Now is as good a time as any to educate current and prospective clients on the importance of incorporating tactical allocation within the portfolio. This discussion need not be overly complicated. Today, we will provide you with some guidance on one effective way to have this conversation.

The major market indices continue to hover around their highs with solid gains logged so far this year. Volatility, as represented by CBOE SPX Volatility Index VIX, remains at record lows, and sector themes have stabilized. Investors, by and large, are "happy" - or as happy as the average investor can be. Of course there will always be obstacles to face and complaints to be heard; but generally speaking, there has been (and continues to be) broad upside participation in this market, which bodes well for most investors. Knowing that this environment will not last forever, now is as good a time as any to educate current and prospective clients on the importance of incorporating tactical allocation within the portfolio. This discussion need not be overly complicated. Today, we will provide you with some guidance on one effective way to have this conversation.

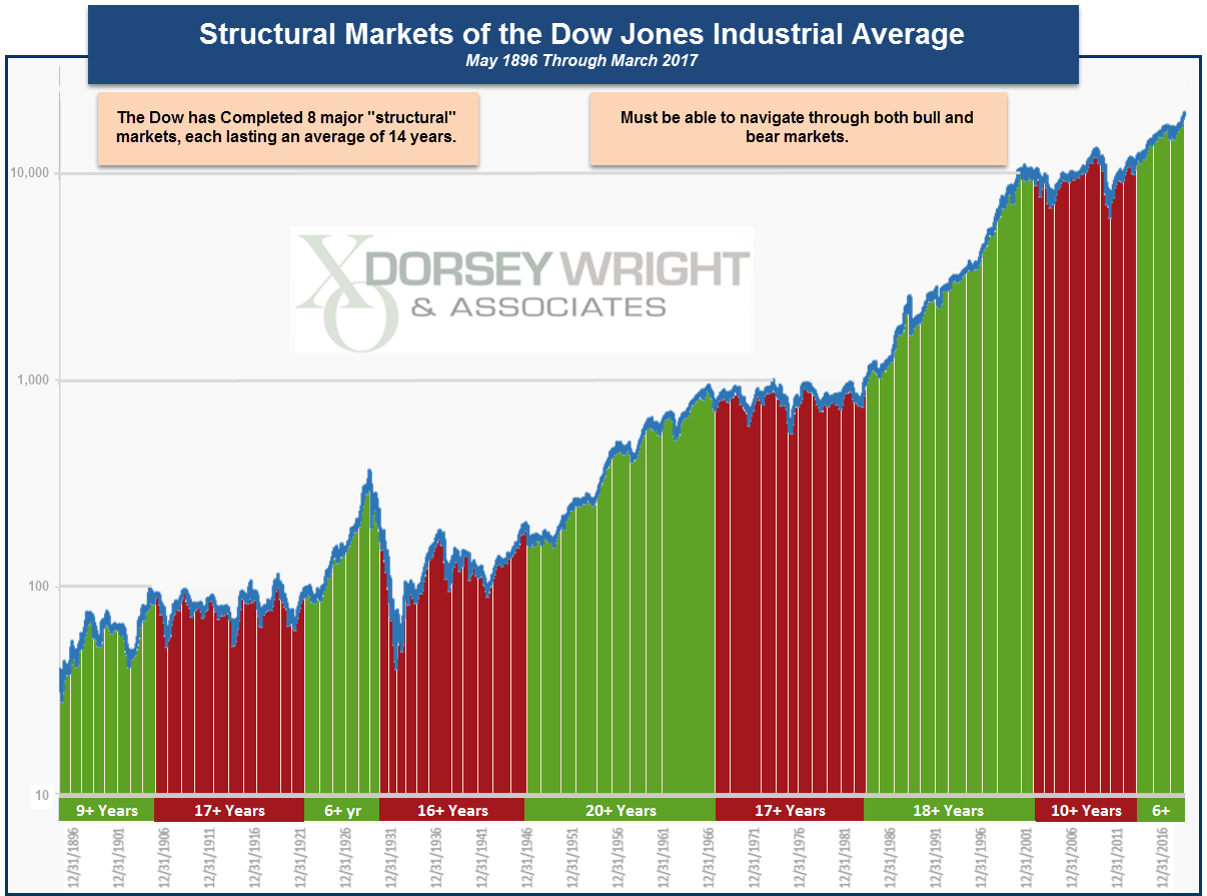

A long-term perspective of the Dow Jones Industrial Average DJIA, since 1896, reveals the reality that there are extended periods of time in which the US Equity market will trend generally upwards and also lengthy periods of time where the market will instead stagnate or move generally lower. There have been eight such alternating cycles completed since 1896, with each averaging fourteen years in duration. On its own, this is not earth-shattering information; however, the application of this concept to investing is integral to the importance of tactical strategies.

Consider this, let's say an individual begins to accumulate meaningful wealth with which to invest around the age of 40. Assuming an average life expectancy around 80, the individual should plan to endure three of these cycles during his investing lifespan. The unknown, of course, is whether the investor will see two bull markets and just one bear market, or be faced with two bear markets and only one bull market. Where an individual gets on the “investment train” can have a tremendous impact on portfolio returns overtime; however, even an individual fortunate enough to see two bull markets needs a game plan to navigate a potential 14+ years' worth of a bear market. It is important to have at one's disposal strategies that are effective in both generally rising (bull) markets and falling (bear, or "fair") markets.

"It is important to have at one's disposal strategies that are effective in both bull markets and bear markets."

One methodology that has existed since the late 1800's and proven effective in both kinds of markets is Point & Figure. One of the first proponents of the methodology was Charles Dow, founder of the Wall Street Journal. Although a fundamentalist at heart, Dow appreciated the merits of recording price action in order to understand the changing relationship between supply and demand in any investment. The Point & Figure Methodology has evolved over the past 100+ years but at its core remains a logical, organized means for recording the supply and demand relationship in any investment vehicle. As both consumers and investors, we are innately familiar with the forces of supply and demand. It is the first subject introduced in any Economics class, and we experience its impact regularly in our daily lives. We know why tomatoes in the winter don’t often taste particularly good, have a short shelf-life, and are paradoxically more expensive than those sent to market in July. What many investors are slow to accept is that the very same forces that cause price fluctuations in a supermarket also trigger price movement in the financial markets. In a free market of any kind, if there are more buyers than sellers willing to sell, price will rise; when there are more sellers than buyers willing to buy, price will fall. If buying and selling are equal, price will remain the same. By charting this price action in an organized manner, we can ascertain who is winning that battle, sellers or buyers (i.e. supply or demand). By having the ability to evaluate changes in the market we have taken the first step toward also becoming responsive to both bullish and bearish periods.

Looking back at the recent stretches of structural bull and bear markets, we find that there has been a clear theme reverberating within the Asset Class Rankings of DALI. During the bull market of the 1990's, US Equities were the #1 ranked asset class 76% of the time, while Cash never managed to garner an overweight position. However, during the bear market of the 2000's, the DALI Asset Class Ranking varied dramatically. US Equities managed to gain the #1 spot just 4% of the time. A stark contrast to the 1990s. Looking at the past six years, between 2010 to today, we find that the current ranking potentially reflects or is at least characterized as that of a "bull market." US Equities have been ranked #1 for 86% of the past six years, while Cash and Currencies have failed to achieve a top ranking. Granted, we know that history will ultimately be a judge of this characterization, but based on the relative strength dynamics of today's market compared to that of the 1990's, we have enough evidence to support the fact that we remain in a bull market for US Equities. We know asset classes rotate and can remain in or out of favor for frustratingly long periods of time, so we are driven to adhere to a form of investment analysis that is capable of changing when those key trends do...and stay with the trends as long as they are in force. Equities, remain a strong trend today. How much longer that will be the case, we cannot possibly know. However, we do know that the only "normal" in this business is that such things change, and our clients pay us to manage that change for them when it occurs.