One thing that caught our attention recently was a Wall Street Journal Article entitled “What We’ve Learned About Target-Date Funds, 10 Years Later.” Similar to robo-advisors, target date funds are another way that some fund companies have attempted to usurp the role of the financial advisor, however, they also offer you an opportunity.

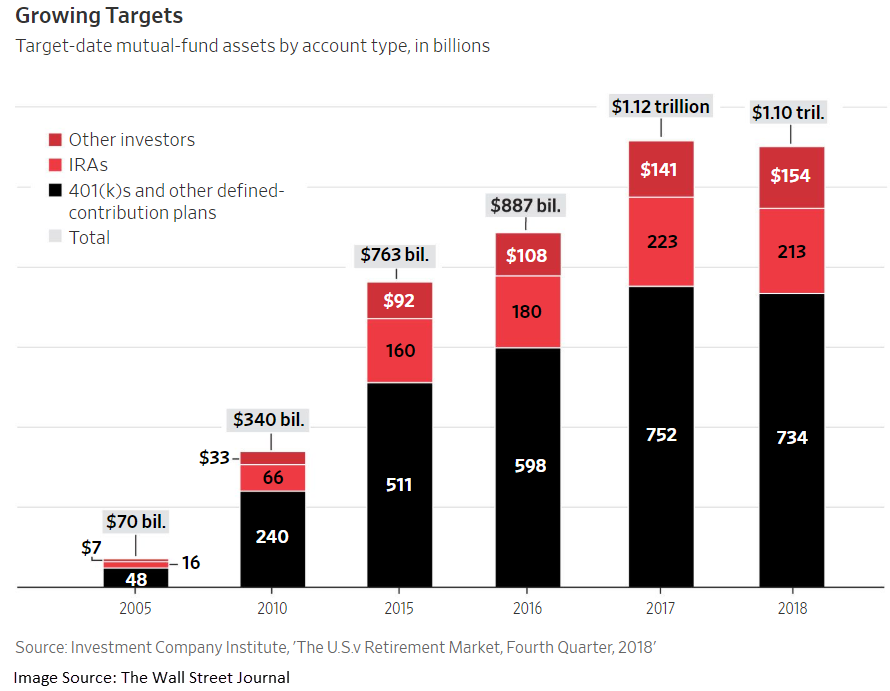

One thing that caught our attention recently was a Wall Street Journal Article entitled “What We’ve Learned About Target-Date Funds, 10 Years Later.” The article begins by discussing how many investors, who were close to retirement in 2008, and were invested in 2010 target-date funds, were taken by surprise when the target-date funds in which they had invested their retirement portfolio lost a substantial portion of their value during the financial crisis. For many of us, even if we don’t know the performance of specific 2010 target-date funds during the financial crisis, this is unsurprising as we now know, that 2008 shined a spotlight on one of the major defects of modern portfolio theory – the proclaimed benefits of diversification disappeared as previously uncorrelated assets suddenly became highly correlated as panic set in and investors looked to liquidate exposure to asset classes across the board. It goes on to say that since then, the amount invested in target-date funds has grown by $532 billion, largely due to investments by 401(k) plan participants. Our point here isn't to tear apart the method by which these funds are actually constructed and rebalanced – unexpectedly large drawdowns during 2008 were by no means restricted only to target-date funds and besides, the biggest problems with target-date funds are more fundamental than simply being too reliant on historical correlations, they lie within the target-date fund concept itself.

Before we jump into the problems, it is worth pointing out, that despite their shortcomings, target-date funds are not without redeeming qualities. Well, maybe one redeeming quality, but, it is a significant one – they provide a default option for 401(k)’s and other retirement plans, many of which, thanks to the research of Richard Thaler and others, have moved to an opt-out instead of opt-in format in an effort to encourage their participants to save for retirement. And people who would not be putting aside money for retirement if they were automatically enrolled in a 401(k) plan and defaulted to a target-date fund are definitely better off than they otherwise would be. However, this does not mean we need to embrace these funds beyond this limited use case.

Similar to robo-advisors, target date funds are another way that some fund companies have attempted to usurp the role of the financial advisor. Essentially what target-date funds do is attempt to take all of the asset allocation work an advisor does for a client and boil it down to a one-size-fits allocation based on a single number – age. The further away the target-date is, the more risk-on the fund is, and as the target date draws closer, the fund’s allocation shifts to a “safer” allocation with greater weight in fixed income. Some of the problems here are immediately apparent. Aside from the questionableness of how safe these funds truly become even when they are very close to their target date, anyone who has actually prepared an asset allocation for a client can tell you trying to generate an optimal allocation based on nothing but age is a fool’s errand. Variables like income, marital status, and lifestyle all have a material impact on how a retirement portfolio should be allocated, but, of course, target-date funds factor in none of these considerations. Target-date funds also don’t take into account individual goals for retirement nor do they adjust to changing conditions. Perhaps a 30% fixed income allocation will allow you to reach your goals if bonds are yielding 5%, however, if bond yields are only 3%, the same allocation may not provide the return you need. But, target-date-funds stay the same whether your goal is to have $500,000 or $5 million and whether bonds are yielding 2% or 10%.

We’ve highlighted the shortcomings of target-date funds, but, as an advisor they also offer you an opportunity. Next time you’re talking to a prospect, ask them about their retirement plan, ask them if they have a target date fund. If they do, it offers a golden opportunity to explain the pitfalls of these funds, show them how you would create a more suitable allocation, and to talk about your methodology. In the past, we’ve also talked about the difficulties of connecting with millennial clients and with making your clients’ children into clients as well. Target date funds offer a great in-road for both. Next time you’re talking to a client with kids who are entering or are close to entering the workforce, ask them about their child’s retirement plan, ask them if they’re using a target-date fund. If they are, offer to put together a sample allocation that will better meet their needs – using the Fund Score system, you can quickly make selections from amongst their 401(k) menu and hopefully add them to your list of clients. You can use a similar approach for millennials who may not have many assets outside of their retirement plan yet, but, by offering to show them an alternative to the target-date fund in their 401(k), you’ll already have an established relationship with them down the road when they need more of the services you provide.