The Emerging Markets Diversified group is now the highest scoring Macro group in the asset class group scores page, sitting ahead of US equity alternatives.

You will recall that last week, the Emerging Markets Diversified group saw its average score break above the 4-threshold, pushing it into the “blue zone” for the first time since April 26th, 2011. With yesterday’s market action, the group was able to achieve the title of highest scoring Macro group, with an average score of 4.22. This move allowed it to surpass both the US All Small Cap (4.15) and the Equal Weight Asset (4.07) Macro groups, which are also in the strong “blue zone”. Notice the S&P 500 Index Funds group is currently found in the “green zone” with a score of 3.94, just below the Cap Weighted Asset group (4.00).

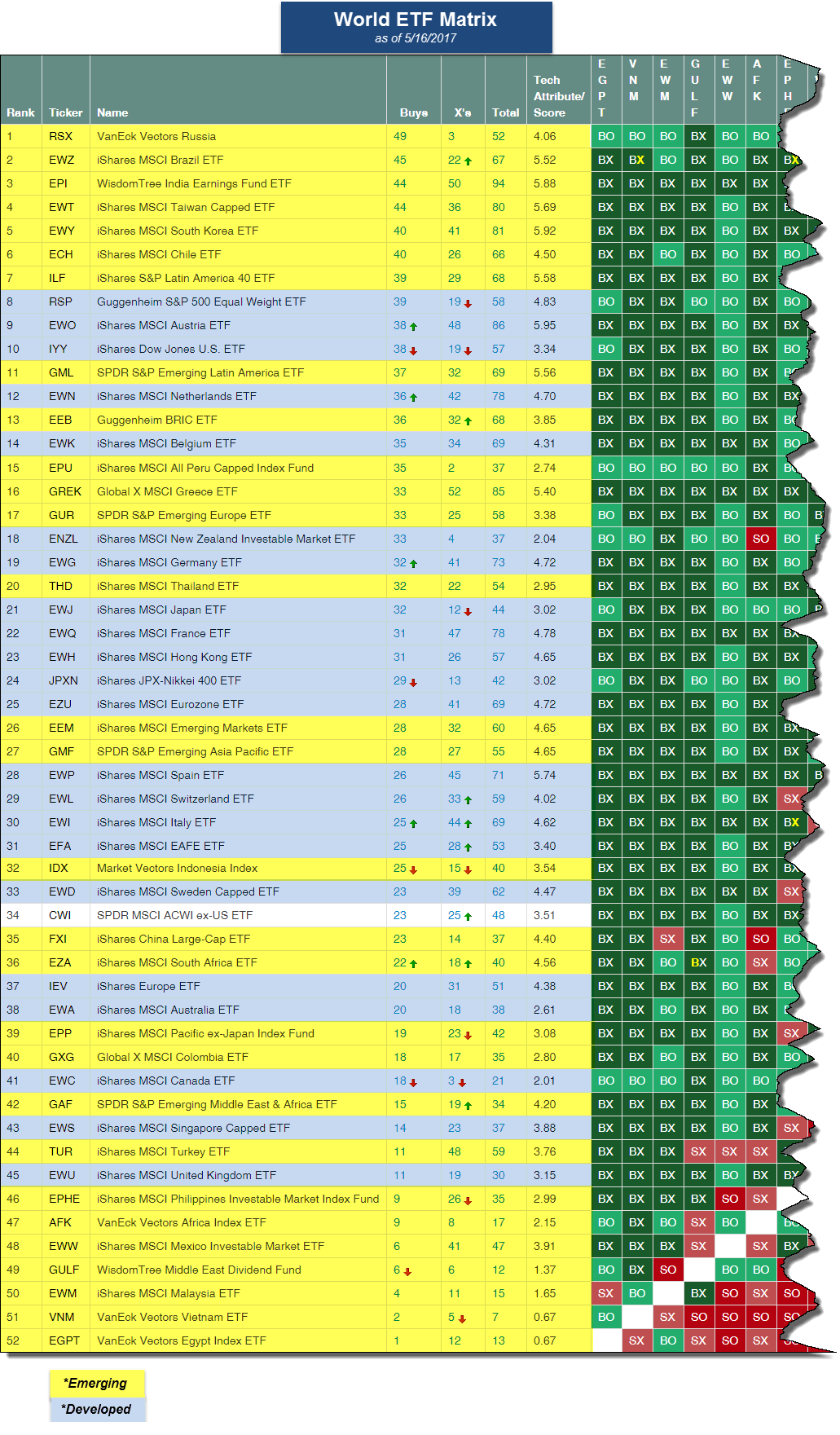

This is the highest average score the Emerging Markets Diversified group has achieved since January 27th, 2011, when it was on its way down from above 5.00. The positive score direction of 2.18, speakings to the recent improvement for the group as well. We can visualize the strength in emerging markets beyond just the fund score averages, as well. Take for instance the World ETF matrix, a premade matrix available under the matrix tool, and shown below. This is a matrix comprised of 52 individual Emerging and Developed funds, including the SPDR MSCI ACWI ex-US ETF CWI. Below we have highlighted the Emerging funds in yellow and the Developed funds in blue. Notice that the top decile of the matrix is made up purely Emerging market funds. Currently, Russia is demonstrating the strongest relative strength followed by Brazil, India, and Taiwan.