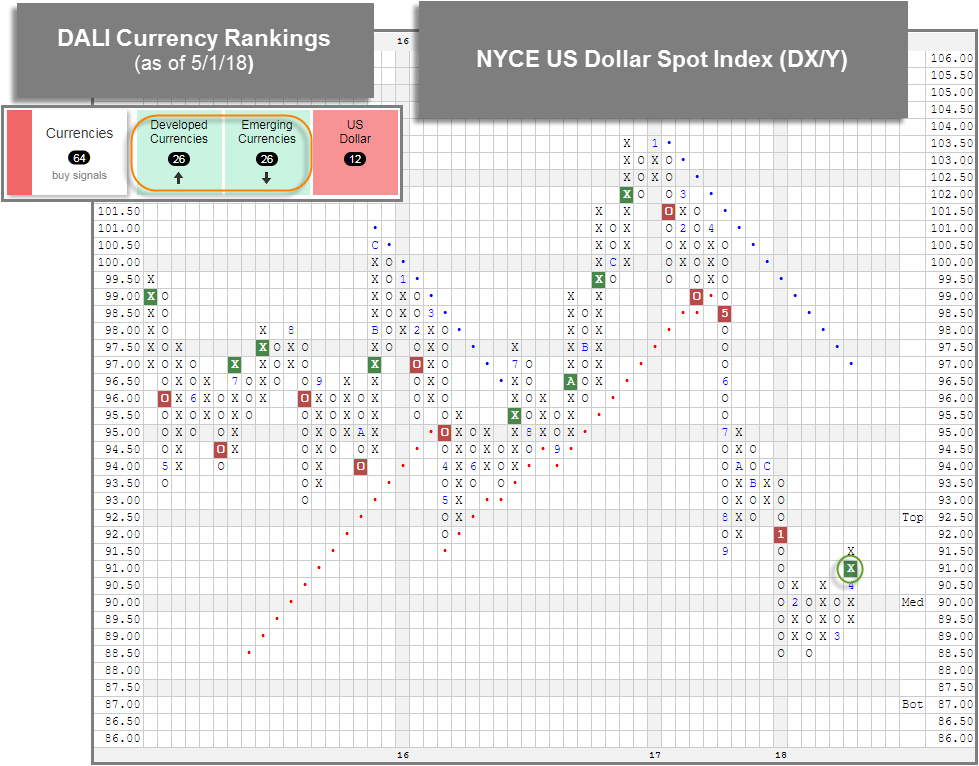

Developed Currencies have overtaken Emerging Currencies for the top spot in the DALI currency rankings. DWA has an upcoming webinar with Oppenheimer and two events in Oklahoma with First Trust.

Upcoming Webinars!

- Beginner Series - There will be no Beginner Series this week since we will be hosting our semi-annual Broker Institute in Las Vegas. We will reconvene next week!

- Oppenheimer Webinar - CE Credits! 1 CFA CE Credit is Available for Attendees of the Dorsey Wright & Oppenheimer Webinar. Click here to register.

Participants will learn:

- What is relative strength investing and how can it be applied in your portfolio building process

- What is revenue weighting and why does it matter

- How are these processes combined in the new Oppenheimer US Revenue Model

- How can this model fit into your overall portfolio

The new Oppenheimer US Revenue Model is Nasdaq Dorsey Wright's first value-oriented portfolio model, which may provide advisors with a more balanced approach to their equity allocation -- especially for those who are currently overweight other style factors, such as growth.

Speakers:

- Ben Jones, Senior Analyst, Nasdaq Dorsey Wright

- David Mazza, Head of ETF Investment Strategy - Beta Solutions, OppenheimerFunds

- Karl Desmond, Product Research Analyst - Beta Solutions, OppenheimerFunds

*Nasdaq is registered with the CFA Institute as a Sponsored Provider of Live CE Programs for CFA Charterholders.

Register Here.

Nasdaq Dorsey Wright and First Trust Event in Oklahoma!

Please join Ben Jones on Tuesday, May 8, 2018 in Oklahoma City and Tulsa for a discussion on "Technical Perspectives – Review of Trends and Relative Strength across Global Markets." There will also be speakers from Riskalyze and First Trust and their discussions will focus on the Riskalyze Platform, the AutoPilot investment tool, as well as an update on Fixed Income. CE Credits are available.

- Oklahoma City - Tuesday, May 8, 2018 - Lunch - Oklahoma City Golf Club and Country Club - 11:30 am - Details Here

- Tulsa - Tuesday, May 8, 2018 - Dinner - Polo Grill - 6:00 pm - Details Here

Space is limited, so please RSVP today. To RSVP, please contact: Steve Martin (630) 765-8688 or stevemartin@ftadvisors.com.

With trading on Tuesday (5/1), Emerging Currencies fell below Developed in the DALI currency rankings. Emerging Currencies had held the top spot since February. Currently, both Developed and Emerging, sit at 26 buy signals, however, as Developed holds the #1 rank as it currently has a higher X rank. Interestingly, this change did not come about because Developed Currencies gained buy signals, instead it was due to Emerging Currencies losing two buy signals to the US Dollar. This is consistent with action we have recently seen in the NYCE US Dollar Spot Index DX/Y. DX/Y recently broke a triple top to reach its highest level since January and is now a buy signal on its default chart for the first time in more than a year. We will be monitoring the 0.25 per box chart more closely in the near term to see if it is able to re-enter a positive trend.