Zoom soars to new heights.

ESS Webinar Series Replays: We are excited to bring you replays of each of the Enhanced Security Selection (ESS) package webinars that we have conducted over the past four weeks. These webinars provide some background information on the tools you get with the ESS package and offer potential implementation ideas to put these tools to work. Each webinar is approximately an hour long. Please see the breakdown of topics and their respective video replays listed below.

- May 7th - The Matrix tool & Models

- May 14th - Fund Scores & Asset Class Group Scores

- May 22nd - FSM Models

- May 28th - Team Builder

Market Webinar Replay: We also have a video replay and slides available from our lastest Market Update Webinar from Monday, June 1st:

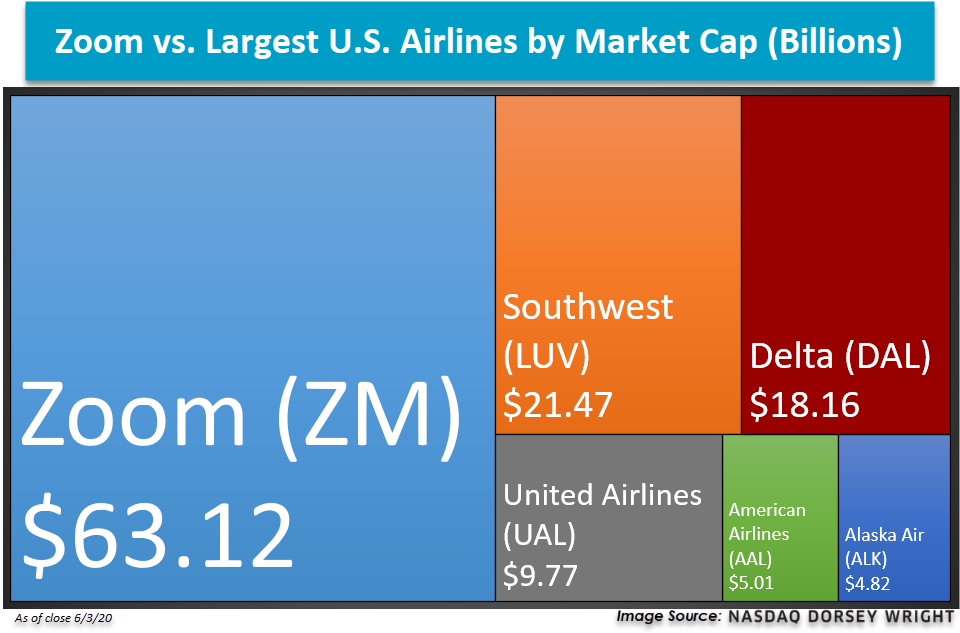

Zoom-ing Higher: As far as historic disruptions to social and economic ways of life, very few in the modern era have been as immediate and as widespread as the COVID-19 outbreak and fallout. In business, however, one company’s (or industry’s) folly is another’s fortune. Perhaps the single best example of a company that has benefited from the current environment lies with Zoom Inc. ZM, which provides teleconference software to individuals and businesses. While Zoom is certainly not the first in this space, its success has been meteoric and has captured the attention of investors seeking the “next big thing” in an era of IPO flops and broken unicorn dreams. Since ZM first began trading on April 17th, 2019, the stock has returned a whopping 478% relative to the S&P 500’s SPX 6.22% during the same period (as of 6/2/20). While the first year of trading was choppy, 2020 has proven much more fruitful as the software provider has rocketed 205.82% on a year-to-date basis. On yesterday’s earnings call, Zoom reported an increase in monthly active mobile app users from 14 million on March 4th to 173 million monthly users as of May 27th, placing an exclamation mark on just how integral of a product Zoom has become during the current market environment (source: CNBC). In fact, after today’s close, ZM’s market cap is higher than that of the 5 largest U.S. airlines that have undoubtedly been impacted by travel restrictions and lockdowns (source: Factset). Despite the success for this strong 5 for 5’er, ZM is heavily overbought at current levels and does not find near-term support until $150 on its default chart.