Volatility has certainly picked up in the market over the past few months; however, US Equities remains the number one ranked asset class in DALI. Specifically, Growth, from an investment style perspective, and Technology, from a sector perspective continue to lead their respective groups. So, we would continue to view these areas as the current leaders in the market. However, the Energy sector has recently been the biggest mover to the upside and is an area that warrants your attention today.

Volatility has certainly picked up in the market over the past few months; however, US Equities remains the number one ranked asset class in DALI. Specifically, Growth, from an investment style perspective, and Technology, from a sector perspective continue to lead their respective groups. So, we would continue to view these areas as the current leaders in the market. However, the Energy sector has recently been the biggest mover to the upside and is an area that warrants your attention today.

Most of the headlines you will read are about Crude Oil (CL/) hitting $70 a barrel for the first time since 2014. What you will not hear is that the Point & Figure chart of Crude Oil moved back into a positive trend in July 2017 at $50 and has remained positive ever since. The improvement in Energy has not been confined to this commodity, it has spilled over to the equity markets, driving improvement in oil-related stocks as well.

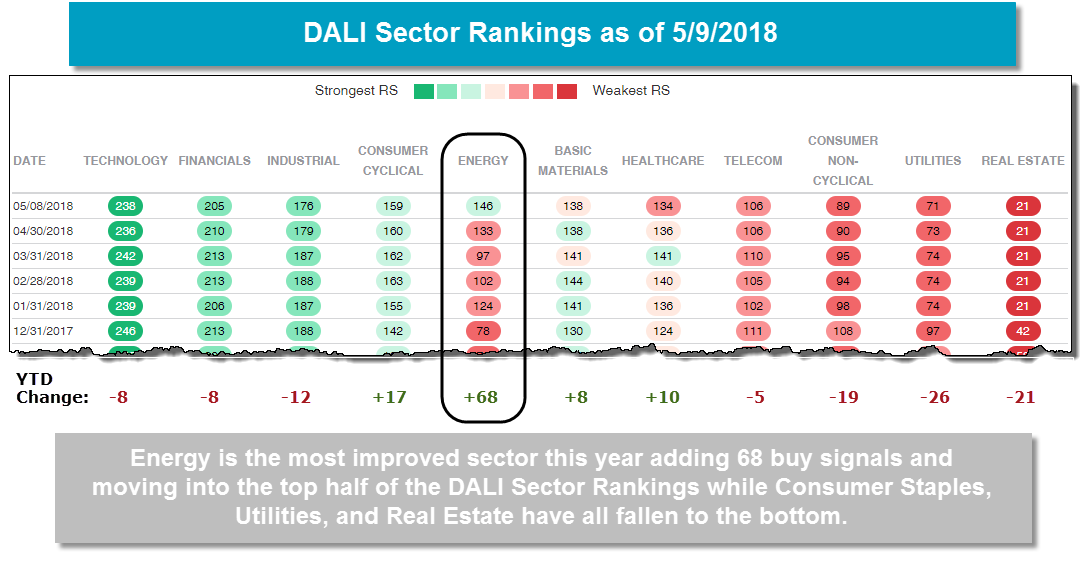

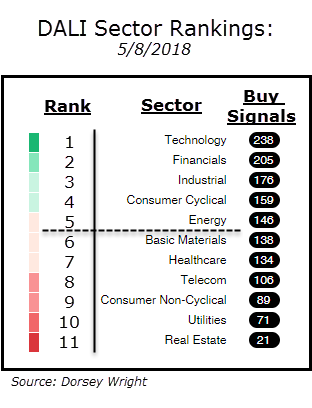

For the first time in over a year, the broad Energy sector has moved into the top half of the DALI Sector Rankings and is by far the most improved sector this year.

Over the course of this year, the Energy sector has added 68 tally buy signals. This is, by far, the most improvement out of all the broad sectors. The second most improved sector has been Consumer Cyclicals (+17 buy signals). On the other hand, the Utilities, Real Estate, and Consumer Staples sectors all have been the biggest movers to the downside and are currently the three lowest ranked sectors in the DALI Sector Rankings.