Daily Summary

12 Days of Christmas: Enhancing Your Process With Scalable Customization in 2021 - Day 1 - Benefits of Models and a Rules-Based Process

Each year, we produce 12 articles throughout the last few weeks of the year, all revolving around one central topic. In the past, we have used this series to discuss various themes ranging from the basics of Point & Figure Relative Strength to trends to know in the coming year. Today, we kick off this year's series, which will revolve around the topic of "Enhancing Your Process With Scalable Customization in 2021".

Daily Equity Roster

Today's featured stock is nLIGHT, Inc.(LASR).

Analyst Observations

AJG, BILI, BLL, BNTX, CHWY, ETSY, FIVN, GGG, MA & MHK

Daily Option Ideas

Call: Marvell Technologies Group (MRVL); Put: Netease.com Inc (NTES); Covered Write: Regions Financial Corporation (RF).

We are excited to announce phase three of the Nasdaq Dorsey Wright Model Builder with the launch of Matrix and FSM-based Relative Strength (RS) Testing Service. As part of this launch, we are granting you free access to the service for the remainder of 2020. The tool is designed to help you more easily design, test, implement, and monitor custom models powered by the Nasdaq Dorsey Wright methodology. Through the end of December, be sure to join us each Thursday at 1 pm EST for a custom modeler demo presented by the analyst team.

11/19/2020: Static Model Builder Demo Replay - Click Here

11/12/2020: Matrix Model Builder Demo Replay - Click here

11/5/2020: FSM Model Builder Demo Replay - Click here

Click here to register for future Nasdaq Dorsey Wright Model Builder Demos

As we do every year, we want to give you some ideas for the holiday shopping season that won't break the bank. Furthermore, your support of these companies directly helps the small businesses of America. Some of these companies are even offering special discounts to Nasdaq Dorsey Wright clients!

Boston Coffee Cake

The Boston Coffee Cake Company was among the first recommendations on our Holiday Gift Idea list many years ago, and today it remains a perennial favorite. This company has always been very professional in their ordering and delivery services, and even as they've grown they have not lost that "home-baked" appeal. Some of the office favorites include their Triple Chocolate and Cinnamon Walnut Coffeecakes. Client feedback tends to rate Pecan Delight and Applicious just as favorably. You don’t necessarily need to take our word for it; Boston Coffee Cake was awarded the gold medal as a USA Taste Champion by the American Masters of Taste. Boston Coffee Cake does offer sugar-free and kosher-certified cakes and there are a number of different gift sets too if you want something more than just a cake.

If you are pinched for time and don't want to be in the kitchen cooking this holiday, try a Boston Coffee Cake, or if you are looking for something for the office or for clients, they make great gifts. As an additional sweetener, if you mention that you heard about them from Dorsey, Wright & Associates, you will receive a 20% discount on the entire order including shipping. Reference the promo code DORSEY. You can get the DWA discount over the phone or through their online ordering process as well. Give it a try, you'll not regret it.

Contact Info:

- Email: customerservice@bostoncoffeecake.com

- Website: www.bostoncoffeecake.com

- Phone: (800) 434-0500

Hubs Peanuts

What gift can be more easily shared among family, friends, or a group of co-workers? What gift could complement a wider array of foods or beverages at a gathering? And what gift could be easier on the budget? Peanuts! We’re not suggesting just any peanuts either. We think you should try Hubs “home-cooked” Virginia peanuts. The Hubbard Peanut Company is located about 80 miles south of Richmond, Virginia, in the town of Sedley, Virginia, and is the original and oldest continuously family-owned and operated processor of a style of peanuts that has become the gold standard in the peanut industry. For 60+ years, Hubs Peanuts, located in the heart of peanut territory, has chosen peanuts from the top 1% of the harvest and turned them into tasty nuggets of nutritional goodness for peanut lovers around the world.

Go traditional with their salted peanuts or if you would rather add a little flair, we suggest the sweet heat! Use the promo code DW2020 when ordering for a 10% discount!

Contact Info:

- Email: hubs@hubspeanuts.com

- Website: www.hubspeanuts.com

- Phone: (800) 889-7688

Chocolates by Kelly

What would a holiday gift list be without fine chocolates? We'd argue it would be like Thanksgiving without a turkey or football. Fear not! If you are going for the "wow" factor, the offerings of "Chocolates by Kelly" will provide plenty of that. Kelly Walker is a local artisan that originated in Richmond, VA, and her chosen material is chocolate, which is sold in some of the finest gourmet boutiques on the East Coast. She specializes in handmade chocolate creations that make for a spectacular gift idea for even the most high-brow of chocolate lovers on your list. For clients, teachers, moms, spouses ... nothing says "thank you" like chocolate, and this year Kelly has offered to extend some special pricing to clients of NDW for orders placed before the end of the year. Her website will give you an idea of what her chocolate assortments will look like when they arrive, all of which are extremely pleasing on both the eyes and the tongue in our experience. Whether you go with a traditional 12-piece chocolate assortment or a "Chocolate of the Month" subscription for someone very special, we think whoever is on the other end of this gift will be impressed. You can order online to send a one-time gift or a monthly subscription of these decadent treats, or call/email Kelly direct for larger bulk orders! Our one suggestion is that you be sure to include something for yourself on any order you place with Kelly. Oh, and that your order should include the Spiced Chai Truffle for milk chocolate lovers, and the Cherry Pomegranate Truffle for those who favor the dark.

Contact Info:

- Email: chocolatesbykelly@gmail.com

- Website: www.chocolatesbykelly.com

- Phone: (307) 360-3400

- Mention Dorsey Wright via phone or email to receive a 15% discount!

Customers now have the ability to fully customize both the chocolates and the packaging for a truly unique gift experience.

Chouquette

Sarah Dwyer, the owner of Chouquette Artisan Chocolates and Confections of Bethesda, MD, left the business world for a year at Le Cordon Bleu in Paris where she learned how to make authentic, European-style soft and flavorful caramels. Using real ingredients—sugar, local butter, and cream—with natural infusions of balsamic, caramel, raspberry, vanilla, and single-origin coffee beans, she creates confections as beautiful as they are delicious. With special labeling of each flavor, never bite into the wrong chocolate again. You can also put custom logos on any chocolate purchase. Be sure to use the code "DWA20" or "NASDAQ20" for 20% off your entire order.

- Esweets@chouquette.us

- Website: www.chouquette.us

- Phone: (301) 651-4442

Blanchard's Coffee

Have you ever noticed that when you call the NDW office in the morning, no matter whom you speak with, we are all awake and alert? Well, for that we have to give at least some credit to David Blanchard and the good folks down at Blanchard's Coffee. David is a stockbroker here in Richmond, Virginia, who always had a certain love for coffee, enough so that he purchased a commercial coffee roaster a few years back and began providing freshly roasted coffee to friends and family as a hobby. Being the only Richmond operation to actually roast coffee, it eventually caught the eye of a local grocery chain, and, long story short, David's coffee operation moved out of his garage and began providing the freshest coffee around to the central Virginia area and beyond. Their brand is high quality, fresh roasted, coffee that can be shipped anywhere in the country within a few days of actually being roasted. If your town is anything like Richmond was a few years ago, freshly roasted coffee is probably a lot like your expertise—something your clients can't find anywhere else.

Blanchard's offers a number of potential gift ideas for clients that may appeal to you including holiday gift boxes, individual bags of coffee, or even custom packs. They have everything from coffee strong enough to please Tom Dorsey (like Dark as Dark) to organic fair trade options, and many others. Again, for a special wholesale discount be sure to tell them that Nasdaq Dorsey Wright sent you.

Contact Info:

- Email: stephen@blanchardscoffee.com

- Website: www.blanchardscoffee.com

- Phone: (804) 687-9443

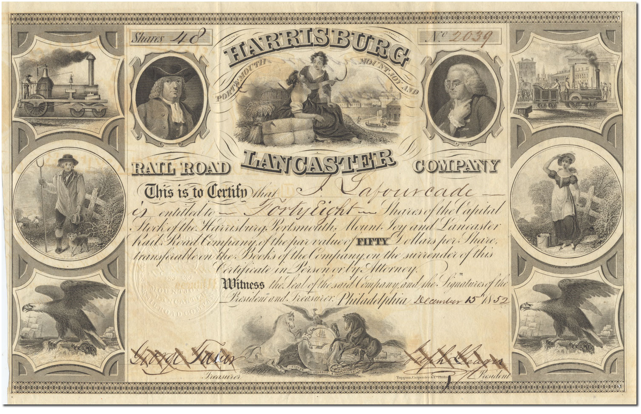

Ghosts of Wall Street (formerly known as Stocklobster)

If you are looking for a truly unique gift idea for clients or loved ones, look no further than Ghosts of Wall Street - an online antique store featuring historic stock and bond certificates. These beautiful pieces - many of which contain stunning artwork - offer a glimpse back to a time when paper documents were issued to investors. The store offers thousands of historical financial documents covering a variety collectible categories including mining, airlines, railroads, automotive, financial scandals and autographs. Their inventory includes pieces from famous firms like Merrill Lynch, Lionel, Sears, and IBM. It's the perfect place to look for that "conversation piece" gift for a long time client, associate or relative.

Currently all orders over $30 ship FREE to U.S. addresses, and Daily Equity Report readers will also receive 30% off any order by using coupon code: SPECIALNDW30.

This offer expires at midnight on December 31, 2020.

- Website: https://ghostsofwallstreet.com/

- Email: support@ghostsofwallstreet.com

Each year, we produce 12 articles throughout the last few weeks of the year, all revolving around one central topic. In the past, we have used this series to discuss various topics ranging from the basics of Point & Figure Relative Strength to trends to know in the coming year. This year, all 12 articles will revolve around the topic of "Enhancing Your Process With Scalable Customization in 2021".

Over the last decade, the advisory business has continued to evolve rapidly with the growing trends of lower fees and increased automation. With the influx of low-cost index funds and Robo-advisors offering nearly-free financial planning, investors can now gain beta market exposure at rock-bottom prices without ever setting foot in an advisor's office. The upshot is that it is now more challenging than ever for you as a traditional financial advisor to justify your fee and grow your client base. That said, you must scale your process and sharpen your value proposition as much as possible. To help you do just that, this year's 12 Days of Christmas Series, "Enhancing Your Process With Scalable Customization in 2021," will navigate you through the benefits, use/implementation, and customization of rules-based, Relative Strength-driven guided model portfolios. Additionally, this series will highlight the NDW Model Builder Tool's new features, providing relevant use-cases to help you scale your business in the coming year.

Enhancing Your Process With Scalable Customization in 2021

At last year's November Point & Figure Institute, we had the pleasure of having Brie Williams, Head of Practice Management for State Street Global Advisors, speak to the challenges mentioned above that continue to shape the financial industry's future. These are the same disruptive forces that have made the use of model portfolios one of the most practical solutions for scaling your business and refocusing your most valuable resource - your time. Below is an excerpt of a recently published State Street Practice Management Research Report titled, "Model Portfolio Solutions and the Client Experience":

Today's wealth management landscape presents a unique set of opportunities. Demand for advisory services is expected to grow at a robust pace, thanks in no small part to Baby Boomers transitioning into retirement. Add this to the complexity and number of investment products and services that call for expert guidance. But along with these opportunities, advisors face more challenges than ever before.

The cost and competitive structures of wealth management have changed dramatically since the global financial crisis. Client needs and expectations are evolving, technology is redefining the service model, and regulatory requirements continue to add operational complexity. Wealth managers will need to generate economies of scale to succeed.

A growing number of advisors are embracing portfolio management outsourcing to improve operational efficiency and respond to client needs. They are choosing model portfolio solutions that fit their business development strategy and align with their investment manager philosophy.

With model portfolios, advisors continue to have transparency into investment objectives and portfolio construction. They can choose investment strategies that are best suited to their clients' financial goals. And access to formal governance, documentation, and strategy performance reviews allows these advisors to continue to meet their professional responsibilities.

Generally speaking, the growing popularity in using guided models throughout the advisory world can be boiled down to three key benefits: scalability, process, and time. Those businesses that incorporate model portfolio solutions are generally looking to optimize the investment process for all clients, which opens up the potential for client-base expansion, including those in the next generations who make up the industry's future. Additionally, using an objective, rules-based model methodology such as Point & Figure Relative Strength creates a transparent, logical, and repeatable process that helps remove emotion, "gut feel," and guesswork from the equation. Finally, incorporating model portfolios across your practice can increase overall productivity, freeing-up valuable time to refocus your attention on high-value activities such as managing existing and potential client relationships.

Since 2002, the NDW Research Platform has provided users with rules-based guided models and the supporting tools and research that have all continued to grow and evolve along with the ever-changing industry. Our model offerings date back nearly 19 years, starting with our first guided ETF model created in partnership with iShares. Since then, we've launched over 100+ stock, ETF, and fund score method (FSM) models along with a suite of DALI Tactical Tilt strategies. Additionally, we've expanded our lineup of single CUSIP products that seek to track similar underlying indexes as a select few of our guided ETF models, providing advisors with options when incorporating these strategies into their business.

As mentioned above, this year's 12 Days of Christmas Series, "Enhancing Your Process With Scalable Customization in 2021," will take a deep dive into the Relative Strength-driven methodologies that drive our lineup of stock, ETF, and FSM model portfolios. Additionally, we will review how to build and incorporate custom models into client portfolios using the newly-enhanced NDW Model Builder tool, which allows users to create static, matrix-driven, and FSM-style models tracked on the NDW Research Platform, complete with model alerts and performance tracking functionality.

A constant talking point over the last couple of months has been the strength of small caps and laggard sectors rallying like energy and financials. The improvement of these areas has shaken up the US Styles view ranking quite significantly as the US Small Cap Growth group is the top-ranked asset class on the entire system with an average score of 5.04. The US Small Cap Blend group is now the only blend group scoring above 4.00 as it now sits at 4.02 with its improvement this week. The US Small Cap Value group has improved significantly, evidenced by its score direction of 2.07, the highest of any US-style group. The near-term improvement is noteworthy, but when we compare Small Cap Growth and Small Cap Value to the S&P 500 over the past year, we find glaring differences between the two groups.

As we can see from the image above, the Russell 2000 Growth index has performed well and is above where it was prior to the March sell-off. Relative to the S&P 500, the Russell 2000 Growth Index is comfortably outperforming year-to-date. On the other hand, the Russell 2000 Value Index is barely in the black on the year returning 1.03%. While the Russell 2000 Growth Index has improved dramatically against the S&P 500 since March, the Russell 2000 Value Index has struggled to improve on a relative basis despite laggards rallying over the past several weeks.

Much of this dispersion can be explained by the underlying sector exposure of Small Cap Growth and Small Cap Value. The iShares Morningstar Small Value ETF's JKL top four sectors in order of exposure are financials, consumer cyclical, industrials, and utilities compared to the iShares Morningstar Small Growth ETF’s JKK top four of healthcare, technology, industrials, and consumer cyclical. The technology, consumer cyclical, industrials, and health care groups all possess scores above 4.00, further evidencing the strength behind small growth. On the other hand, small value does have an overweighting to consumer cyclical and industrials, but the financials group has yet to move above the 4.00 mark and the utilities group remains below the acceptable 3.00 mark.

As we look to end a quite unusual year, it is just as important as ever to make sure we stick to areas of the market exhibiting the most strength. While we’ve seen value areas of the market perform well lately, we have yet to see these groups take leadership over areas like technology and consumer cyclical which are usually growth-oriented. By keeping tabs on the Asset Class Group Scores page we can be prepared if/when there is a change in leadership and have a plan in place for such an event.

Average Level

49.60

| AGG | iShares US Core Bond ETF |

| USO | United States Oil Fund |

| DIA | SPDR Dow Jones Industrial Average ETF |

| DVY | iShares Dow Jones Select Dividend Index ETF |

| DX/Y | NYCE U.S.Dollar Index Spot |

| EFA | iShares MSCI EAFE ETF |

| FXE | Invesco CurrencyShares Euro Trust |

| GLD | SPDR Gold Trust |

| GSG | iShares S&P GSCI Commodity-Indexed Trust |

| HYG | iShares iBoxx $ High Yield Corporate Bond ETF |

| ICF | iShares Cohen & Steers Realty ETF |

| IEF | iShares Barclays 7-10 Yr. Tres. Bond ETF |

| LQD | iShares iBoxx $ Investment Grade Corp. Bond ETF |

| IJH | iShares S&P 400 MidCap Index Fund |

| ONEQ | Fidelity Nasdaq Composite Index Track |

| QQQ | Invesco QQQ Trust |

| RSP | Invesco S&P 500 Equal Weight ETF |

| IWM | iShares Russell 2000 Index ETF |

| SHY | iShares Barclays 1-3 Year Tres. Bond ETF |

| IJR | iShares S&P 600 SmallCap Index Fund |

| SPY | SPDR S&P 500 Index ETF Trust |

| TLT | iShares Barclays 20+ Year Treasury Bond ETF |

| GCC | WisdomTree Continuous Commodity Index Fund |

| VOOG | Vanguard S&P 500 Growth ETF |

| VOOV | Vanguard S&P 500 Value ETF |

| EEM | iShares MSCI Emerging Markets ETF |

| XLG | Invesco S&P 500 Top 50 ETF |

Long Ideas

| Symbol | Company | Sector | Current Price | Action Price | Target | Stop | Notes |

|---|---|---|---|---|---|---|---|

| AOS | A.O. Smith Corporation | Building | $56.31 | mid to upper 50s | 72 | 47 | 4 for 5'er, four consec buy signals, mutli-year high, market RS buy signal since 9/2008, 1.86% yield |

| SPWR | Sunpower Corporation | Electronics | $21.16 | low 20s | 33.50 | 18 | 5 for 5'er, #3 of 59 names in ELEC sector matrix, pos wkly mom flip, pot cov. write |

| BECN | Beacon Roofing Supply, Inc. | Building | $38.93 | 36 - 40 | 56 | 30 | 4 for 5'er, top third of fav DWABUIL, consec buy signals, 52 week highs, pos weekly mom flip |

| APAM | Artisan Partners Asset Management, Inc | Finance | $47.76 | mid-to-upper 40s | 53.50 | 39 | 5 for 5'er, top 20% of FINA sector matrix, multiple buy signals, pos wkly mom flip, 6% yield |

| CZR | Caesars Entertainment Inc. | Gaming | $71.13 | low-to-mid 70s | 88 | 62 | 4 for 5'er, #1 of 12 in favored GAME sector matrix, triple top breakout, pot. covered write |

| APPS | Digital Turbine Inc. | Computers | $42.68 | low to upper 40s | 78 | 35 | 5 for 5'er, LT market RS buy signal, consec buy signals, pullback from ATH,fav COMP sector |

| MLM | Martin Marietta Materials In | Building | $266.74 | 270s - 290s | 312 | 236 | 3 for 5'er, top half of favored BUIL sector matrix, spread quintuple top, |

| CVNA | Carvana Company | Autos and Parts | $260.47 | 230s - 260s | 348 | 204 | 4 for 5'er, pullback from ATH, pos weekly mom, fav DWAAUTO |

| LASR | nLIGHT, Inc. | Semiconductors | $34.14 | low-to-mid 30s | 55 | 27 | 5 for 5'er, top 10% of SEMI sector matrix, consec buy signals, pullback from multi-year high |

Short Ideas

| Symbol | Company | Sector | Current Price | Action Price | Target | Stop | Notes |

|---|

Follow-Up Comments

| Comment |

|---|

| ENPH Enphase Energy Inc R ($135.23) - Electronics - We will now raise our stop to $114, the third potential sell signal on ENPH's default chart. |

| ENPH Enphase Energy Inc R ($135.69) - Electronics - We will now raise our stop to $120, the second potential sell signal on ENPH's default chart. |

DWA Spotlight Stock

LASR nLIGHT, Inc. R ($33.48) - Semiconductors - LASR is a 5 for 5'er that ranks in the top decile of semiconductors sector matrix. On its default chart, LASR has given four consecutive buy signals and reached a multi-year high before pulling back slightly in Friday's trading, offering an entry point for long exposure. The stock also offers a potential covered write opportunity on the March '21 call options. Exposure may be added in the low-to-mid $30s. We will use the the third potential sell signal, $27, as our initial stop, which combined with the bullish price objective of $55, gives us a reward-to-risk ratio north of 3.0.

| 19 | 20 | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| 36.00 | X | 36.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| 35.00 | X | X | o | 35.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 34.00 | X | O | X | o | 34.00 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 33.00 | X | X | O | X | o | 33.00 | ||||||||||||||||||||||||||||||||||||||||||||||||

| 32.00 | X | X | O | C | O | 32.00 | ||||||||||||||||||||||||||||||||||||||||||||||||

| 31.00 | X | O | X | O | X | 31.00 | ||||||||||||||||||||||||||||||||||||||||||||||||

| 30.00 | X | O | X | O | X | 30.00 | ||||||||||||||||||||||||||||||||||||||||||||||||

| 29.00 | X | O | X | O | 29.00 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 28.00 | X | O | 28.00 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 27.00 | • | X | Mid | 27.00 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 26.00 | X | • | X | X | X | 26.00 | ||||||||||||||||||||||||||||||||||||||||||||||||

| 25.00 | X | O | • | X | O | 8 | O | X | 25.00 | |||||||||||||||||||||||||||||||||||||||||||||

| 24.00 | 4 | O | • | 6 | O | 7 | O | X | B | 24.00 | ||||||||||||||||||||||||||||||||||||||||||||

| 23.00 | 3 | 5 | • | X | O | X | O | X | O | X | 23.00 | |||||||||||||||||||||||||||||||||||||||||||

| 22.00 | X | O | • | • | X | O | X | O | X | O | X | 22.00 | ||||||||||||||||||||||||||||||||||||||||||

| 21.00 | • | X | O | • | C | X | X | • | • | X | O | 9 | X | A | 21.00 | |||||||||||||||||||||||||||||||||||||||

| 20.00 | X | • | 2 | O | 7 | • | X | O | X | O | X | O | X | • | X | O | 20.00 | |||||||||||||||||||||||||||||||||||||

| 19.50 | X | O | • | X | X | X | O | X | X | O | • | X | O | X | O | X | O | X | O | • | X | 19.50 | ||||||||||||||||||||||||||||||||

| 19.00 | X | O | • | • | X | O | X | O | X | O | X | O | X | O | • | X | 1 | 2 | O | O | X | O | • | X | 19.00 | |||||||||||||||||||||||||||||

| 18.50 | • | O | 1 | • | X | O | X | O | X | 6 | X | O | X | O | X | O | X | O | O | • | X | 18.50 | ||||||||||||||||||||||||||||||||

| 18.00 | O | X | X | O | X | O | • | O | • | O | • | O | • | O | X | O | X | O | • | X | 18.00 | |||||||||||||||||||||||||||||||||

| 17.50 | O | X | O | X | O | X | • | • | • | • | O | X | X | O | O | • | X | • | 17.50 | |||||||||||||||||||||||||||||||||||

| 17.00 | O | X | O | X | O | • | O | X | O | X | O | • | X | X | • | 17.00 | ||||||||||||||||||||||||||||||||||||||

| 16.50 | O | O | • | • | O | X | O | X | X | O | X | • | X | O | X | • | Bot | 16.50 | ||||||||||||||||||||||||||||||||||||

| 16.00 | • | O | X | 8 | X | O | X | • | O | 3 | O | • | X | O | X | • | 16.00 | |||||||||||||||||||||||||||||||||||||

| 15.50 | O | X | O | X | O | X | • | O | X | O | X | O | X | • | 15.50 | |||||||||||||||||||||||||||||||||||||||

| 15.00 | O | O | X | O | X | • | O | X | O | X | O | X | • | 15.00 | ||||||||||||||||||||||||||||||||||||||||

| 14.50 | O | 9 | A | X | • | O | O | X | X | 5 | • | 14.50 | ||||||||||||||||||||||||||||||||||||||||||

| 14.00 | O | X | O | X | • | O | X | O | X | • | 14.00 | |||||||||||||||||||||||||||||||||||||||||||

| 13.50 | O | X | O | X | • | O | X | X | O | X | • | 13.50 | ||||||||||||||||||||||||||||||||||||||||||

| 13.00 | O | B | • | O | X | O | X | O | • | 13.00 | ||||||||||||||||||||||||||||||||||||||||||||

| 12.50 | • | O | X | O | X | X | • | 12.50 | ||||||||||||||||||||||||||||||||||||||||||||||

| 12.00 | O | X | O | X | O | X | • | 12.00 | ||||||||||||||||||||||||||||||||||||||||||||||

| 11.50 | O | X | O | X | O | X | • | 11.50 | ||||||||||||||||||||||||||||||||||||||||||||||

| 11.00 | O | X | O | X | O | X | • | 11.00 | ||||||||||||||||||||||||||||||||||||||||||||||

| 10.50 | O | X | O | X | O | X | • | 10.50 | ||||||||||||||||||||||||||||||||||||||||||||||

| 10.00 | O | O | X | 4 | X | • | 10.00 | |||||||||||||||||||||||||||||||||||||||||||||||

| 9.50 | O | O | • | 9.50 | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 19 | 20 |

| AJG Arthur J. Gallagher & Co. ($119.88) - Insurance - AJG shares moved higher today to break a double top at $120 to mark its fifth consecutive buy signal and reach a new all-time high. This 5 for 5'er has been in a positive trend since May and on an RS buy signal versus the market since October of 2018. Recent price action has put AJG into heavily overbought territory, so those wishing to initiate a long position may be best served to wait for a pullback or price normalization. From here, support is offered at $110. |

| BILI Bilibili, Inc. Sponsored ADR Class Z ($75.64) - Media - BILI broke a double top at $78 before moving higher to $81. This stock is a 5 for 5’er within the favored media sector that is trading in a positive trend. From here, support sits at $72. Note BILI is extremely overbought at current levels. |

| BLL Ball Corporation ($92.47) - Business Products - BLL gave an initial sell signal when completed a bearish triangle at $92 in Friday's trading. Despite this move, the technical picture of BLL remains positive as it is a 5 for 5'er that has been on a market RS buy signal since 2000 and ranks in the top third of the business products sector matrix. BLL currently sits against support at $92, with additional support at $87. |

| BNTX BioNTech SE Sponsored ADR ($126.27) - Biomedics/Genetics - BNTX shares moved higher today to break a triple top at $130 to mark its second consecutive buy signal and reach a new all-time high. This 5 for 5'er has been in a positive trend since October and on an RS buy signal versus the market since June. Recent price action has put BNTX into heavily overbought territory, so those wishing to initiate a new position may be best served to wait for a pullback or price normalization. From here, support can be found at $118. |

| CHWY Chewy, Inc. Class A ($84.80) - Retailing - CHWY, a 3 for 5’er, broke a double top at $83 before moving higher to $84 and is now trading at new all-time highs. Today’s breakout marks the stock’s third consecutive buy signal, confirming that demand is in control. From here, support sits at $76. |

| ETSY Etsy Inc ($169.90) - Retailing - ETSY broke a double top at $168 before moving higher to $170 on Friday, marking the stock’s fourth consecutive buy signal and new all-time high. ETSY is a 3 for 5’er within the favored retailing sector that has experienced two weeks of positive weekly momentum. From here, support sits at $158. |

| FIVN Five9, Inc. (Five9) ($161.29) - Software - FIVN moved higher Friday to break a double top at $160 before reaching $162 intraday. This 4 for 5'er moved to a positive trend in March and ranks in the top quintile of the software sector RS matrix. The stock has also been on an RS buy signal since late-2015. The technical picture remains strong and continues to improve. Exposure may be considered at current levels, with initial support offered at $150. Further overhead resistance may be found initially at the all-time high of $166 from last month. |

| GGG Graco Inc ($69.75) - Machinery and Tools - Shares of GGG reversed up into a column of Xs on Friday, now residing just one box away from a fourth consecutive buy signal and a new all-time high. The 4 for 5'er resides in the top half of the favored machinery and tools stock sector matrix and demonstrates favorable long-term relative strength versus the market. Demand is in control. Initial support is offered around $66. |

| MA Mastercard Incorporated Class A ($325.61) - Finance - Shares of MA moved lower today to give a sell signal at $328. This stock is still a technically sound 3 for 5'er that moved back to a positive trend in November and has maintained an RS buy signal against the market since mid-2011. The technical picture is mixed at current levels, as the long-term strength remains intact while the near-term picture is showing signs of weakness. From here, further support can be found at $324 and $312, the current location of the bullish support line. MA would return to a buy signal from current levels with a triple top break at $348. |

| MHK Mohawk Industries, Inc. ($134.75) - Household Goods - MHK completed a bullish catapult pattern with a double top buy signal at $136. MHK is a solid 4 for 5’er within the favored household goods sector. From here, support sits at $126. |

Daily Option Ideas for December 11, 2020

New Recommendations

| Name | Option Symbol | Action | Stop Loss |

|---|---|---|---|

| Marvell Technology Group Ltd. - $42.94 | O: 21E42.00D21 | Buy the May 42.00 calls at 5.65 | 39.00 |

Follow Ups

| Name | Option | Action |

|---|---|---|

| Fastenal Company ( FAST) | Feb. 42.50 Calls | Initiate an option stop loss of 5.20 (CP: 7.20) |

| Centene Corporation ( CNC) | Mar. 62.50 Calls | Stopped at 61.00 (CP: 60.91) |

New Recommendations

| Name | Option Symbol | Action | Stop Loss |

|---|---|---|---|

| Netease.com Inc. (China) ADR - $88.26 | O: 21O89.00D19 | Buy the March 89.00 puts at 7.70 | 92.00 |

Follow Up

| Name | Option | Action |

|---|---|---|

| Activision Blizzard, Inc. (ATVI) | Mar. 80.00 Puts | Stopped at 84.00 (CP: 83.58) |

New Recommendations

| Name | Option Sym. | Call to Sell | Call Price | Investment for 500 Shares | Annual Called Rtn. | Annual Static Rtn. | Downside Protection |

|---|---|---|---|---|---|---|---|

| Regions Financial Corporation $15.85 | O: 21B16.00D19 | Feb. 16.00 | 0.85 | $7,421.90 | 35.16% | 24.10% | 4.42% |

Still Recommended

| Name | Action |

|---|---|

| Marathon Petroleum Corp. (MPC) - 43.83 | Sell the April 45.00 Calls. |

| JD.COM INC (JD) - 81.71 | Sell the March 90.00 Calls. |

| Phillips-Van Heusen Corporation (PVH) - 94.64 | Sell the March 90.00 Calls. |

| Comerica Incorporated (CMA) - 53.06 | Sell the April 57.50 Calls. |

| Ventas, Inc. (VTR) - 48.83 | Sell the February 50.00 Calls. |

| Delta Air Lines Inc. (DAL) - 42.62 | Sell the March 45.00 Calls. |

| General Motors (GM) - 42.87 | Sell the March 45.00 Calls. |

The Following Covered Write are no longer recommended

| Name | Covered Write |

|---|---|

| LM Ericsson Telephone Company (Sweden) ADR ( ERIC - 12.27 ) | April 13.00 covered write. |