Commodity groups that are more correlated to the strength of the domestic equity market have seen further improvement in scores, such as the commodity-related stock group.

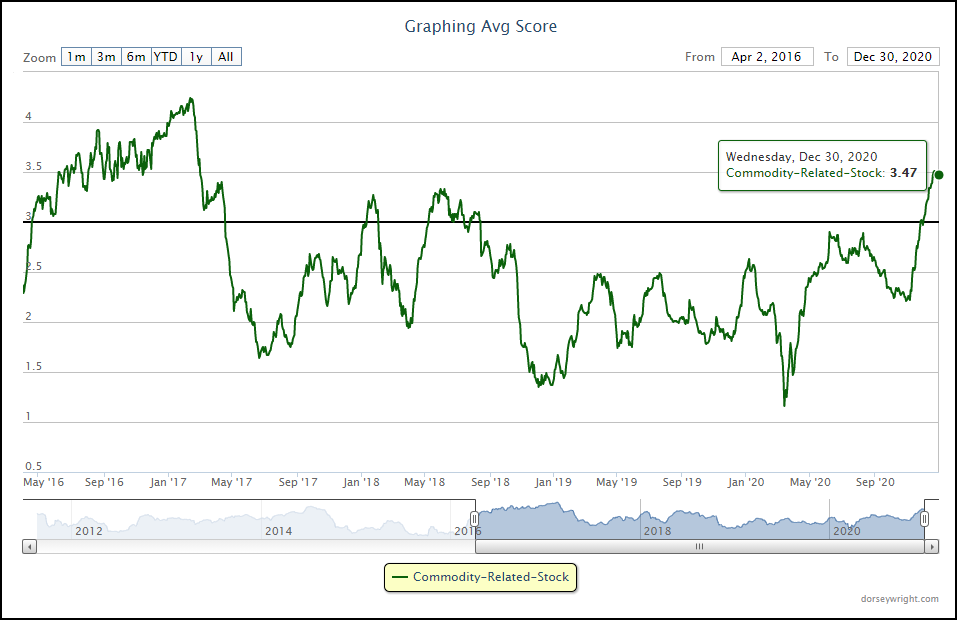

The broad strength of the domestic equity market has continued to carry over to risk-on oriented areas over the past few weeks, such as the commodities space. Earlier this week, the commodities asset class showed enough improvement from a relative strength perspective to move into the third-ranked position in the DALI asset class rankings, overtaking that spot from fixed income. This improvement has also been seen from some commodity-related groups on the Asset Class Group Scores (ACGS) page as well, although the broad commodity group has had difficulty ascending north of the 3.00 average score threshold, as we covered in yesterday’s Alternative Asset Update. Areas that are more correlated to the strength of the domestic equity market have seen further improvement in scores, such as the commodity-related stock group.

The commodity-related stock group represents equity funds that are tied to commodities, including but not limited to funds with exposure toward areas such as metals miners, oil producers, and solar companies. The group also includes funds with broad exposure to commodity-related equity areas. This group pushed largely higher since moving off its score low of 1.16 in mid-March to reach a group score of 2.90 in June. The group then spent the next few months in stagnation before beginning to ascend again in early-November. Commodity related stock has now maintained a score north of 3.00 since the beginning of December and now sits at an average score of 3.47. Prior to this move, the commodity-related stock group had not seen these scores since March 2017. This score is paired with a positive group score direction of 1.35 and a relatively normalized average overbought/oversold reading of 64.92%.

One fund that has shown consistent improvement over the past several weeks is the SPDR S&P Metals & Mining ETF XME, which reversed up in trading Thursday to form a double top and match its 52-week chart high at $33.50. This fund offers exposure to companies involved with the production or mining of both industrial and precious metals. The broad nature of its exposure has led to consistent improvement from a fund score perspective as well, as can be seen by the 1.87 score direction leading to a recent score posting of 4.48. This bests the aforementioned average for commodity-related stock (3.47) as well as the average for all-US funds (3.90). While the technical picture is strong here and improving, the fund is now in overbought territory so those looking to add exposure may be best served to wait for a pullback or normalization of the trading band. Initial support can be found at $32.