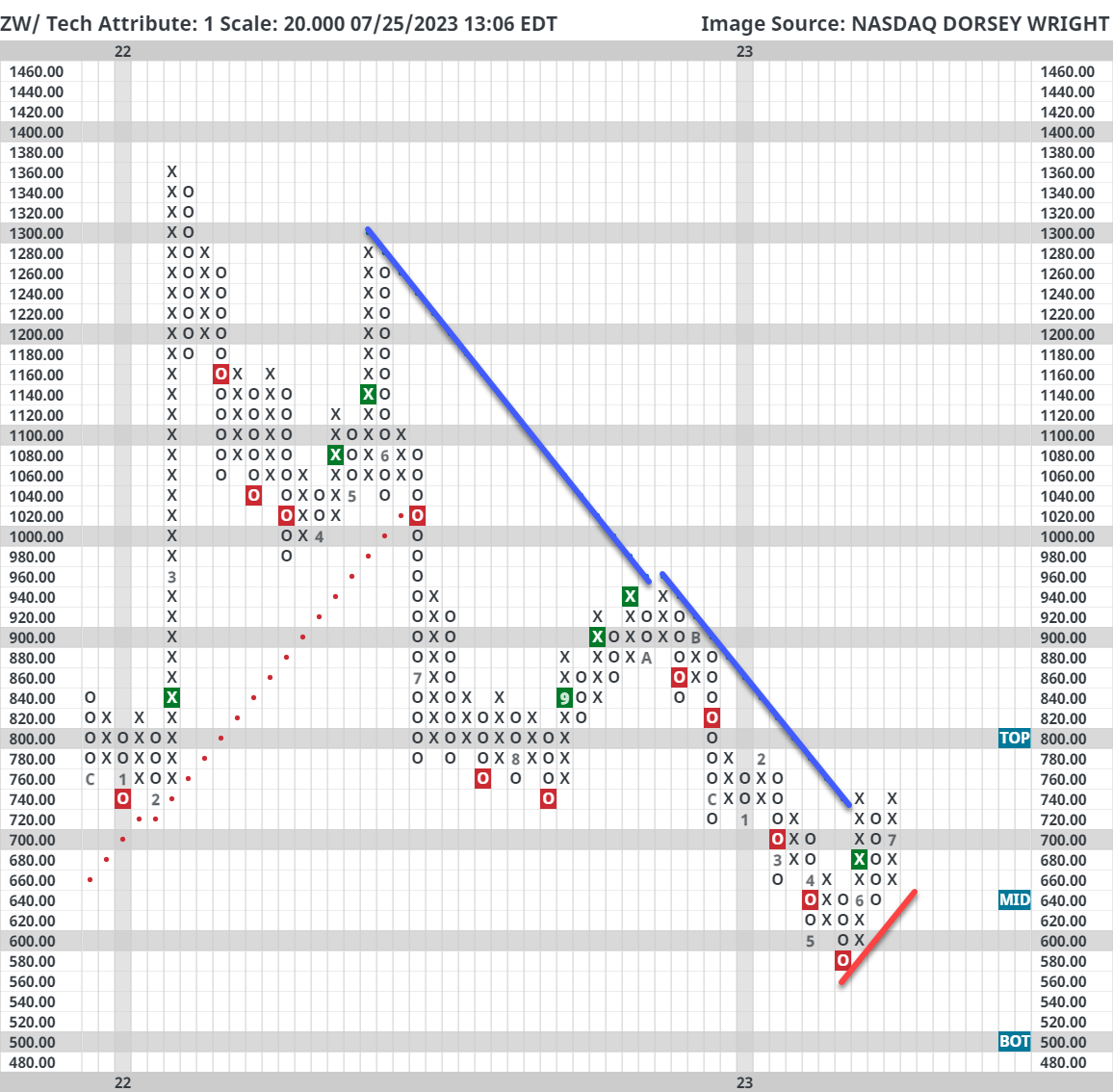

The more recent changes have been in the agriculture space, many agricultural commodities just went through their July harvest. Like equity markets, agriculture markets like wheat have seasonal tendencies as well. During the crop harvest in June and July, supply is bolstered and prices often sell off barring any bad harvests. Prices then usually trend higher. This seasonal trend was broken this year as wheat moved to a buy signal on its 20-point chart, its first buy signal since September. Wheat also entered a positive trend in June breaking through its negative trend line that had been in place since the previous June. The geopolitical influences on wheat were felt fully yesterday as wheat futures (ZW/) went limit up gaining the maximum of 60 points in a single session. Wheat prices had been steadily trending lower since October and food inflation numbers, one of the stickiest, had stabilized since March.

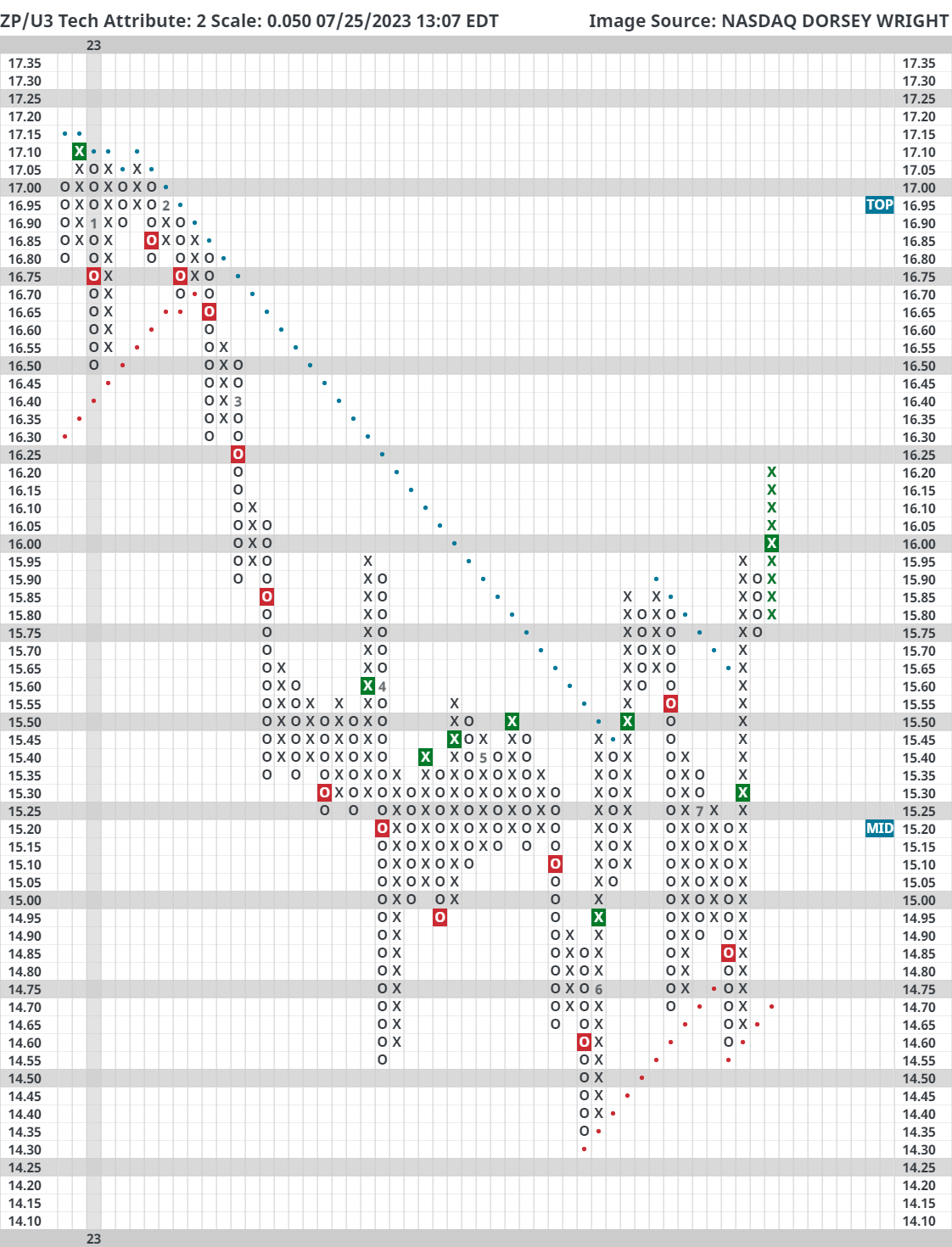

Corn (ZG/) remains in a strong downtrend and sold off heavily in June and early July. Recent news may have helped corn rally from $480 up to $560 but it’s still over 100 points off its 2023 highs. September rough rice futures (ZP/U3) have similar seasonality dynamics to corn as prices usually fall in July. India’s new export ban sent the September futures to their highest level since March on the back of an over 9% rally in less than two weeks. Briefly touched on earlier, food inflation had screeched to a halt since March with the month-over-month change averaging less than 0.1% but this does not appear like it will be sustained due to geopolitical and technical developments over the last several weeks. Both energy and agriculture markets have shown constructive moves in recent weeks. It’s still unclear whether these moves can be built upon further, but this is the first time in many months that commodities are making a joint effort to move higher. Consumer expectations remain relatively high, highlighted by the Conference Board’s one-year inflation expectations that came out this morning at 5.7%. Given the Fed’s “data-driven” approach to derive its rate decisions, an uptick in inflation will raise the chances of more rate hikes and more hawkish rhetoric which will impact both the bond and equity markets.