On July 24th the Nasdaq 100 will undergo a special rebalancing for the third time in its history and the first time since 2011.

Note to Wells Fargo Advisors: A CAR approved version of last Thursday's 2Q23 Newsletter has been added to the Media & Education section of the Resources tab. The CAR # is CAR-0723-00391.

On July 24th the Nasdaq 100 will undergo a special rebalancing for the third time in its history and the first time since 2011. The reason for the special rebalancing is due to the aggregate weight of companies, each having more than 4.5% weight in the index, exceeds 48%. While the rebalancing takes place, the cap is set to 40%. The adjustment will be based on shares outstanding as of July 3rd. Five stocks have at least a 4.5% weight including names like Microsoft (12.91%), Nvidia (7.04%), Amazon (6.89%), and Tesla (4.50%). The effects of the change will be more felt after the rebalance takes place. As most are aware, much of the performance attribution for both the Nasdaq 100 and S&P 500 indices have been at the hands of the stocks previously mentioned. Now that they will have a lower weighting in the Nasdaq 100, the influence these names have on the index will be less. Since Alphabet has two share classes, despite the total weighting of the two share classes exceeding the 4.5% threshold, it will not be affected by the rebalance.

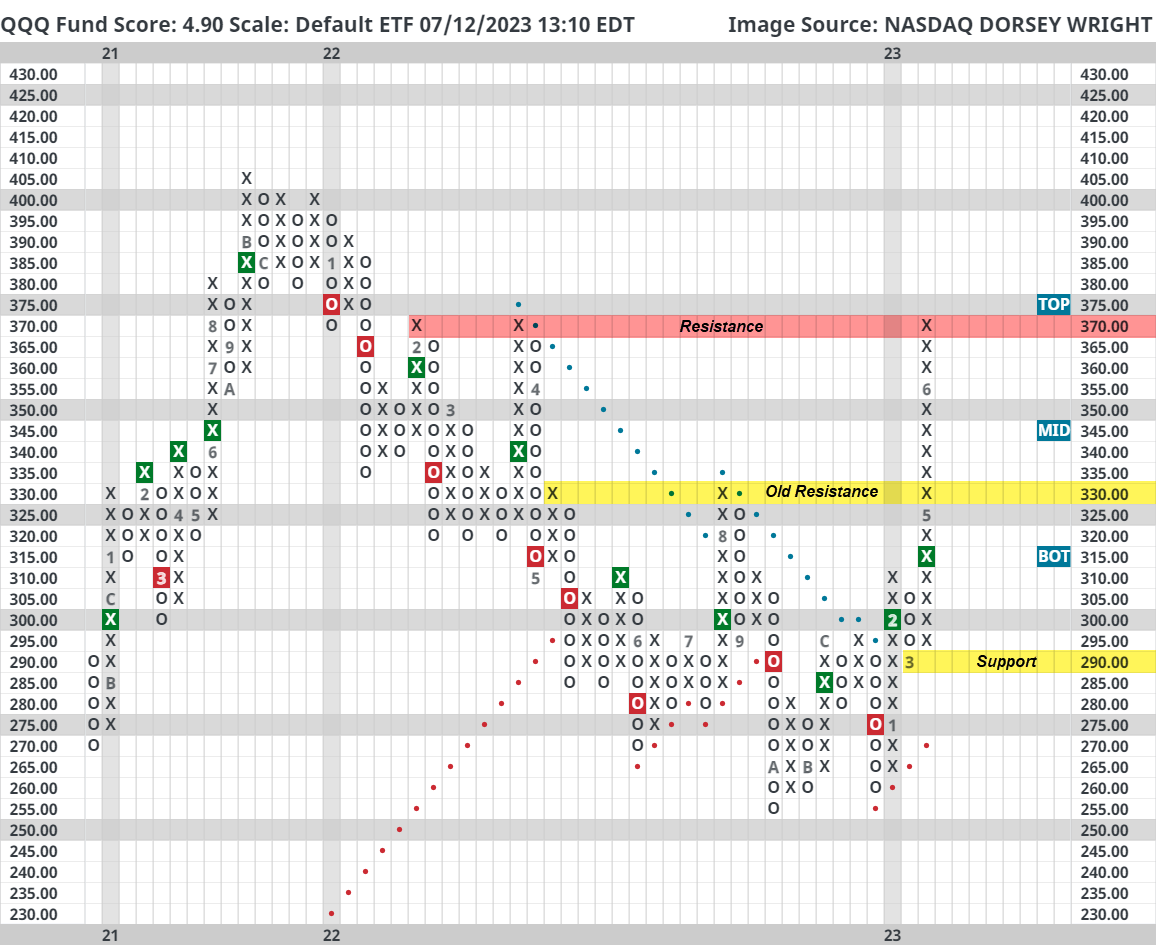

From a technical standpoint, the Nasdaq 100 has had an exceptionally strong year thus far, well noted in our research so far this year. The Invesco QQQ Trust (QQQ) has gained 38.26% year-to-date and possesses a strong fund score of 4.90. QQQ does sit in heavily overbought territory with a weekly overbought/oversold reading of 70% and is trading on a stem. Its current chart level of $370 is at a notable area of resistance dating back to February and April of 2022. From $370, its next level of true support is offered at $290, however, the $330 level may also act as support if revisited since it was a major resistance level previously. Nonetheless, the strength in Nasdaq 100 and other large-cap growth names has been exceptional so far this year and has yet to show any major signs of slowing down aside from some potential short-term headwinds.