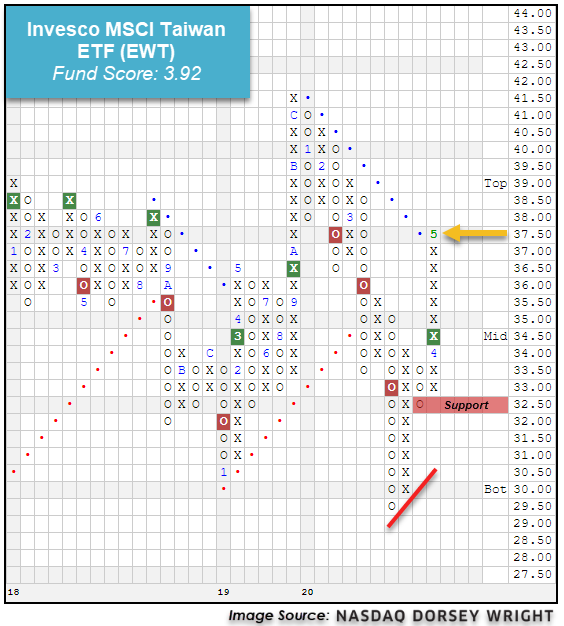

Although Taiwan has not seen as much focus recently, its equity market has certainly demonstrated notable technical improvement, as we highlight through the iShares MSCI Taiwan ETF (EWT).

Broad international equities have largely continued higher over the past week, with the iShares MSCI EAFE ETF EFA moving higher to $59 in intraday trading Wednesday, placing the fund just one box shy of its longer-term bearish resistance line. The iShares MSCI Emerging Markets ETF EEM has shown muted gains, however, the fund still sits at a double top formation at $37.50. A movement to $38 would not only lead the fund to a third consecutive buy signal but would also break through EEM’s respective bearish resistance line to place the fund back in an overall positive trend. While we have seen continued improvement in the broader emerging markets space, there has been more improvement from some individual factors within international equities, namely momentum.

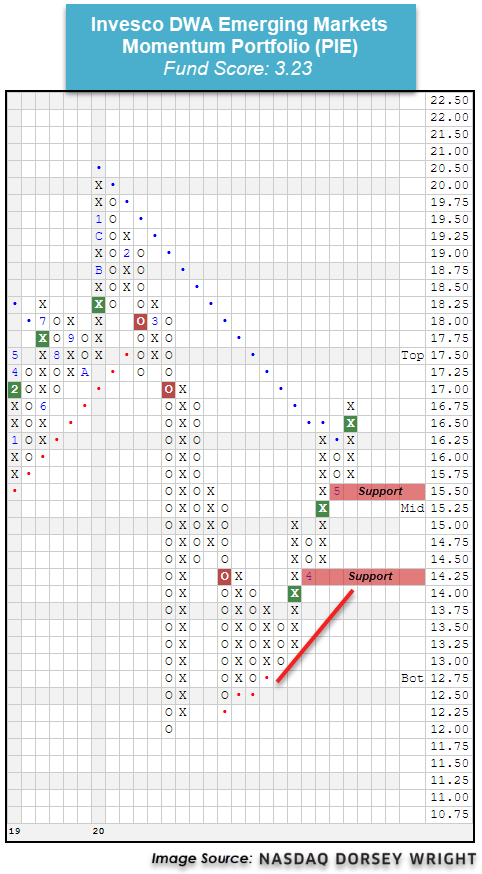

The Invesco DWA Emerging Markets Momentum Portfolio PIE has shown a substantial move to the upside, as the fund advanced off of its near-term low of $12 to recently give its third consecutive buy signal at $16.50, which also moved the fund back to an overall positive trend in mid-May before it continued higher to its current chart position of $16.75. PIE has also demonstrated strength from a fund score perspective, with a recent score posting of 3.23 besting the average emerging markets fund (1.72) as well as the average non-US fund (1.77), paired with a positive score direction of 1.67.

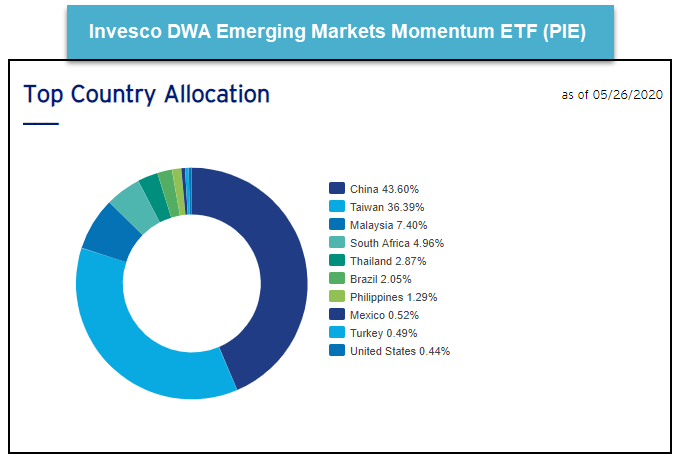

In order to review which areas this leadership-seeking strategy is positioned towards, we can take a look underneath the hood at the individual country allocation of the portfolio. In doing so, we see, perhaps unsurprisingly, that China represents the highest weighting of any country in the portfolio at over 43% of the allocation. China has maintained its positing as the highest-scoring international group on the Asset Class Group Scores (ACGS) page throughout this market turbulence, which has been a continued focus of our international equity research over the past few weeks. Interestingly enough, we see that Taiwan makes up a significant portion of the remaining portfolio allocation, at 36% of the fund. This puts almost 80% of PIE’s allocation in only two countries, China and Taiwan.

(Source: invesco.com)

Although Taiwan has not seen as much focus recently, its equity market has certainly demonstrated notable technical improvement, as we can see through the iShares MSCI Taiwan ETF EWT, which fell to give three consecutive sell signals earlier this year before moving to a new multi-year low at $29.50 in March. Since that time, however, EWT has improved drastically, returning to a buy signal at $34.50 in April before pushing further to $37.50 in trading on Tuesday, which broke through the fund’s bearish resistance line and places it back in an overall positive trend. EWT has also maintained a fund score north of 3.90 since the end of April, which outpaces the average Asia fund of 2.41. The near-term rally has left the fund on a rather large stem, however, near-term support can be found at $32.50. From current levels, overhead resistance may come initially around $39 from March of this year.