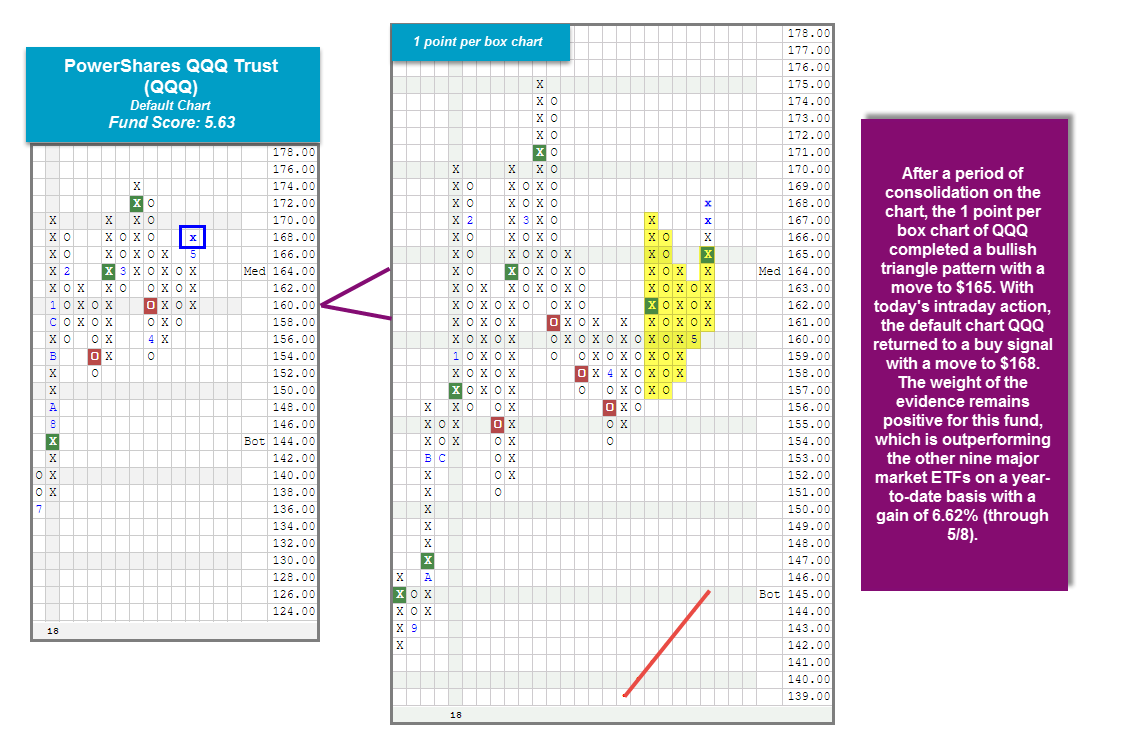

The PowerShares QQQ Trust (QQQ) returned to a Point & Figure buy signal today with move to $168.

Portfolio View - Major Market ETFs

| Symbol | Name | Price | Yield | Trend | RS Signal | RS Col. | Score | 200 Day MA | Weekly Mom |

| DIA | SPDR Dow Jones Industrial Average ETF Trust | 243.42 | 2.02 | Positive | X | 3.44 | 237.85 | +3W | |

| EFA | iShares MSCI EAFE ETF | 70.95 | 2.54 | Positive | Sell | O | 2.76 | 69.63 | +5W |

| FRN | PowerShares Frontier Markets ETF | 15.45 | 3.49 | Positive | Sell | X | 4.01 | 15.20 | -7W |

| IJH | iShares S&P MidCap 400 Index Fund | 191.22 | 1.27 | Positive | Buy | X | 4.39 | 184.60 | +3W |

| IJR | iShares S&P SmallCap 600 Index Fund | 80.12 | 1.17 | Positive | Buy | X | 5.53 | 75.20 | +3W |

| QQQ | PowerShares QQQ Trust | 166.07 | 0.79 | Positive | Buy | X | 5.63 | 155.58 | +2W |

| RSP | PowerShares S&P 500 Equal Weight ETF | 99.93 | 1.62 | Positive | Buy | X | 4.51 | 98.54 | +3W |

| SPY | SPDR S&P 500 ETF Trust | 266.92 | 1.82 | Positive | O | 2.72 | 261.49 | +3W | |

| VWO | Vanguard FTSE Emerging Markets ETF | 45.31 | 2.37 | Positive | Sell | O | 4.58 | 45.64 | -8W |

| XLG | PowerShares S&P 500 Top 50 ETF | 190.12 | 1.84 | Positive | O | 2.58 | 186.04 | +3W |

Additional Comments:

It was a mostly positive week (5/1 – 5/8) for the 10 major market ETFs covered in this report, as eight were able to finish up while just two finished in the red. The biggest mover to the downside this week was once again the PowerShares Frontier Markets ETF FRN while the biggest gainer was the iShares S&P SmallCap 600 Index Fund IJR. On a year-to-date basis, the PowerShares QQQ Trust QQQ continues to lead the pack in terms of performance with a gain of 6.62% (through 5/8). In fact, just this past week, we witnessed the more sensitive 1 point per box chart for the QQQ return to a Point & Figure buy signal as it successfully completed a bullish triangle with a move to $165. With today's (5/9) market action, demand continues to have the upper hand as QQQ was able to push higher and returned to a Point & Figure buy signal on its default chart with a move to $168. The fund continues to trade well above its bullish support line and offers an impressive fund score of 5.63 with a positive score direction of 0.51. At this juncture, QQQ remains near the middle of the 10 week trading band with an OBOS% reading of 10% and recently experienced a flip back to positive weekly momentum, suggesting the potential for higher prices. All in all, the weight of technical evidence remains positive for QQQ and new positions are welcome on this breakout. Looking to the default chart, the first sell signal from here would come with a move to $156, while further support is offered in the mid- $150s.