You’ve probably heard of Black Friday, but what about Green Monday?

We are excited to announce phase three of the Nasdaq Dorsey Wright Model Builder with the launch of Matrix and FSM-based Relative Strength (RS) Testing Service. As part of this launch, we are granting you free access to the service for the remainder of 2020. The tool is designed to help you more easily design, test, implement, and monitor custom models powered by the Nasdaq Dorsey Wright methodology. Through the end of December, be sure to join us each Thursday at 1 pm EST for a custom modeler demo presented by the analyst team.

11/19/2020: Static Model Builder Demo Replay - Click Here

11/12/2020: Matrix Model Builder Demo Replay - Click here

11/5/2020: FSM Model Builder Demo Replay - Click here

Click here to register for future Nasdaq Dorsey Wright Model Builder Demos

You’ve probably heard of Black Friday, the day after Thanksgiving, Cyber Monday, the Monday after Thanksgiving, but what about Green Monday? Like the other infamous shopping events, Green Monday, the second Monday in December, refers to one of the retail industry’s most profitable days as consumers make their last-minute purchases before the holidays. Interestingly, according to large transporters like United Parcel Service UPS and USPS, December 15th marks the latest date to send domestic packages using regular ground shipping; FedEx FDX is a bit tighter with December 14th as their final day. However, in an era filled with retail giants like Amazon AMZN, Target TGT, and Walmart WMT, closer-dated shipping may still be a distinct possibility/reality for many. In recognition of Green Monday, we’ve provided a few bullet points on the DWA Retail Sector and respective model.

- The DWA Retail Sector Portfolio currently holds five positions and boasts an impressive 78% year-to-date return. This is the portfolio’s best return since inception in 2008, clearing the second-highest by roughly 35% (through 12/11).

- Despite the continued strength from many big-box retailers, the sector portfolio currently tilts considerably toward small- and mid-caps.

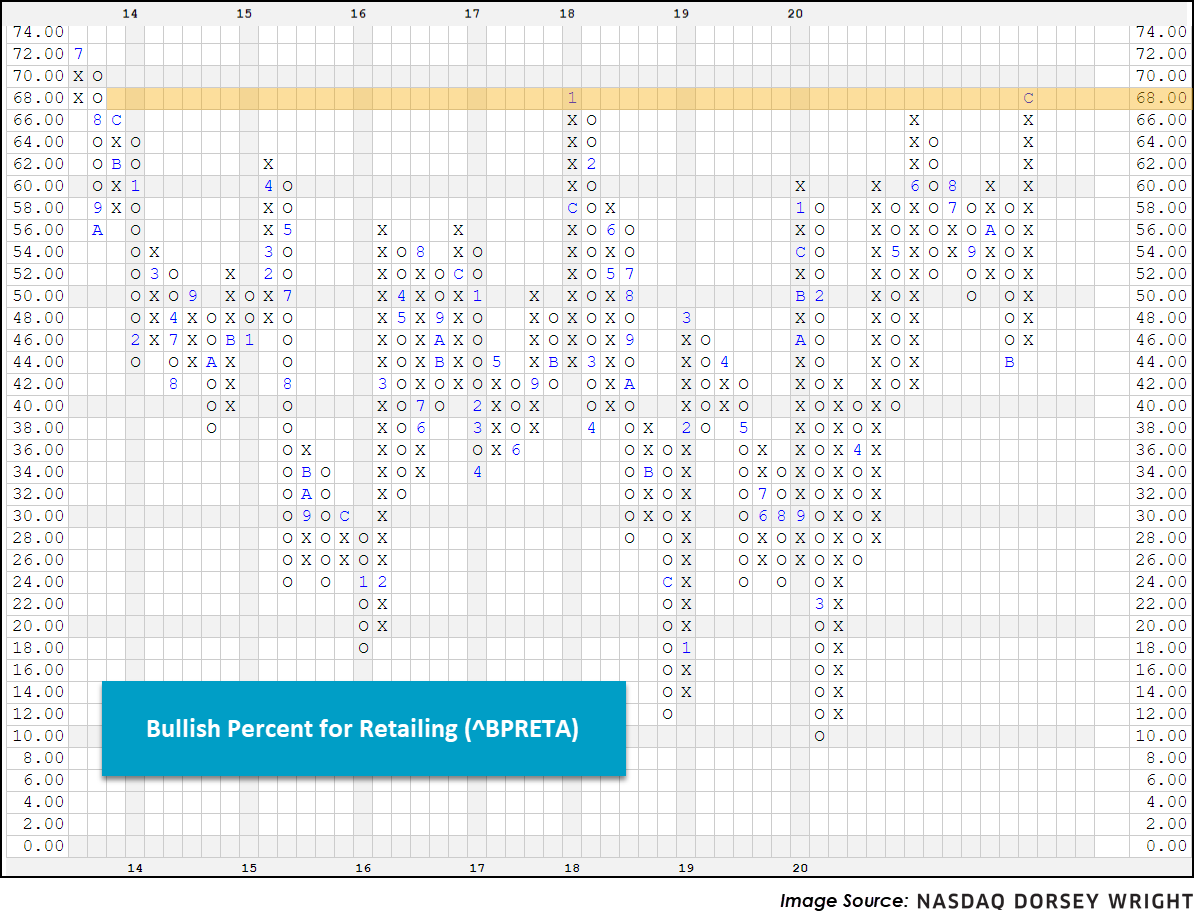

- Within the DWA Retailing Sector, we find substantial breadth as 68% of stocks are trading on Point & Figure buy signals, measured by the bullish percent BPRETA. This matches the highest chart level since January of 2018. Should the sector gain further net participants to the upside and advance to 70%, that would mark the highest chart reading since July of 2013.