The past week saw no significant technical developments in the Basic Materials, Healthcare, Communication Services, Utilities or Real Estate Sectors. Those that saw noteworthy movement are included below.

U.S. Sector Updates

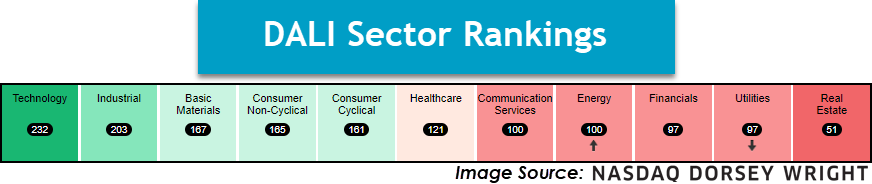

The past week saw no significant technical developments in the Basic Materials, Healthcare, Communication Services, Utilities or Real Estate Sectors. Those that saw noteworthy movement are included below, in order of their relative strength ranking in the DALI domestic equity sector rankings. Sector designations are based on DALI sector rankings and are as follows: 1 - 3 overweight, 4 - 7 equal-weight, and 8 - 11 underweight.

Technology – Overweight, Improving

The technology sector continued to gain strength in June to maintain the top-ranked position in the DALI sector rankings. That strength has been furthered this week, with breadth improving across the various subsectors. The equally weighted sector representative RSPT completed a bullish triangle pattern on its 2-point chart Wednesday, showing improvement after a few weeks of consolidation. Semiconductors continue to consolidate but show more bullish participation, with SMH reversing back up into Xs this week to form a triple top at $154. A further breakout there could offer a more opportune entry point given the normalization over the past few weeks. Software stocks are also showing strength, with names like U and HUBS each showing consistent improvement.

Industrial- Overweight

The sector continues to improve, earning over 200 buy signals this week. This extends its lead over the rest of the group but leaves it well out of range of leader technology for the time being. With that said, there are many investable areas one may consider when looking for exposure to industrials. Starting broadly, both XLI & RSPN moved higher over the last week to all-time highs, and while heavily overbought could be considered on pullbacks. There are also several technically strong stocks one may look towards, including MOG.A, ODFL, and RSG.

Consumer Non-Cyclicals- Equal Weight

Consumer Staples maintained its DALI position this week, but the sector broadly continues to weaken relative to the rest of the pack. We are seeing an intensifying divergence between staples and discretionary on the Asset Class Group Scores page, while SPDR Sector ETF XLP was the worst performing of the major 11 and just posted its lowest fund score in roughly five years. All that said, a handful of non-discretionary stocks like LW, MNST, and TAP still look strong.

Consumer Cyclical- Equal Weight

XLY was down 32 basis points over the holiday-shortened week, but the group did see improvement within the Asset Class Group Scores pages as it moved above the 4 score threshold this week for the first time since 2021. Home Construction (ITB) continues to carry the leadership baton from an RS standpoint, remaining actionable at current levels along with Lennar Corp. LEN. Domino’s Pizza DPZ announced a partnership with UBER in which DPZ will list its menu on the Uber Eats App. With Wednesday’s rally, DPZ moves above the $400 level and reverses back into Xs on its market RS chart, bringing the stock up to a 2 for 5’er. UBER provides a stronger technical picture with a 5 attribute and is on a pullback from a recent rally high.

Energy- Underweight

Energy moved up to eighth in the DALI sector rankings this week. The Energy Select Sector SPDR Fund (XLE) gave a second consecutive buy signal and returned to a positive trend this week when it completed a bullish catapult at $83. XLE’s fund score has steadily improved over the last month and recently crossed the 3.5 threshold.

Financials – Underweight