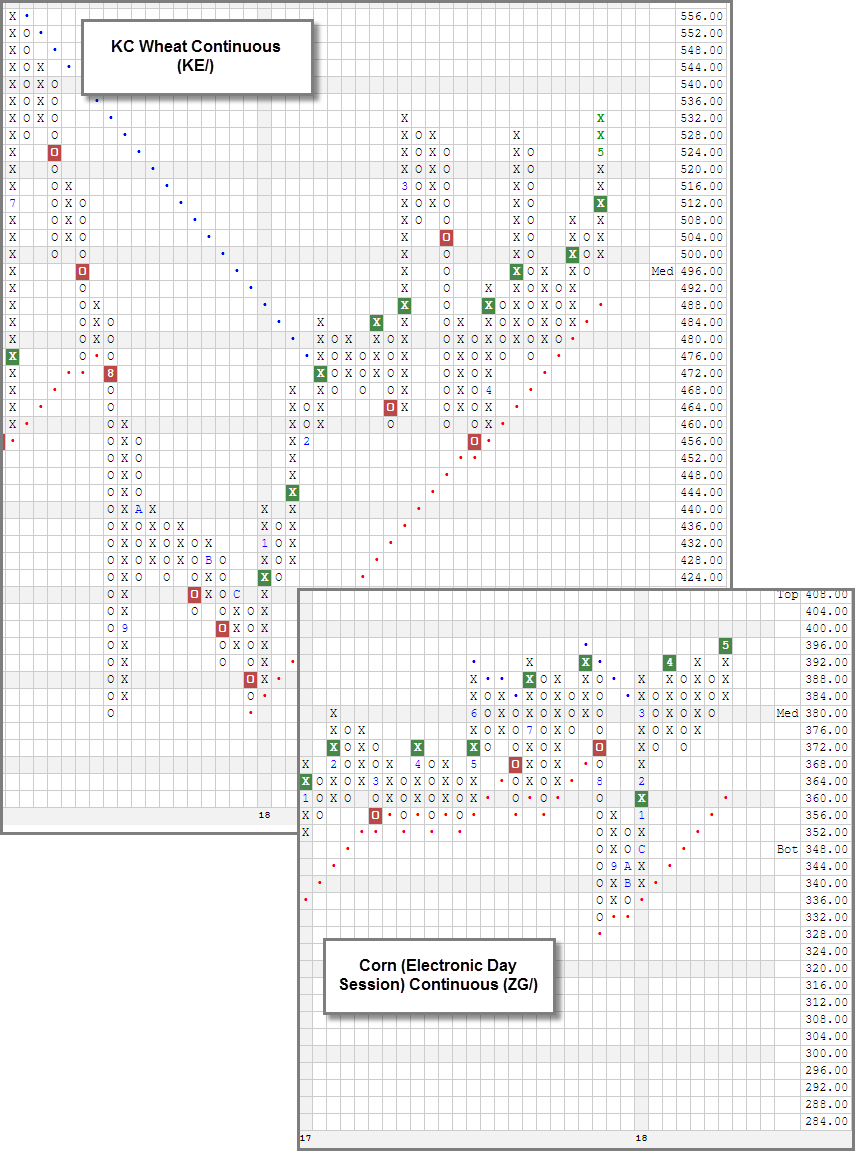

Corn and Wheat are breaking out to the upside.

Remember, these are technical comments only. Just as you must be aware of fundamental data for the stocks we recommend based on technical criteria in the report, so too must you be aware of important data regarding delivery, market moving government releases, and other factors that may influence commodity pricing. We try to limit our technical comments to the most actively traded contracts in advance of delivery, but some contracts trade actively right up to delivery while others taper off well in advance. Be sure you check your dates before trading these contracts. For questions regarding this section or additional coverage of commodities email ben.jones@dorseywright.com.

Data represented in the table below is through 05/01/18:

Broad Market Commodities Report

Portfolio View - Commodity Indices

| Symbol | Name | Price | Trend | RS Signal | RS Col. | 200 Day MA | Weekly Mom |

| CL/ | Crude Oil Continuous | 67.46 | Positive | Buy | X | 57.04 | +4W |

| DBLCIX | Deutsche Bank Liquid Commodities Index | 362.03 | Negative | Sell | O | 334.58 | +7W |

| DWACOMMOD | DWA Continuous Commodity Index | 480.78 | Positive | Sell | O | 463.77 | +3W |

| GC/ | Gold Continuous | 1305.20 | Negative | Buy | X | 1305.03 | -2W |

| GN/Y | S&P GSCI Index Spot | 470.92 | Positive | Sell | X | 423.03 | +4W |

| HG/ | Copper Continuous | 3.03 | Positive | Buy | X | 3.06 | +3W |

| ZG/ | Corn (Electronic Day Session) Continuous | 396.75 | Positive | Sell | X | 359.14 | -4W |

| Links to Additional Summaries |

Grains Starting to Show Absolute Strength:

Within the Agricultural space, we have seen both Corn Continuous ZG/ and KC Wheat Continuous KE/ break out to the upside. KE/ has been trading in a positive trend since February when it broke through the negative trendline at $476. It tested the bullish support line after a brief pause in March at $456, but the trendline held and KE/ continues to push higher. With the recent action, KE/ moved back to its 2018 high at $532 and is now testing this important resistance level. KE/'s weekly momentum has also turned positive. Meanwhile, Corn Continuous ZG/ has broken out to the upside as well. On ZG/'s default chart, ZG/ broke through a significant resistance level when it completed a spread quintuple top at $396. The Agriculture sector, as a whole, lacks the relative strength of Energy or Industrial Metals, but it does provide an area for trading opportunities, as we are seeing divergence and absolute strength emerge for this sector.