Some analysts and investors have expressed concerns that the fiscal and monetary stimulus efforts undertaken to combat the economic slowdown due to the COVID-19 could result in heightened inflation.

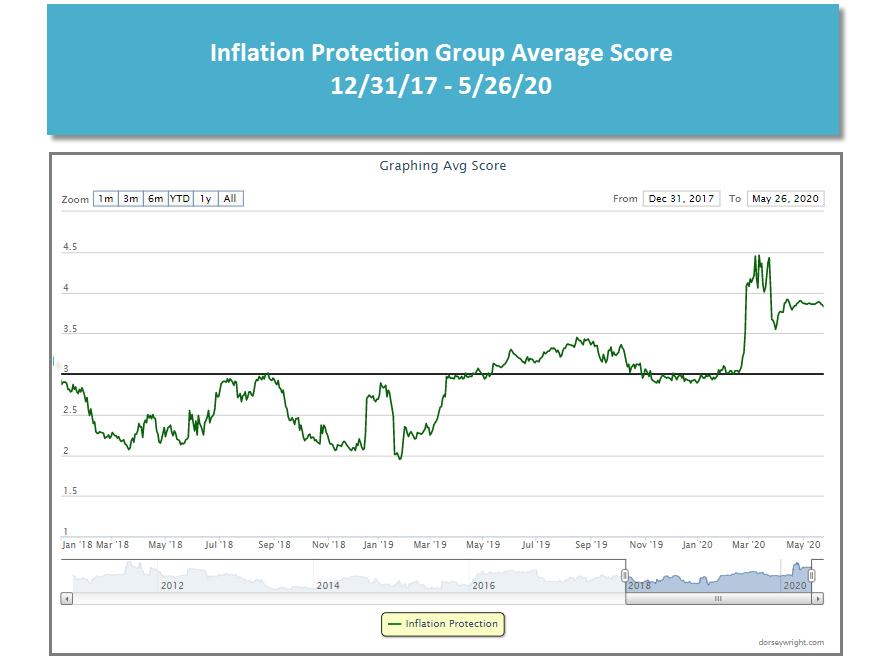

Some analysts and investors have expressed concerns that the fiscal and monetary stimulus efforts undertaken to combat the economic slowdown due to the COVID-19 could result in heightened inflation. As a general rule, inflation is good for borrowers and bad for lenders, and, of course, lenders include bondholders. If you are concerned about higher inflation, one way to hedge that risk is through the use of inflation protected securities. Within the Asset Class Group Scores system, we have seen the average score of the Inflation Protection group rise from around 3.0 at the beginning of February, to a peak north of 4.0 in March, and then pull back slightly to its current level of 3.83, which puts it in sixth place among all fixed income groups. The primary inflation protected securities for domestic investors are U.S. Treasury Inflation Protected Securities (TIPS), which are issued by the U.S. government.

- The principal (par) value of TIPS are indexed to the CPI, i.e. the value changes with changes in the rate of inflation. The coupon payments are based on the principal value and therefore also change with inflation.

- TIPS can be an effective way to hedge against inflation, however, they also have a few disadvantages:

- The face (principal) value of TIPS will decrease if there is deflation. And while you are guaranteed to receive at least the issuance face value at maturity, a reduction in the principal value will reduce the interim coupon payments.

- If you hold individual TIPS and the principal value is adjusted upwards, the increase is a taxable gain in that year. This is known as “phantom income.”

- TIPS are available via ETFs and mutual funds, however, the performance of these funds may differ from that of the underlying bonds – a fund manager may buy or sell the underlying securities before maturity, which may lead to gains or losses.

- In addition to TIPS, there are other inflation-protected securities, mostly issued by foreign sovereigns. The specifics of how these securities are protected from inflation and how inflation is measured will vary by issuer.

One additional characteristic of TIPS funds that investors should be aware of is that they tend to have a relatively high duration (i.e. interest rate sensitivity). The iShares TIPS Bond ETF TIP for example has an effective duration of 7.83 years, which is actually greater than the effective duration of the iShares Core U.S. Aggregate Bond ETF AGG at 5.72 years. While longer duration is not bad per se, it does mean that the fund can be expected to lose (gain) value if interest rates rise (fall), and investors may be concerned about adding duration exposure given that interest rates are currently at historically low levels.

If you're concerned about inflation, but also concerned about the duration exposure of a TIPS fund, one alternative you can consider is the Index IQ Real Return ETF CPI. CPI is part of the IQ Alternative Allocation Model IQALT universe, which is itself designed to be an alternative to traditional fixed income without the same strong negative correlation to interest rates. CPI tracks an index that seeks to provide a "real return" or a return above the rate of inflation, thereby providing a hedge against the U.S. inflation rate, as represented by the Consumer Price Index. The fund holds a mix of fixed income, equities, and real assets. As of April 30th, its portfolio consisted of approximately 83% short-term bonds, 10% equities, and 7% real assets. (Source: New York Life Investment).