The Nasdaq Composite marked a 5% pullback Friday, but many names inside the index have fared far worse.

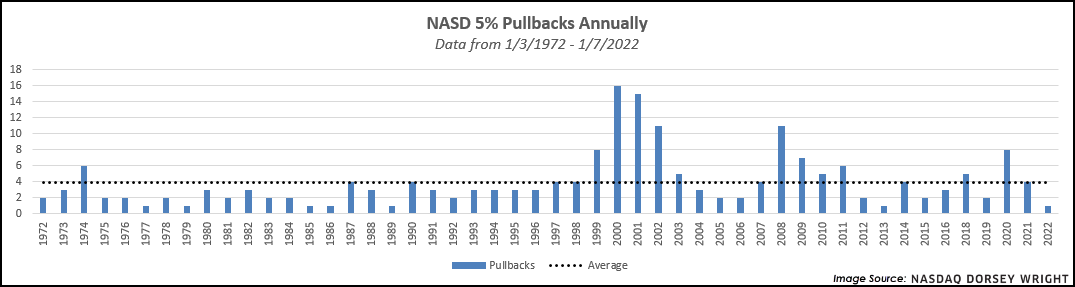

The Nasdaq Composite NASD has had a rocky start to 2022, with the index posting its fourth consecutive daily loss on Friday. In fact, the NASD has seen a decline in eight out of the last ten trading days. With Friday’s decline, the Composite has now pulled back over 5% from its closing value on December 27. There were a total of four 5% pullbacks in the NASD during 2021, which is right at the annual average dating back to 1972. There was only a 37-day gap between the last 5% pullback at the beginning of December and the most recent one, which is much quicker than the 92-day average gap between prior pullbacks. This also marks the swiftest 5% pullback since June 2020 at just eleven calendar days.

The recent decline has been amplified by many of the names underneath the hood of the Nasdaq Composite. Roughly 40% of the 3655 names in the index currently sit more than 50% lower than their 52-week high. While this number may seem alarming at first, we can separate those names into groupings by style as well as technical strength for a better understanding of the recent movement. The vast majority of names in the NASD are weak attribute names, with just 22% of the stocks having a TA rating of 3 or greater. The size and style breakdown shows that 77% of the index is classified in the small-cap space, and those three style boxes are the only of the nine to be at least 40% off their 52-week highs on average.