Growth has outperformed Value across all market cap size categories this year, with Large Cap Growth leading the way.

Through the first four months of the year the S&P 500 SPX has been on a bit of a roller coaster ride experiencing new all-time highs in January, the first 10% pullback in two years, a 10% rally, and then experienced another 8% pullback. At the end of the day that ride in the SPX has resulted in a return of --0.96% this year, thru the end of April. While the one main difference in 2018 versus 2017 is the increased level of volatility, one constant has been the leadership of Growth versus Value.

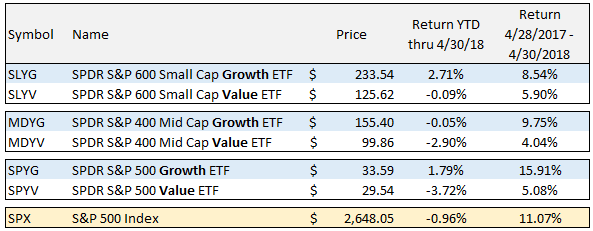

In each of the market cap sizes (Small, Mid, and Large), growth has the upper hand over value with the biggest dispersion coming in Large Growth versus Large Value. YTD (thru April 30th) the SPDR S&P 500 Growth ETF SPYG is up 1.79% versus a return of -3.72% for the SPDR S&P 500 Value ETF SPYV, and when you look at the one year performance comparison that gap is even wider at 15.91% versus 5.08% for Large Growth and Large Value, respectively. In the table below you can see the performance comparison for the nine style boxes for YTD 2018 as well as the trailing 12 months thru the end of the April, and notice in each case the growth style has outperformed value.

A look at the current DALI Size and Style rankings shows that Large Cap Growth is the number one ranked style box, and that has been the case since October 2017. On the other hand, Large Cap Value is ranked last, in 9th position, and that has been the case since March 2009! Additionally, all of the Growth style are currently ranked in the top four spots with Small Growth at number two and Mid Growth at number four.

The DALI Size and Style Rankings offer perspective into the market styles in terms of where the relative strength lies, and it is safe to say the strength, for the past few years, has been in Growth. This idea is exactly what the First Trust Size and Style Model FTSIZESYLE is designed to do, invest in the strongest market style boxes based on their relative strength ranking. Specifically, the FTSIZESTYLE Model owns a First Trust ETF from each the top three Size and Style boxes based on the DALI rankings.

Currently, the FTSIZESTYLE Model holds positions in Large Cap Growth FTC, Small Cap Growth FYC, and Mid Cap Core FNX. So far this year (thru 4/30) the FTSIZESTYLE Model is up 2.32%, compared to a -0.96% return for the S&P 500, and over the past year, ending 4/30, the model is up 15.97% compared to 11.07% for the S&P 500 over the same time period.