A look at the percentage of revenue of U.S. companies that comes from abroad.

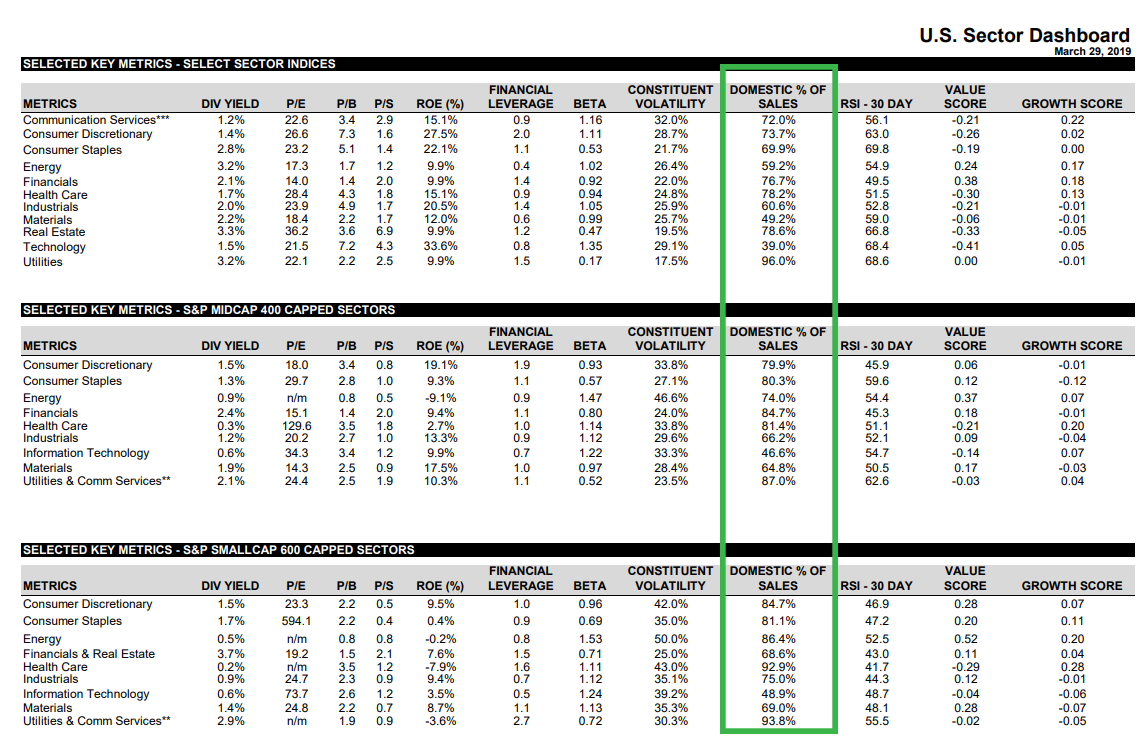

A preference or bias in investing is normal. After all, we are all human and have individual preferences, risks, and goals to keep in mind when we are selecting what allocations, funds or securities we choose. Some advisors are still dye-in-the-wool users of mutual funds and do not trust ETF’s, while others prefer to only pull income like dividends and interest from the account. One preference that has been discussed extensively is the preference to invest in your home market. Simply put, people in the U.S. have an overweight in U.S. stock relative to global market share. One reason we often hear advisors mention is that “The large companies have enough non-U.S. exposure.” While it is true it may not be as much as you may think, Below is a chart that is published by S&P every month showing statistics on each sector and market cap segment.

Source: S&P Global Indexes

For large caps, a very large portion of the revenue still comes from U.S. consumers, especially when looking at the more defensive and higher dividend sectors. Technology and Materials derive a large portion of their revenue from outside the U.S., which is not surprising when you look at Google, Apple, Facebook or Qualcomm. So when your portfolio becomes more defensive and shifts from your growth sectors and you need diversification or differentiated alpha, is exactly the time you will be losing the benefit.

For the last 10 years owning just U.S. equities has worked out great as the U.S. large cap (specifically mega cap) market has had an amazing run. Prior to the great run up that we have had, however, this was not the case, and many investors have forgotten the lost decade for the S&P. During the 2000’s if you bought anything outside of the S&P, you made more money. Unfortunately some clients forget that diversification works over time, not every time. The question for investors is are we likely to have another decade of U.S. domination or will other areas of the market begin to revert back up to historical valuations relative to U.S. equities?