Small Growth - Upticking again.

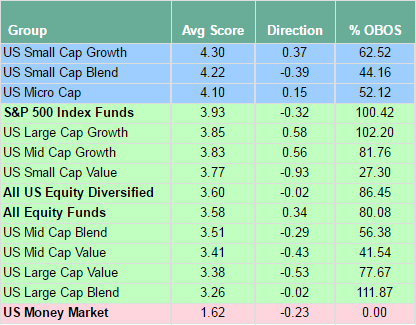

Concerning US Styles, the group scores for Small Growth continue to lead and are starting to uptick again. This 4.30 score is the best score we have seen from this group in this particular cycle coming up from the score lows in February 2016. They seemed to hover during the second quarter, but are showing signs of movement in this present month. Small Cap and Micro Caps also are upticking this month and comprise the only groups that score above the 4 score threshold. At this point in the rally, none of the US Style boxes are in extreme overbought territory on their ten week trading bands and thereby are workable here. Large Value, in general are at the tail end of the list as Large Growth and Small Growth lead in either score or score direction.

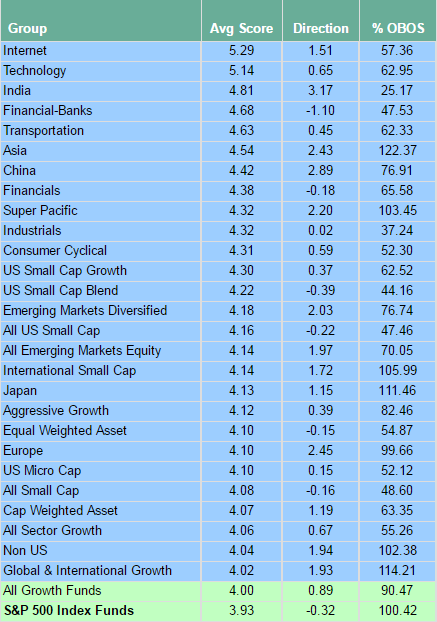

Internet and Tech continue to officially lead the entire list as they alone hold the top two scores above the 5 area. Concerning all groups, the amount of blue groups (those that score above the 4 score line) is pretty huge. As we have been pointing too, is the infiltration of all of these International-related assets that have shown dominance among the rankings. You would be using this information over the quarter to get your international weighting increased as well as paying attention to the US leadership in your available fund inventory. As I hear, your firms are just beginning to highlight Non-US areas, so you have their backing as well as this technical data that you have been using from DWA. In general we don’t see extreme OBOS reading in this universe either, although Asia assets have an elevated reading at this moment. Many of the other blue groups have very modest readings on their ten week trading bands and look very workable here in June. Commodities sit at the very bottom of the score list today offering the lowest long-side score in this cycle. The current score of 1.19 is the lowest score we’ve seen on a 1 year roll, but keep in mind that in the last three years we have seen the group touch on the 0.5 score level. If we see that kind of relative washout, I’ll bring that to your attention.