The consistency of the social responsibility group has also been demonstrated in the outperformance from the FSM ESG100 Sustainable All Asset Rotation 5S PR4050 model.

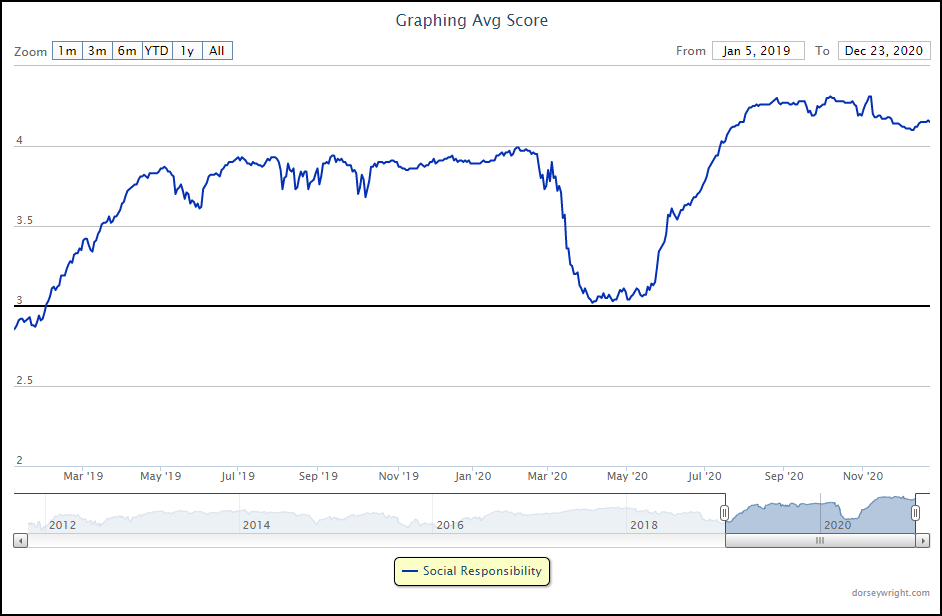

There has been no shortage of upside participation from risk-on groups on the Asset Class Group Scores (ACGS) page over the past few weeks. There are 101 out of the 135 groups that possess an average score of at least 3.00, and 35 of those groups that possess an average score north of 4.00. The social responsibility group has been one of the more consistent groups in the “blue sky zone,” as it has maintained a score of at least 4.00 since mid-July. The group has also maintained a score above 3.00 since January of 2019, as it pulled back in March with the global equity drawdown but did not show as much deterioration as other equity areas.

When looking underneath the hood at the group constituents, we see that the social responsibility group includes a significant amount of clean energy funds that make up most of the top end of the score rankings. There is also a significant amount of actively managed funds that utilize their own ESG screening process to discern between holdings. The ESG space has continued to grow in popularity over the past few years, leading to a growing number of funds looking to capitalize on the increased investment appetite for the space.

In addition to the multitude of social responsibility ideas available on the ACGS rankings, we also have the FSM ESG100 Sustainable All Asset Rotation 5S PR4050 model available for those seeking a more objective, rules-based way to play the space. This model looks at an inventory of 100 ESG ETFs and mutual funds following the typical five-holding FSM approach, which is evaluated at the beginning of each seasonal quarter. The inventory of this strategy includes both ETFs and actively managed mutual funds, providing a flexible inventory of potential holdings. The strategy also utilizes the PR4050 trigger to cash, which allows it to become defensive should the need arise. In following the five-holding FSM approach, the model will seek to hold the top five scoring funds in its inventory at the time of each model evaluation, which we last saw in early-November. While the model could potentially invest in “risk-off” areas of ESG-related fixed income, the most recent model evaluation led to full exposure towards equities, including both domestic and international representatives. This has aided the model in reaching a year-to-date return of 52.61% through Tuesday, which made it the best performing FSM model on the NDW system at that time. Those looking to utilize this approach should be mindful of the turnover associated with the strategy, as it saw at least two new positions at each of the four model evaluations in 2020, leading to an annualized turnover of 184%. In order to follow the model, you can set alerts on the Model Portfolios page.