As we do each year, today we've created a list of candidates for tax loss selling bounce plays.

This is the time of year when investors sell laggard stocks from their portfolio to realize losses before the end of the of year and offset any taxable gains they may have. Last Friday, we published an article on tax loss harvesting with a list of stocks that may be good candidates to sell for this purpose. When many investors are selling the same underperforming stocks in the last few months of the year it creates the potential for those stocks to become oversold and bounce as tax selling subsides.

Here are a few guidelines about tax loss harvesting which are also good to bear in mind when attempting tax loss bounce plays as the tax rules can impact when investors sell (and potentially repurchase) these stocks. First, consult your CPA for the specific long-term and short-term holding periods as well as how the tax rates affect your customers. If selling a long position for a taxable loss, the trade date must be on, or before, December 31st, 2019. The IRS requires that the trade date be the 31st (this year), not the settlement date, which is a source of some confusion each year. Current tax laws also limit the window for avoiding wash sale treatment, whereby an investor must have transacted buys in November (or before) to double a position, in order to sell a matching position for a capital loss on December 31st. Also, to avoid other aspects of the wash sale restrictions, you cannot repurchase a stock sold for a loss for 30 days following your tax loss sale. We certainly are not tax professionals and do not solicit tax advice, but those are some tax basics for this time of year. Again, we recommend that you consult your CPA for the specific rules.

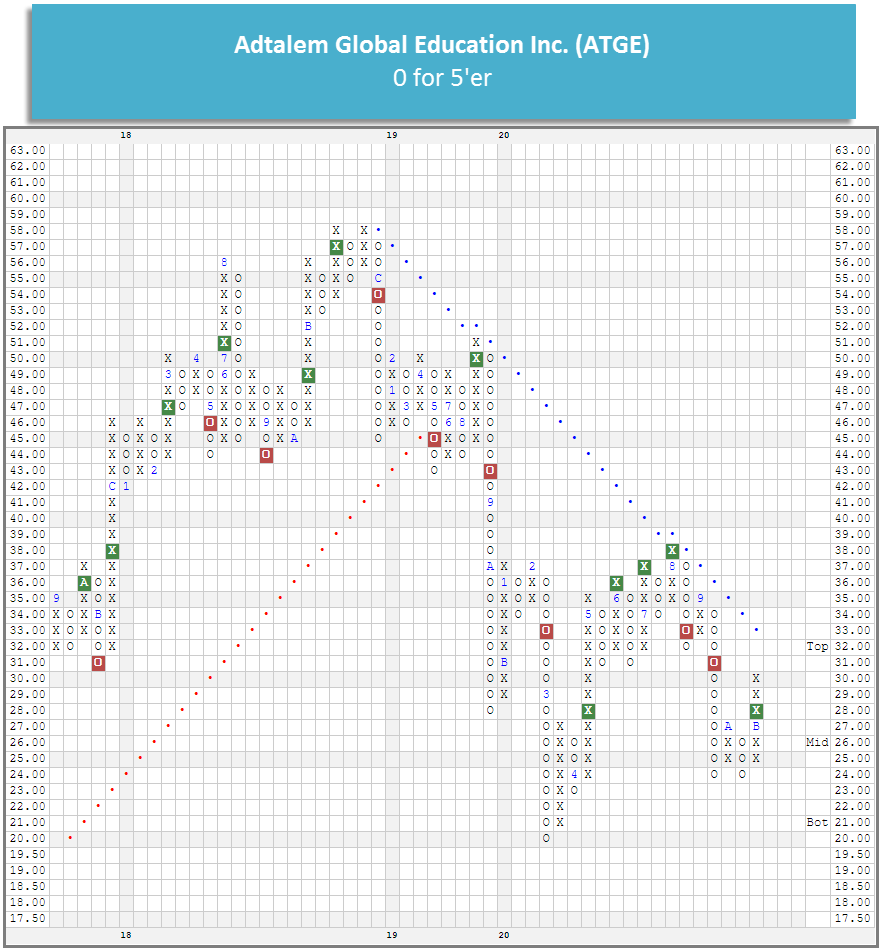

To reiterate, the basic concept of tax loss bounce plays is to capitalize on saturation of supply caused by tax-loss selling of weak, depressed, often small-cap stocks. Those are the stocks most prone to being sold (typically towards the end of the year) to offset gains in one's portfolio (for tax reasons). Typical tax-loss selling brings a weakened stock down even further as we near the end of the year - this is part of the “Pre-January Effect” - but eventually, all those that want to sell for tax reasons have already done so, and the stock finds a bottom. Here’s an example – Adtalem Global Education Inc. ATGE.

ATGE Adtalem Global Education Inc. ($28.93) - Business Products - is a 0 for 5’er that ranks 84th out of 92 names in the business products sector matrix. The stock has been trading in a negative trend since May of 2019. ATGE is down just over 18% this year and around 50% from its 2019 peak, making it a prime candidate for tax loss harvesting. There are already some indications that ATGE may have found a near-term bottom and that demand has increased as it formed but did not break a double bottom at $24 in October, before reversing up and giving a double top buy signal at $28. ATGE is currently trading around $29 and does not face any overhead resistance on its default chart until $33, where its bullish support line currently sits. The nearest support is more than 20% away, so those interested playing a potential bounce may wish to use a dollar or percent-based stop.

Keep in mind that most of these plays should be considered aggressive in nature (more of a bottom fish play), as they are typically both counter-trend, and often have negative RS, and therefore are specific just to short-term holdings. You need to be willing to take profits upon getting a bounce, sticking to the reason why you are buying the stock, especially if a bounce does not impact a change in trend or RS. Furthermore, if you get to the 3rd or 4th week in January and you have not seen a bounce in the stock you are playing, then sell it. As well, be sure to look at the chart of any names you choose to buy in order to set a stop loss point on the downside. In some instances, you will need to set a dollar amount stop loss point if no viable PnF breakdown or violation of support is available. With that, here is this year's list for tax loss selling bounce candidates, with the focus on Small Cap stocks. This list can be found under "DWA Portfolios" in the Portfolio tool and it is called "Tax Loss Selling Bounce Plays 12.3.20” or by clicking here.

Tax Loss Selling Bounce Play Candidates

| Symbol | Name | Recent Price | DWA Sector | Tech Attrib | YTD Perf. |

| AJRD | Aerojet Rocketdyne Holdings Inc. | $38.50 | Aerospace Airline | 0 | -15.68 |

| ALKS | Alkermes Incorporated | $18.82 | Biomedics/Genetics | 0 | -7.74 |

| ARCH | Arch Resources Inc | $36.41 | Oil | 1 | -49.25 |

| ATGE | Adtalem Global Education Inc. | $28.61 | Business Products | 0 | -18.19 |

| AUPH | Aurinia Pharmaceuticals Inc | $14.66 | Drugs | 1 | -27.64 |

| AVA | Avista Corporation | $37.43 | Utilities/Electricity | 0 | -22.17 |

| BEN | Franklin Resources, Inc. | $22.49 | Wall Street | 0 | -13.43 |

| BLKB | Blackbaud, Inc. | $55.09 | Software | 0 | -30.79 |

| BLUE | Bluebird Bio | $46.19 | Biomedics/Genetics | 0 | -47.36 |

| BMRN | BioMarin Pharmaceutical Inc. | $79.86 | Biomedics/Genetics | 0 | -5.55 |

| BTI | British American Tobacco Sp-Adr (United Kingdom) ADR | $35.99 | Food Beverages/Soap | 0 | -15.24 |

| CARA | Cara Therapeutics Inc | $14.90 | Biomedics/Genetics | 0 | -7.51 |

| CARG | CarGurus, Inc. Class A | $24.98 | Retailing | 0 | -28.99 |

| CBD | Brasil Distr Pao Acu-Spr Adr (Brazil) ADR | $12.80 | Food Beverages/Soap | 0 | -41.47 |

| CINF | Cincinnati Financial Corporation | $79.93 | Insurance | 0 | -23.98 |

| COG | Cabot Oil & Gas Corporation | $17.05 | Oil | 0 | -2.07 |

| COLL | Collegium Pharmaceuticals Inc | $18.70 | Drugs | 0 | -9.16 |

| CONN | Conn's, Inc. | $11.93 | Retailing | 0 | -3.71 |

| DLX | Deluxe Corporation | $26.00 | Business Products | 0 | -47.92 |

| EHTH | eHealth, Inc. | $75.76 | Insurance | 0 | -21.15 |

| EPZM | Epizyme | $13.38 | Biomedics/Genetics | 1 | -45.61 |

| FCN | FTI Consulting, Inc. | $104.47 | Business Products | 0 | -5.59 |

| GBDC | Golub Capital BDC LLC | $14.06 | Finance | 0 | -23.81 |

| GBT | Global Blood Therapeutics Inc | $44.78 | Drugs | 0 | -43.67 |

| GILD | Gilead Sciences, Inc. | $61.13 | Biomedics/Genetics | 0 | -5.92 |

| GSK | GlaxoSmithKline Plc. (United Kingdom) ADR | $37.40 | Drugs | 0 | -20.41 |

| HE | Hawaiian Electric Industries, Inc. | $36.29 | Utilities/Electricity | 0 | -22.56 |

| IBM | International Business Machines Corp. | $124.62 | Computers | 0 | -7.03 |

| IFF | International Flavors & Fragrances Inc. | $112.51 | Chemicals | 0 | -12.8 |

| INCY | Incyte Genomics, Inc. | $82.27 | Biomedics/Genetics | 0 | -5.78 |

| INTC | Intel Corporation | $49.90 | Semiconductors | 0 | -16.62 |

| INVA | Theravance Inc | $10.45 | Drugs | 0 | -26.24 |

| IONS | Ionis Pharmaceuticals Inc. | $51.31 | Biomedics/Genetics | 0 | -15.06 |

| JOBS | 51job, Inc. (China) ADR | $72.80 | Business Products | 0 | -14.25 |

| KL | Kirkland Lake Gold Inc | $41.22 | Precious Metals | 1 | -6.47 |

| LNTH | Lantheus Holdings Inc | $13.49 | Healthcare | 0 | -34.23 |

| LUMN | Lumen Technologies Inc. | $10.50 | Telephone | 0 | -20.51 |

| MLCO | Melco Crown Entertainment Ltd. (Hong Kong) ADR | $18.21 | Gaming Bear Alert | 0 | -24.66 |

| MO | Altria Group Inc. | $40.02 | Food Beverages/Soap | 0 | -19.82 |

| NBIX | Neurocrine Biosciences | $97.17 | Biomedics/Genetics | 0 | -9.6 |

| NEWR | New Relic Inc | $60.35 | Software | 0 | -8.16 |

| NFG | National Fuel Gas Company | $40.84 | Gas Utilities | 0 | -12.25 |

| NTCT | NetScout Systems, Inc. | $24.03 | Software | 0 | -0.17 |

| NUVA | NuVasive, Inc. | $46.90 | Biomedics/Genetics | 0 | -39.36 |

| OMER | Omeros Corporation | $12.43 | Biomedics/Genetics | 0 | -11.78 |

| POR | Portland General Electric Company | $41.71 | Utilities/Electricity | 0 | -25.24 |

| PRGO | Perrigo Co. PLC | $47.96 | Drugs | 0 | -7.16 |

| SAP | SAP AG (Germany) ADR | $122.50 | Software | 0 | -8.57 |

| SIMO | Silicon Motion Technology Corporation (Taiwan) ADR | $38.94 | Semiconductors | 0 | -23.21 |

| TDC | Teradata Corporation | $21.46 | Computers | 0 | -19.84 |

| TDS | Telephone & Data Systems Inc | $19.13 | Telephone | 0 | -24.77 |

| THS | TreeHouse Foods, Inc. | $40.36 | Food Beverages/Soap | 0 | -16.78 |

| TNK | Teekay Tankers, Ltd. | $11.52 | Transports/Non Air | 0 | -51.94 |

| TRP | TransCanada Corporation | $44.99 | Gas Utilities | 1 | -15.61 |

| UVE | Universal Insurance Holdings, Inc. | $14.27 | Insurance | 0 | -49.02 |

| WAFD | Washington Federal, Inc. | $24.45 | Savings & Loans | 1 | -33.29 |

| ZGNX | Zogenix, Inc. | $21.49 | Drugs | 0 | -58.78 |

| ZUO | Zuora, Inc. Class A | $11.58 | Software | 0 | -19.19 |

Data as of 12/2/20.