Oil demand outlook uncertainty remains the driving force of the volatility as the Delta variant poses risks to demand while limited U.S. production and inflation fears stoke the flames for higher prices.

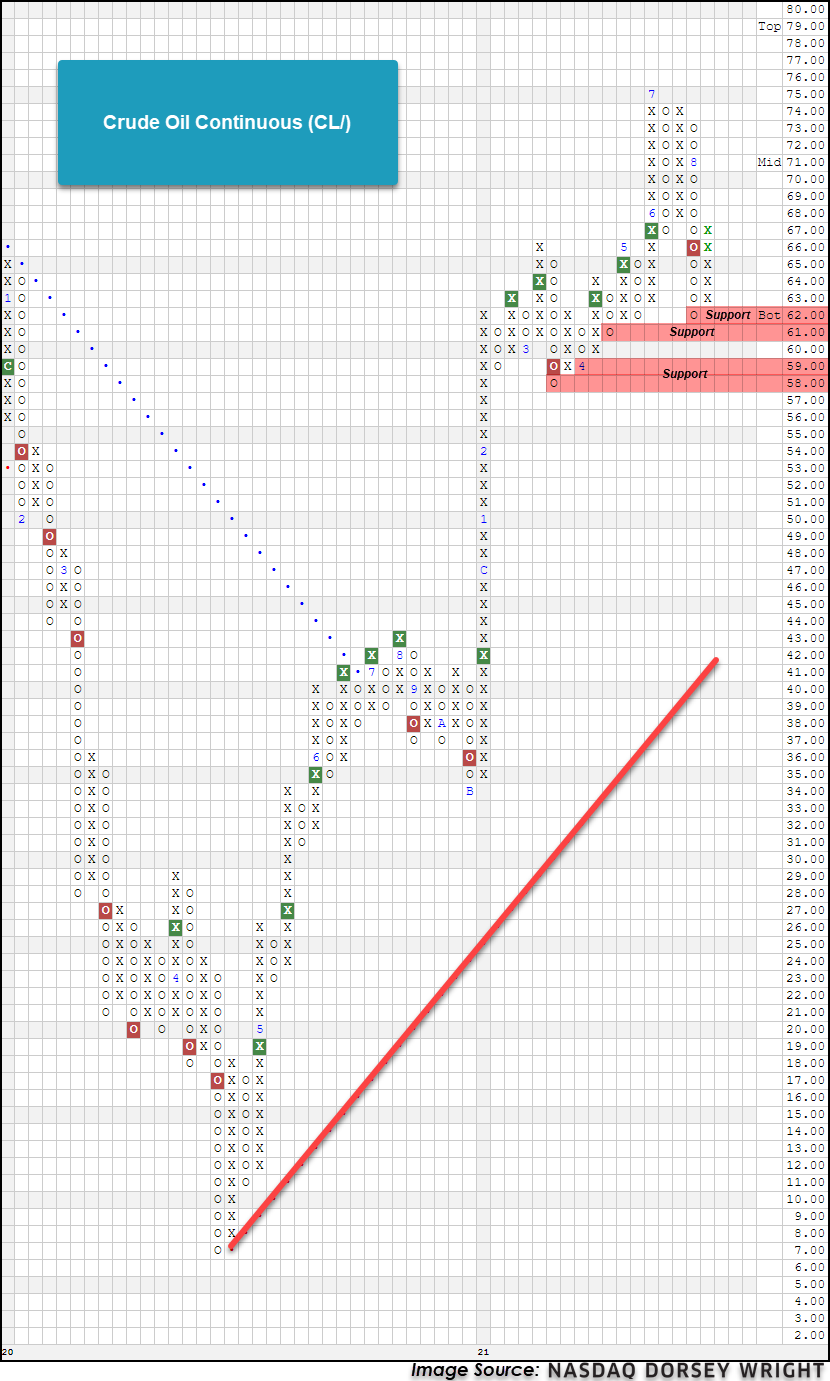

Crude oil prices have been extremely volatile in recent weeks with prices quickly fluctuating between the mid 70s and low 60s. Oil demand outlook uncertainty remains the driving force of the volatility as the Delta variant poses risks to demand while limited U.S. production and inflation fears that stoke the flames for higher prices. With some worries of prices continuing higher, the Energy Department plans to auction off 20 million barrels of crude from its strategic reserves which hold 621 million barrels as of August 13th (Bloomberg). The pullback in crude over the last week has had a major effect on our DALI sector rankings as Energy fell from the second-ranked sector at the end of June to the last ranked sector today. After a swift move lower last week, crude oil rebounded on Monday and Tuesday rallying from $62 to $67 and remains in oversold territory. From its current level, crude has multiple levels of support in the $58 to $62 area. Year-to-date crude oil is up 39.51%.