The Money Market Percentile Rank (MMPR) continues lower, while convertible bonds push higher.

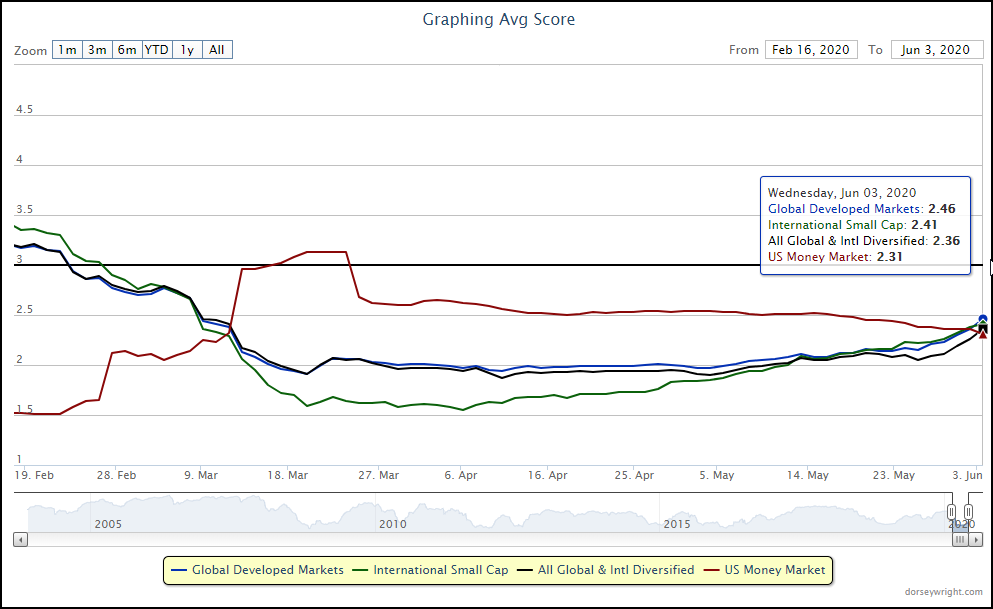

The Money Market Percentile Rank (MMPR) has continued to decline over the past week, falling to a recent posting of 27.46%. As a refresher, this reading tracks the relative position of the US money market group against the rest of the groups on the Asset Class Group Scores (ACGS) system, and we have now seen the reading fall below 30% for the first time since it began to rise in early March. Interestingly enough, we can also see that the MMPR never sat in the 30s during its ascent, jumping from a level of 23% to 47% on March 12th. This exemplifies the swift moves this reading is capable of, and while we have yet to see a drastic tick to the downside, that is certainly something to keep an eye out for as we continue to see the level drop.

One point we have continued to monitor in the recent movement of the MMPR has been what groups have moved above the US money market group, as the actual average score of the group has declined but continued to show rather muted score changes. The past few days have seen some notable improvement in unfavorable areas, with MLPs advancing ahead of US money market. The bulk of other groups that have risen above money market come from foreign equity classifications, as we have seen the all global & international diversified, international small-cap, and global developed markets groups push higher towards the 2.50 score threshold. This indicates a continuing broadening of improvement across foreign equities, following the increased participation we have seen in US markets.

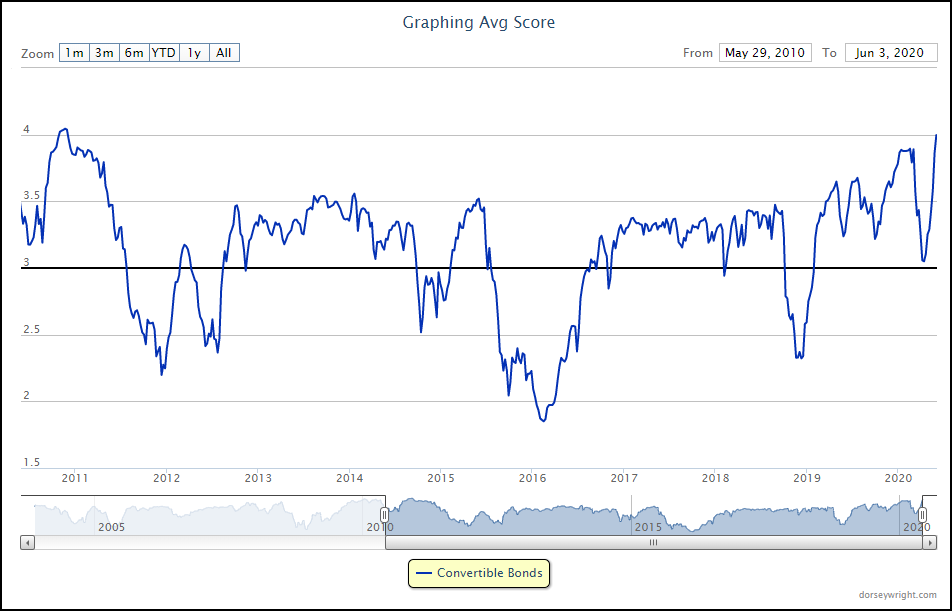

The top of the ACGS rankings continues to be dominated by domestic equity-focused areas, as there are now 10 such groups that score above the sought-after 4 score line. One of the more surprising areas that have seen improvement has been convertible bonds, which rose into above the blue threshold this week with a recent average score posting of 4.04. Convertible bonds tend to be more correlated to equity movement given their structure, however, it is certainly noteworthy to see such significant improvement from a more defensively-minded group on the backs of broadening strength in domestic equities. The recent score posting of the group actually marks its highest level since November of 2010, when the group saw an average score above 4.00 for about a month before moving back south. This will also be an area to monitor as we move towards the halfway point of the year, especially given its current overbought status created by the recent price rally.