We spotlight two recently-launched ETFs that track modified versions of the FSM CoreSolution U.S. and All-Cap World models.

Team Builder Webinar: Want to learn more about how to effectively use the Team Builder tool? Join us on Thursday, May 28th at 1 pm as we navigate through Team Builder and discuss use cases. Register here.

Replay for FSM Models Webinar: We have a replay available for our latest webinar on Applying the Fund Score Method through FSM Models, which took place on Thursday, May 21st. This webinar featured an overview of the various FSM strategies and offered potential implementation ideas. Click here to view the replay.

Market Webinar Replay: We also have a video replay and slides available from our lastest Market Update Webinar from Tuesday, May 26th:

Core Solutions: Late last year, AdvisorShares launched two ETFs that are based on FSM models available on the research platform: the FSM Core Solution US Core 2S PR4050 and FSM CoreSolution All Cap World 2S PR4050. The respective products, the AdvisorShares Dorsey Wright FSM U.S. Core ETF DWUS and the AdvisorShares Dorsey Wright FSM All Cap World ETF DWAW, follow the same inventory guidelines in which the fund score is used to determine the first and second-ranked ETFs from a list of highly liquid, core-based funds. As the names suggest, the U.S. Core model derives its holdings from a purely large-cap domestic equity constituency, whereas All Cap World draws from a wider list that includes size and style ETF constituents, as well as international core products should relative strength lean in that direction. However, the manner in which the ETFs will raise cash is different. DWUS and DWAW are updated on a seasonal quarter basis, but instead of reviewing the PR4050 offense/defense indicator that is evaluated for specific FSM models on a monthly basis, the strategies review the indicator weekly. If triggered, the strategies incrementally increase or decrease cash exposure by scaling into a defensive or offensive allocation (source: AdvisorShares). Both strategies serve well as core-equity exposure foundations that allow for tactical leaning toward stylistic changes within the core while maintaining the integrity of broad-market, multi-sector, and beta-like exposure.

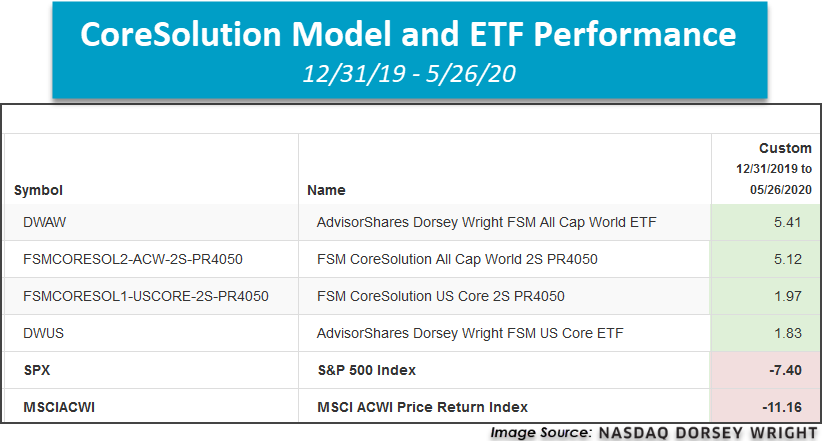

On the year, both models and model-based ETFs have outperformed their respective model benchmarks, as shown below. Additionally, each respective fund scores above the sought-after optimal 4.00 fund score threshold, suggesting both absolute and relative strength. For more information on each fund, please visit the AdivosrShares website for DWUS and DWAW.