With fixed income lagging behind global equities, we take a look at a few potential bright spots moving forward.

As we’ve seen a broadening out of the equity markets from domestic and international or large and small, fixed income as an asset class has weakened from an asset class group scores perspective. Currently, there is only one fixed income group that has a positive score direction which is Convertible Bonds. It’s probably not a coincidence that this is a group with a strong positive correlation to equity markets. Even a group that was extremely strong over the past few months has weakened significantly, as the Inflation Protection group has a negative score direction of 2.12 despite a continuation to the downside for the US Dollar. The low rate environment has investors struggling to find areas of strength to fill out their fixed-income allocations.

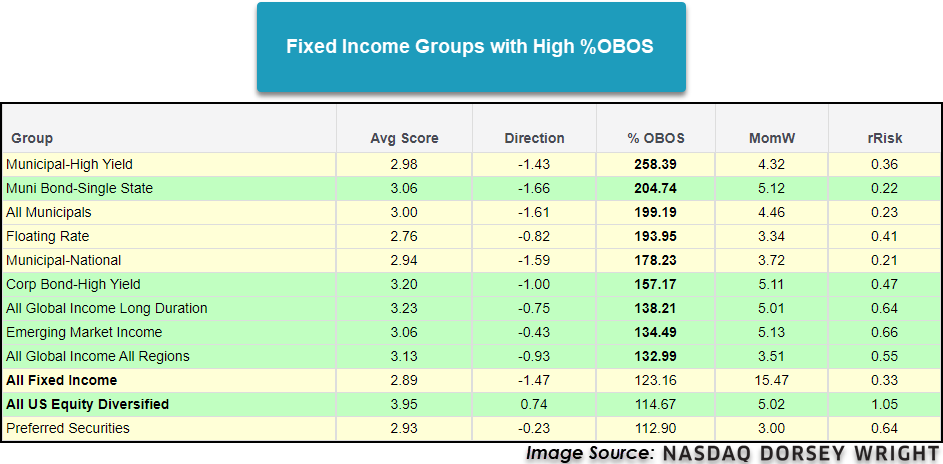

With fixed income weakening as an asset class, there a good number of groups with high overbought/oversold readings. A few of these groups are All Municipals, Floating Rate, Corporate Bond High Yield, and a few global fixed income groups. These groups are also exhibiting shorter-term momentum characteristics as they all have held on average positive weekly momentum for three or more weeks.

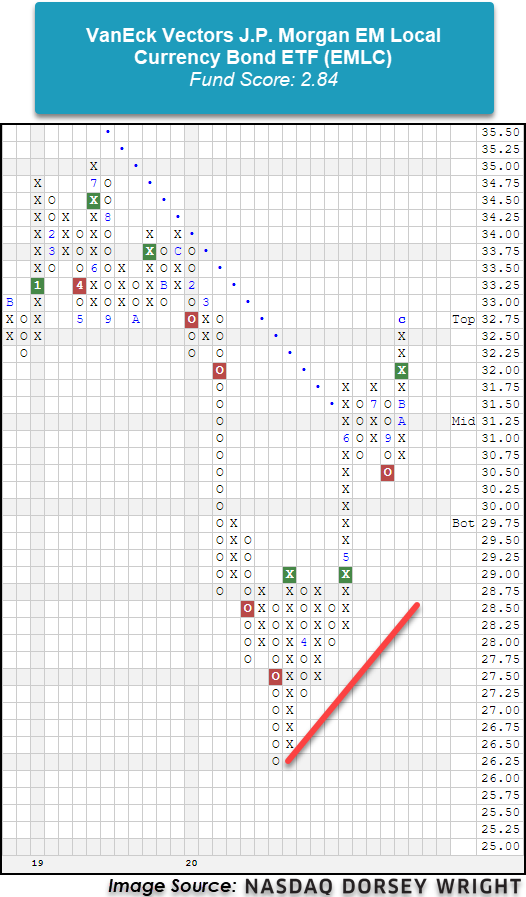

The Emerging Market Income group is one area that has an average group score above 3.00, and more specifically local currency bond funds have seen tailwinds from the falling dollar environment. One such fund is the VanEck Vectors J.P. Morgan EM Local Currency Bond ETF EMLC which has a suboptimal fund score of 2.84 but a highly positive score direction of 2.19 highlighting its improvement over the last six months. Recent price action has put the fund into heavily overbought territory with a weekly overbought/oversold reading of 81%. EMLC offers a yield of 5.27%. Even though EMLC isn’t scoring above the 3.00 threshold, it will be a fund to monitor as strong and improving areas within fixed income are fairly slim.

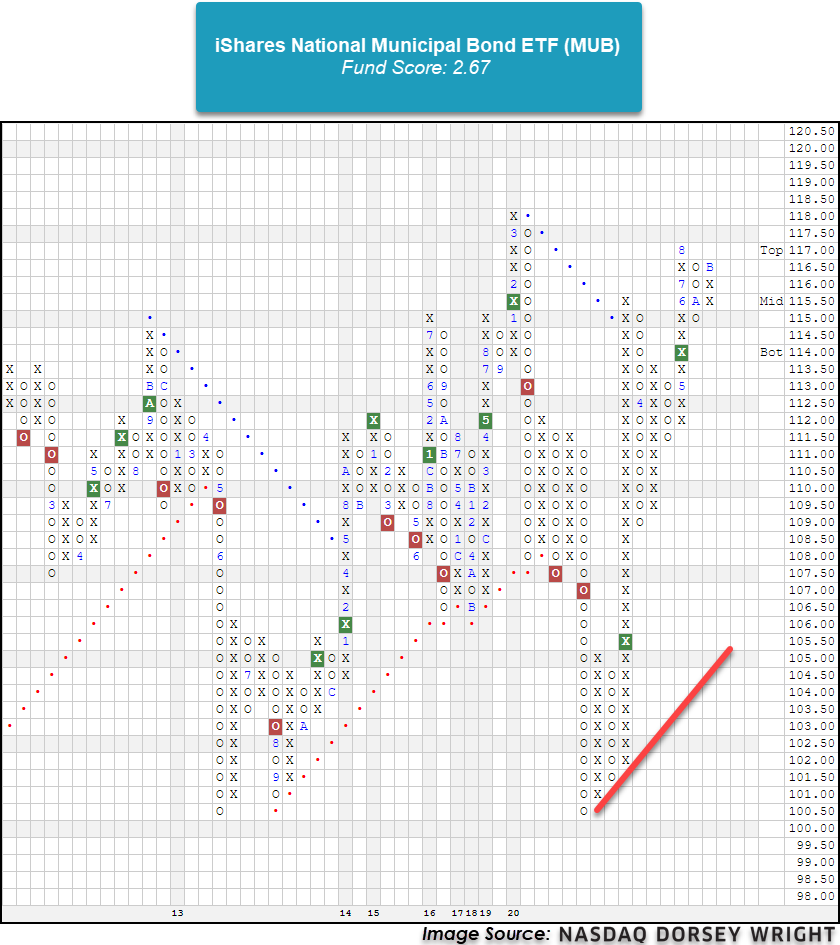

Municipals are another area that, despite score deterioration, have positive weekly momentum along with high weekly overbought/oversold readings. The All Municipals group has an average group score of 3.00 but a negative score direction of 1.61. The group has an average overbought/oversold reading of 199% with average weekly momentum of 4.46. The iShares National Municipal Bond ETF MUB has a fund score of 2.67 and is trading in a positive trend. In terms of its trading band, MUB is actionable with a weekly overbought/oversold reading of 61% and offers a yield of 2.18%.

With fixed income as an asset class taking a backseat to domestic and international equities, these are a few areas to keep an eye on as potential areas to fill out your client’s fixed income sleeve. Equities have taken the lion’s share of attention as of late, but it is still important to monitor fixed income as it is typically a portion of clients’ portfolios. A few of the areas discussed may not be ideal in terms of average scores or direction, but they could potentially be additive in the future. As always, be sure to visit the Asset Class Group Scores page to stay on top of market trends and changes.