International Debt has fallen out of the top spot in the DALI Fixed Income rankings and been replaced by US Preferreds & Convertibles.

On Monday (5/7/18), we saw US Preferreds & Convertibles moved ahead of International Debt to take the number one spot in the DALI Fixed Income rankings. This change is directly related to another recent development – strengthening in of the U.S. dollar.

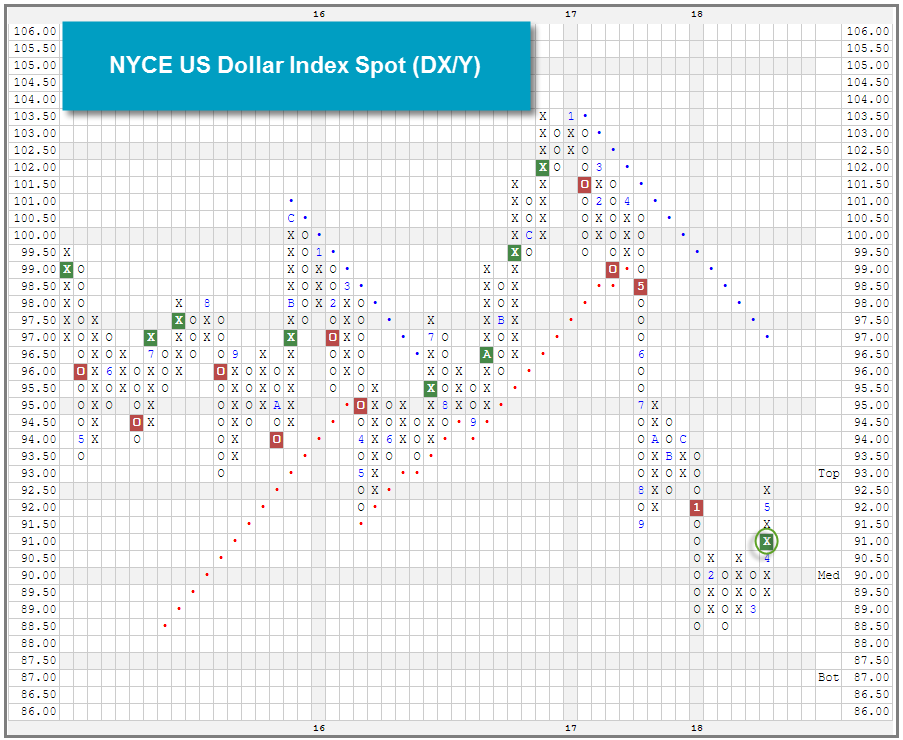

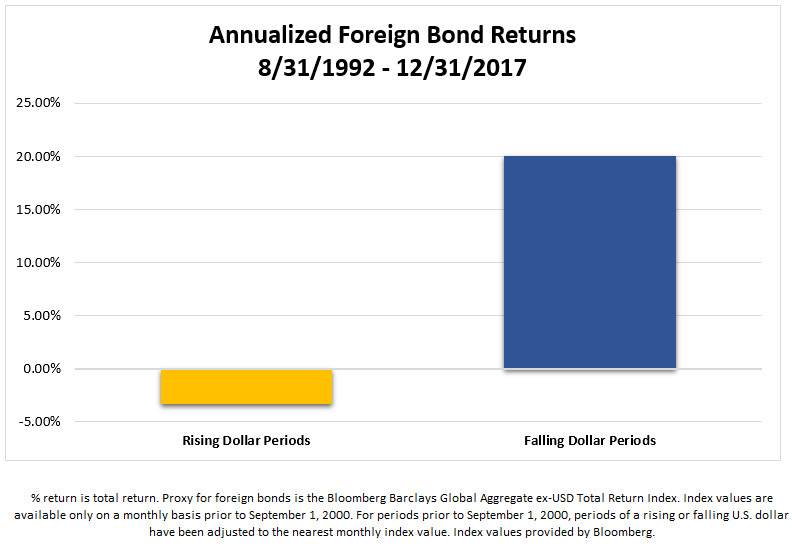

After hitting a multi-year low in February, the NYCE U.S. Dollar Spot Index DX/Y, reversed up late last month, broke a triple top, and currently sits at a 2018 high on its default chart. If this trend of a strengthening dollar continues, it may present something of a conundrum for fixed income investors – as we’ve been in a rising interest rate environment over the last several months, foreign bonds have been an area of relative safety as they are fairly insensitive to changes in domestic rates. However, the performance of foreign bonds is significantly impacted by changes in the U.S. dollar – in fact, currency return is often the largest component of the total return on foreign fixed income investments. Therefore, if we continue the U.S. dollar strengthen, investors may have fewer attractive rate-insensitive fixed income options.

We have already begun to see the rising dollar’s effects in the Asset Class Group Scores. Over the last 30 days, the six groups with the largest score deterioration are Emerging Market Income, Global Currency, and four global income groups.