Hong Kong came to the center stage of world news late last year due to protests against mainland China after a controversial law was passed. Hong Kong residents viewed the legislation as infringing on their rights based on the agreement of “one country two systems” after Hong Kong was handed back to China in 1997 from Great Britain. US and China tensions are beginning to boil over again with the latest development of China passing a plan to increase its security presence in Hong Kong. The US has signaled that it was likely to end some or all of the US government’s special trade and economic relations with Hong Kong due to China’s actions. The state department no longer considers Hong Kong to have significant autonomy. The current special status allows the US dollar can be freely exchanged with the Hong Kong dollar, Hong Kong gets preferential treatment with regards to trade, and the US and Hong Kong have a visa-free travel policy. If this were to change, Hong Kong would be treated like any other Chinese city and American businesses may choose to leave due to higher costs and restricted travel. Also, Hong Kong would be subject to the same export controls over sensitive technology. The further deterioration of the US and China relationship could have serious implications on US markets as many large US companies rely heavily on China for revenue.

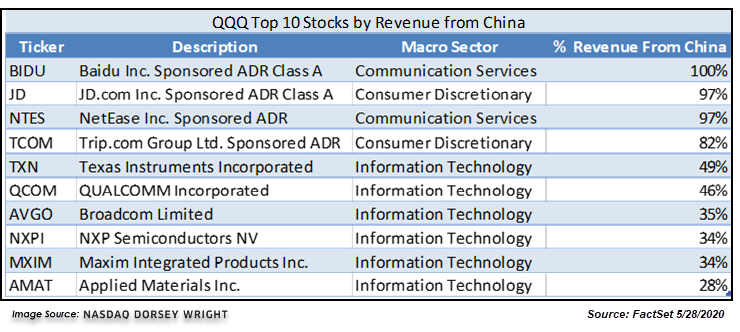

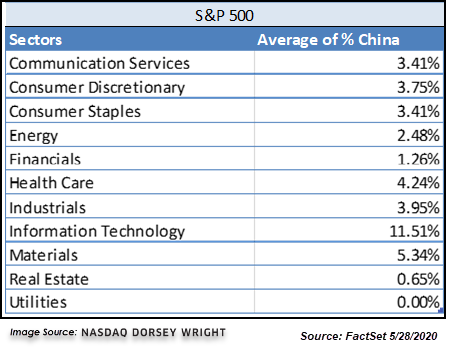

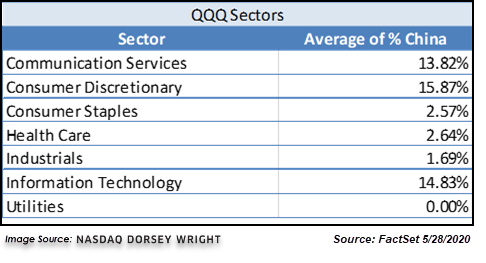

According to FactSet, the average company tracked in the S&P 500 has 4.19% of its revenue derived from China, and the companies tracked in the Invesco QQQ Trust QQQ have an average of 11.02% revenues derived from China. Some popular names that rely on China for revenue include Apple Inc. (AAPL) with 15.70% of its revenue from China, Starbucks (SBUX) with 14.39%, and Chevron with 26.38% amongst many others.

In terms of sectors, some are more reliant than others on China for revenue. As seen in the tables below, some of these sectors attribute a significant portion of revenues to China.

If tensions between the US and China continue to escalate, these high revenue exposure sectors like Information Technology, Communication Services, and Consumer Discretionary could be negatively affected. Some of the larger names that have China exposure could face a damaging impact and pull these cap-weighted indices with them. The averages were given equal weights, so large names like Microsoft and Apple that derive a significant portion of revenue from China could have an even larger negative effect on the major indices than the numbers above suggest. Regardless of weightings, the continuation of tensions between the US and China brings a large level of uncertainty to US companies that depend on China for a significant portion of their revenue stream.

(Sources: The New York Times, FactSet)