Odds & Ends:

-

Join us Friday, May 12th at 2:00 pm ET for a live webinar exclusively for new or beginner DWA Platform users. The webinar will cover different aspects of the research as well as provide new users with the opportunity to ask questions. Click Here to access the registration link. The password is pnfpnf. Registration is required.

-

Please join Andy Hyer, Client Portfolio Manager at DWA, for a webinar on our family of Systematic Relative Strength Portfolios on Friday, May 12th at 1 p.m. ET. These strategies are available on a large and growing number of SMA and UMA platforms. Click here to register for the webinar. The event password is dwadwa.

- There was a change to the iShares Alternative Model ISHRALT. The iShares Silver Trust SLV was sold due to its deterioration in the matrix rankings and the iShares Cohen & Steers Realty ETF ICF was added in its place.

- Not only has Energy deteriorated from a Domestic Equity sector standpoint (currently 10th out of 11 broad sectors), but it also has fallen to the bottom of the broad Commodity matrix in fourth place. This continues to be an area we will avoid due to its poor relative strength characteristics.

- Check out our Podcast and other important updates on Twitter!

Listen to this week’s DWA Podcast – Mkt Updates For Seasonal Weak Months: https://t.co/q02lS8MrYf …$DWA $IEV $EWU $EWG $EWF $EWQ $TNX $EZU

— Dorsey Wright (@DorseyWrightDWA) May 11, 2017

The major market indices continue to hover around their highs with solid gains logged so far this year. Volatility, as represented by CBOE SPX Volatility Index VIX, remains at record lows, and sector themes have stabilized. Investors, by and large, are "happy" - or as happy as the average investor can be. Of course there will always be obstacles to face and complaints to be heard; but generally speaking, there has been (and continues to be) broad upside participation in this market, which bodes well for most investors. Knowing that this environment will not last forever, now is as good a time as any to educate current and prospective clients on the importance of incorporating tactical allocation within the portfolio. This discussion need not be overly complicated. Today, we will provide you with some guidance on one effective way to have this conversation.

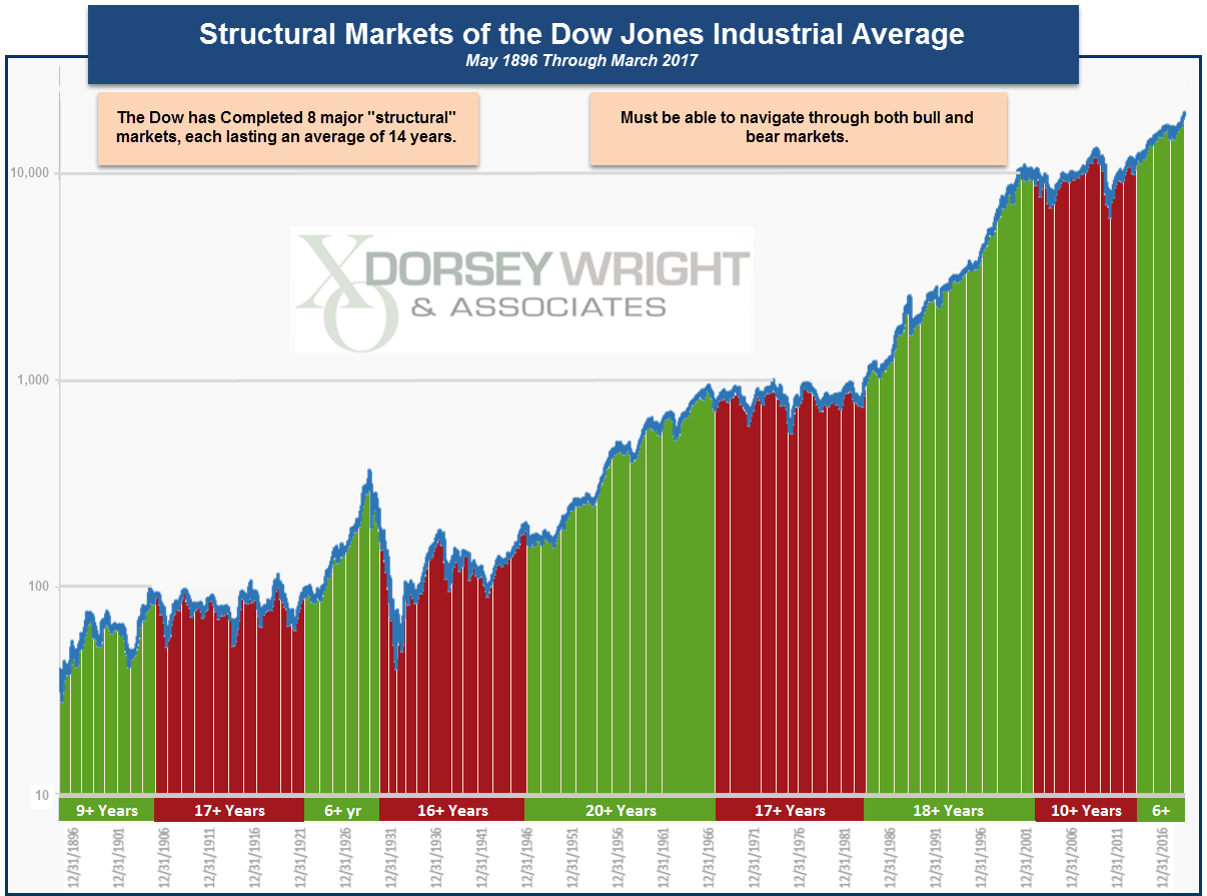

A long-term perspective of the Dow Jones Industrial Average DJIA, since 1896, reveals the reality that there are extended periods of time in which the US Equity market will trend generally upwards and also lengthy periods of time where the market will instead stagnate or move generally lower. There have been eight such alternating cycles completed since 1896, with each averaging fourteen years in duration. On its own, this is not earth-shattering information; however, the application of this concept to investing is integral to the importance of tactical strategies.

Consider this, let's say an individual begins to accumulate meaningful wealth with which to invest around the age of 40. Assuming an average life expectancy around 80, the individual should plan to endure three of these cycles during his investing lifespan. The unknown, of course, is whether the investor will see two bull markets and just one bear market, or be faced with two bear markets and only one bull market. Where an individual gets on the “investment train” can have a tremendous impact on portfolio returns overtime; however, even an individual fortunate enough to see two bull markets needs a game plan to navigate a potential 14+ years' worth of a bear market. It is important to have at one's disposal strategies that are effective in both generally rising (bull) markets and falling (bear, or "fair") markets.

"It is important to have at one's disposal strategies that are effective in both bull markets and bear markets."

One methodology that has existed since the late 1800's and proven effective in both kinds of markets is Point & Figure. One of the first proponents of the methodology was Charles Dow, founder of the Wall Street Journal. Although a fundamentalist at heart, Dow appreciated the merits of recording price action in order to understand the changing relationship between supply and demand in any investment. The Point & Figure Methodology has evolved over the past 100+ years but at its core remains a logical, organized means for recording the supply and demand relationship in any investment vehicle. As both consumers and investors, we are innately familiar with the forces of supply and demand. It is the first subject introduced in any Economics class, and we experience its impact regularly in our daily lives. We know why tomatoes in the winter don’t often taste particularly good, have a short shelf-life, and are paradoxically more expensive than those sent to market in July. What many investors are slow to accept is that the very same forces that cause price fluctuations in a supermarket also trigger price movement in the financial markets. In a free market of any kind, if there are more buyers than sellers willing to sell, price will rise; when there are more sellers than buyers willing to buy, price will fall. If buying and selling are equal, price will remain the same. By charting this price action in an organized manner, we can ascertain who is winning that battle, sellers or buyers (i.e. supply or demand). By having the ability to evaluate changes in the market we have taken the first step toward also becoming responsive to both bullish and bearish periods.

Looking back at the recent stretches of structural bull and bear markets, we find that there has been a clear theme reverberating within the Asset Class Rankings of DALI. During the bull market of the 1990's, US Equities were the #1 ranked asset class 76% of the time, while Cash never managed to garner an overweight position. However, during the bear market of the 2000's, the DALI Asset Class Ranking varied dramatically. US Equities managed to gain the #1 spot just 4% of the time. A stark contrast to the 1990s. Looking at the past six years, between 2010 to today, we find that the current ranking potentially reflects or is at least characterized as that of a "bull market." US Equities have been ranked #1 for 86% of the past six years, while Cash and Currencies have failed to achieve a top ranking. Granted, we know that history will ultimately be a judge of this characterization, but based on the relative strength dynamics of today's market compared to that of the 1990's, we have enough evidence to support the fact that we remain in a bull market for US Equities. We know asset classes rotate and can remain in or out of favor for frustratingly long periods of time, so we are driven to adhere to a form of investment analysis that is capable of changing when those key trends do...and stay with the trends as long as they are in force. Equities, remain a strong trend today. How much longer that will be the case, we cannot possibly know. However, we do know that the only "normal" in this business is that such things change, and our clients pay us to manage that change for them when it occurs.

A current score direction review reveals that Non-US assets make up most of the improvers among the asset classes as we have entered into the seasonally weak market cycle. At #1 and #2 in score direction on the system are India and then Europe. The European group's rRisk is much lower than India's, therefore the concept of risk adjustment and consistency could come into play to say the European is the best idea among these improvers.

This inflection of Non-US improvement is indeed showing up in your inventory one way or another. If you are modeling or using models then you can see the infusion of Non-US exposure climbing in these mechanisms. As a segway towards examining this would be to look at the example of the flagship American Funds Top 5 MMPR50 model. This model recently updated and added the Small Cap World Fund SMCWX to the lineup. As you know, the model updates on seasonal quarters and the fund line-up does change on an active basis. While that sounds simple enough, the internal breakdowns of the asset allocation really reveal sophisticated asset shifting. As a case in point let’s dive into particulars about this latest allocation.

The weighting scheme of the model equal weights across 5 options, so each fund holds 20% of your money. Glancing at the current fund scores we can see that each of them are scoring better than 4. None of these score above 5 at this time as American Funds does not have a fund scoring 5 or better. The net weighted portfolio fund score is at a 4.49, well above the group score net average of 3.75. Each fund within the line-up is well above the average score of the groups in which they compete. The Morningstar rating nets out to a 3.60 as 2 of these funds are rated below a 4 on that system. The high score belongs to New Economy, which is among the lowest rated Morningstar fund in this field. Fund score is sensitive to the question of what should we invest in NOW, not focusing on the way things used to be.

From a portfolio incremental breakdown we can see a net equity weighting of 90%, which the highest equity weighting I have seen in quite a while. But what is interesting here is that the Non-US weighting has risen to 23% as of this update. Non-Stock and Cash are at 10% so what you have here is a 90-10 model footprint. This 90-10 is more of the highest aggressive weighting scheme we often see from this model. As it typically hovers around 70-30, possibly much lower at specific times. The high US stock weighing goes to Washington Mutual and the high Non-US goes to Small World. The high Bond position goes to Amcap with 2% and it also holds the high on Cash positions at 9%.

Concerning relative Risk, the higher rRisk values go to New Economy and Small World with a 1.13 respectively. The low rRisk goes to Washington Mutual with a .96. What is interesting here is that the Net weighted portfolio rRisk lands at a 1.05, well below the reading of the Average Group rRisk which would land at a 1.18. This set up gets you well above averaging on relative strength compared to the average strength of the asset classes, but gets you in that strength at a lower volatility than the average risk of those asset classes. This relationship is indeed a selling point to talk over with your clients and prospects.

The sector breakdowns can be seen here through Morningstar mechanics. You got it all here with the higher sector weighting going to Technology and the next spot going to Consumer Cyclicals. What you don’t have here is Real Estate and Utilities and Energy has a relatively low weighting. If you are in agreement with that, then this is a great allocation scheme for you. Real Estate has a current score of 2.81 and if you need that you could but another fund if you wish. The Non-US country high weighing goes to Asia Emerging markets and European Developed Markets. The top stocks held here are Microsoft and Amazon and Home Depot in the US with Avago Tech from China to get you started.

The result of a dynamic Top 5 Model can tell a wide story that many of your clients would want to hear about. Included in that story is the weighting scheme, the sector stratification, the country exposure and the top stocks that are in play. Though FSM is a simple strategy for you to deploy, it produces a vibrant picture for you to talk about. Summing up, a descent of appropriate benchmark for the model could indeed be the 70/30 split benchmark. Over time the model inflects exposure above that line and then also well below that line, not to mention that the whole model can go to 100% cash. From a Wealth Building point of view, the American Funds model defeats the benchmark long term. Along the way, the win ratio of single years is running at 80%. Put FSM to work for your clients.

*Images from Morningstar, courtesy of Morningstar.

The Distribution Report below places Major Market ETFs and Indices into a bell curve style table based upon their current location on their 10-week trading band. The middle of the bell curve represents areas of the market that are "normally" distributed, with the far right being 100% overbought on a weekly distribution and the far left being 100% oversold on a weekly distribution. The weekly distribution ranges are calculated at the end of each week, while the placement within that range will fluctuate during the week. In addition to information regarding the statistical distribution of these market indexes, a symbol that is in UPPER CASE indicates that the RS chart is on a Buy Signal. If the symbol is dark Green then the stock is on a Point & Figure buy signal, and if the symbol is bright Red then it is on a Point & Figure sell signal.

The average Bullish Percent reading this week is 58.33% down 0.9% from the previous week

| <--100 | -100--80 | -80--60 | -60--40 | -40--20 | -20-0 | 0-20 | 20-40 | 40-60 | 60-80 | 80-100 | 100-> | |||

|

||||||||||||||

Legend:

| Symbol | Name | Symbol | Name |

| AGG | iShares US Core Bond ETF | NASD | Nasdaq Composite |

| CL/ | Crude Oil Continuous | NDX | NASDAQ-100 Index |

| DJIA | Dow Jones Industrial Average | RSP | Guggenheim S&P 500 Equal Weight ETF |

| DVY | iShares Dow Jones Select Dividend Index | RUT | Russell 2000 Index |

| DX/Y | NYCE U.S.Dollar Index Spot | SHY | iShares Barclays 1-3 Year Tres. Bond Fund |

| EFA | iSharesMSCI EAFE Index Fund | SML | S&P 600 Small Cap Index |

| FXE | CurrencyShares Euro Trust | SPX | S & P 500 Index |

| GC/ | Gold Continuous | TLT | iShares Barclays 20+ Year Treasury Bond Fund |

| GSG | iShares S&P GSCI Commodity-Indexed Trust | UV/Y | Continuous Commodity Index |

| HYG | iShares iBoxx $ High Yield Corporate Bond ETF | VOOG | Vanguard S&P 500 Growth ETF |

| ICF | iShares Cohen & Steers Realty Index | VOOV | Vanguard S&P 500 Value ETF |

| IEF | iShares Barclays 7-10 Yr. Tres. Bond Fund | VWO | Vanguard FTSE Emerging Markets ETF |

| LQD | iShares iBoxx $ Investment Grade Corp. | XLG | Guggenheim S&P 500 Top 50 ETF |

| MID | S&P 400 MidCap Index |

DG Dollar General Corp. R ($72.45) - Retailing - Last August shares of DG ended a 5 year run as a high attribute stock when it moved into a negative overall trend. Further deterioration was observed in March when this stock produced a new RS sell signal as it continued to trade much closer to 52-week lows than the new all-time highs that the overall market was publishing. In more recent weeks we have seen a pattern development similar to a bearish triangle formation, and also a rally back into near-term overbought territory. With the stock in the bottom-half of the Retail sector matrix, and the Retail sector itself a market laggard today, this becomes a logical short sale target here in the low-70s. We will use a buy stop of $80 initially, and a price target of $60 on the downside. Okay to initiate short sales in the $70-74 range. Long Ideas

Stock

Symbol

Sector

Current Price

Action Price

Target

Stop

Notes

Danaher Corporation

DHR

Machinery and Tools

$83.21

81-85

123

75

4/5'er, Long-term market leader that pulled back after reporting earnings, Great R-R.

DTE Energy Company

DTE

Utilities/Electricity

$104.62

100-106

109

95

5 for 5'er, favored EUTI sector, yield > 3%, low beta name for seasonally weak period.

Morgan Stanley

MS

Wall Street

$43.10

mid-40s

75

40

5/5'er, Top 5 ranking in S&P 100 matrix & Wall Street matrix, Weekly Momentum turns Positive.

NetFlix Inc.

NFLX

Internet

$160.28

148-154

182

138

3 for 5'er, leader in favored INET sector, positive diverger, good R-R, RS vs Mkt buy signal

Eagle Materials, Inc.

EXP

Building

$100.82

99-102

112

93

5/5'er, Top quartile rank in BUIL matrix, new positive weekly momentum change (after 19 weeks), Earn. 5/18.

Rockwell Automation, Inc.

ROK

Electronics

$157.64

Mid 150s

170

146

5 for 5'er, pulled back creating entry point, Weekly Momentum Neg. 10 weeks.

Domino's Pizza, Inc.

DPZ

Restaurants

$195.67

186-192

268

172/152

5/5'er, Positive Weekly Momentum Change, Bullish Triangle formation, Top 5 rank in REST matrix.

Cummins Inc.

CMI

Machinery and Tools

$159.24

154 - 158

200

142

Favored sector, Triple top completes Shakeout Use pullback to initiate positions, Positive trend RS charts in Xs.

MarketAxess Holdings Inc.

MKTX

Wall Street

$188.16

180-190

234

176

5/5'er, Positive Weekly Momentum Change, Long-term leadership trend, Investors may purchase through call options.

Cullen/Frost Bankers Inc

CFR

Banks

$91.99

88-92

105

82

4/5'er, New RS buy signal, PB to improve R-R, Among most improved in BANK matrix.

Short Ideas

Stock

Symbol

Sector

Current Price

Action Price

Target

Stop

Notes

Diamond Offshore Drilling, Inc.

DO

Oil Service

$15.06

(15-16)

10.50

17.50

0 for 5'er, bottom quartile of unfavored OILS sector, negative market and sector diverger.

Simon Property Group, Inc.

SPG

Real Estate

$165.65

(172-166)

140

182

1/5'er, Recent RS Sell Signal, Move to "low attribute" rating for first time since early-2009.

Dollar General Corp.

DG

Retailing

$73.91

(70-74)

60

80

1/5'er, Recent RS Sell Signal, Low Ranking in Laggard sector (Retail), Earn. 6/1.

Removed Ideas

Stock

Symbol

Sector

Current Price

Action Price

Target

Stop

Notes

Vmware, Incorporation

VMW

Software

$94.15

low 90's

TOP

85

VMW remains actionable for new long exposure in the low-90s, those already involved may hold with a stop loss of $85. Earn. 6/1.

Follow-Up Comments

Comment

COF Capital One Financial Corporation R ($80.32) - Finance - Shares of COF were recommended back in February, but regressed to hit our trading stop loss in March. Today the stock is testing the bullish support line and a print at $79 would mark a violation of trend. This serves as the stop loss for investors, as the attribute rating would decline to 2 if that trend change occurs.

DWA Spotlight Stock

15

16

17

96.00

X

•

96.00

95.00

7

O

•

95.00

94.00

X

O

•

94.00

93.00

X

8

•

93.00

92.00

X

O

X

•

92.00

91.00

6

O

X

O

•

91.00

90.00

X

O

X

O

•

90.00

89.00

X

O

O

•

89.00

88.00

X

O

•

88.00

87.00

4

X

O

•

87.00

86.00

X

O

X

O

•

86.00

85.00

X

O

X

X

O

•

85.00

84.00

X

O

X

O

X

O

84.00

83.00

X

O

5

O

X

O

83.00

82.00

•

X

O

X

O

X

O

82.00

81.00

X

X

•

X

O

X

O

X

O

81.00

80.00

7

O

X

O

•

X

O

O

X

O

X

80.00

79.00

X

O

X

O

•

X

O

O

X

O

X

Top

79.00

78.00

X

8

X

O

•

X

O

X

O

X

X

O

78.00

77.00

X

O

O

•

X

O

X

C

X

O

X

O

77.00

76.00

X

X

O

X

•

2

X

X

O

X

O

X

O

X

O

76.00

75.00

X

O

6

O

X

O

X

•

X

O

X

X

O

X

O

X

O

X

O

X

O

X

75.00

74.00

3

O

X

O

X

O

X

O

•

X

O

X

O

X

O

X

•

O

X

O

X

O

2

O

X

O

5

74.00

73.00

X

4

X

O

X

O

X

O

X

•

X

X

O

X

O

X

3

•

9

X

O

X

1

X

O

X

O

X

73.00

72.00

X

5

O

X

O

•

9

X

O

•

X

O

X

O

X

O

X

•

O

X

O

X

O

X

3

O

X

72.00

71.00

X

X

X

O

•

O

X

O

•

X

O

X

O

X

O

•

O

B

O

O

X

O

X

Med

71.00

70.00

X

O

X

O

X

X

•

O

X

O

X

1

X

O

X

•

O

X

O

O

X

70.00

69.00

X

O

X

O

X

O

X

•

O

A

X

O

X

O

X

•

O

X

O

X

69.00

68.00

C

O

1

X

O

X

•

O

X

X

X

O

O

•

A

X

4

68.00

67.00

X

O

X

O

X

•

O

X

O

X

O

C

•

O

67.00

66.00

X

X

O

2

•

O

X

O

X

O

X

•

66.00

65.00

X

X

O

X

•

O

O

B

X

•

65.00

64.00

X

O

B

O

X

•

O

X

•

Bot

64.00

63.00

X

O

X

O

•

O

X

•

63.00

62.00

X

9

X

•

O

X

•

62.00

61.00

X

O

X

•

O

X

•

61.00

60.00

X

A

X

•

O

•

60.00

59.00

X

O

X

•

•

59.00

58.00

X

O

•

58.00

57.00

8

•

57.00

56.00

X

•

56.00

55.00

X

•

55.00

15

16

17

| Comments |

|---|

| ALK Alaska Air Group Inc ($83.76) - Aerospace Airline - ALK broke a double bottom at $83 marking its fourth consecutive sell signal. This breakdown is noteworthy as well since it violates the bullish support line. Those still long may look to exit positions on this breakdown since supply has taken control of the stock. No new positoins at this time. Look to avoid ALK moving forward unless its technical picture is able to turn around. |

| AMBC Ambac Financial Group, Inc. ($17.06) - Insurance - AMBC broke a spread triple bottom at $17 and fell further to $16.50. This move broke the bullish support line, flipping the trend negative and downticking the stock to an unacceptable 0 for 5’er. Monthly momentum has been negative for three months, suggesting the potential for further downside from here. Additionally, AMBC ranks 61st out of 74 names in the Insurance sector RS matrix. Supply is in control and the weight of the evidence is negative. Avoid. The next level of support is at $15 while resistance is at $20. |

| AN Autonation Inc. ($39.50) - Autos and Parts - On Thursday, AN broke a triple bottom at $39, a new 52 week low. This move broke through the bullish support line, flipping the trend negative and downticking this stock to an unacceptable 0 for 5’er. Monthly momentum just flipped negative after being positive for four months. Additionally, AN ranks within the bottom decile of the Autos and Parts sector RS matrix, adding to the negative technical picture. Avoid as there is no remaining support on the chart. Resistance is at $45. |

| BID Sotheby's ($50.24) - Retailing - With the most recent market action, BID broke a double top at $50, marking a new 52 week high as well as the third consecutive buy signal on the chart. BID is an acceptable 3 for 5’er within the Retailing sector that just had a weekly momentum flip back to positive, suggesting the potential for further upside from here. The technical picture is positive here. Okay to buy or hold here. The first sign of trouble comes with a move to $43, a double bottom sell signal. |

| BOH Bank of Hawaii ($80.66) - Banks - BOH broke a double bottom at $80. This breakdown is notable as it violates the bullish support line. As a result, the stock will become a 3 for 5'er. Traders may sell on this breakdown, while investors may wish to see if it can hold support at $78 before exiting. No new positions at this time. |

| LL Lumber Liquidators Holdings Inc ($25.15) - Building - LL broke a double top at $25, a new 52 week high as well as the second consecutive buy signal on the chart, confirming that demand is in control. LL is a perfect 5 for 5’er as it is trading in a positive trend and is showing significant strength relative to the market and its peers. Additionally, this stock ranks #1 in the Building sector RS matrix, making it the strongest name within this favored space. LL has a price target of $42.50, offering a reward to risk ratio north of 3, assuming a stop at $19. Okay to hold here or buy on a pullback as the stock is overbought here. The first sign of trouble comes with a move to $19, a double bottom sell signal. |

| MDSO Medidata Solutions, Inc. ($71.15) - Software - MDSO broke a double top at $70, marking a new all-time high on the chart as well as the fourth consecutive buy signal on the chart. MDSO is a strong 5 for 5’er that is showing near-term strength relative to the market and its peers. Monthly momentum has been positive for three months and the bullish price objective is $79, both suggesting the potential for further upside from here. Okay to buy or hold here as the stock is trading above the top of the 10 week trading band. The first sign of trouble from here comes with a move to $63, a double bottom sell signal. |

| MPC Marathon Petroleum Corp. ($52.92) - Oil - MPC broke a double top at $53 on Thursday, completing a bullish triangle pattern on the chart. This stock is a strong 4 for 5’er that ranks within the top decile of the Oil sector RS matrix. Weekly momentum has been positive for three weeks, suggesting the potential for further upside from here. Demand is in control and the weight of the evidence is positive. Okay to initiate new positions on the breakout. The first sign of trouble comes with a move to $47, a double bottom sell signal while move to $45 would violate the bullish support line. Resistance is at $54. Note this stock has a yield of 2.72% attached to it. |

| MRCY Mercury Computer Systems Inc ($41.17) - Computers - MRCY broke a triple top at $41. This marks a new all-time high for the stock. The 5 for 5'er ranks in the top ten of the favored Computers sector matrix. The weight of technical evidence is positive allowing for new positions to be initiated on this breakout. The first sign of trouble comes with a move to $36, a triple bottom break. |

| NXST Nexstar Media Group Inc. ($60.48) - Media - NXST is trading in a negative trend and with the most recent action, broke a double bottom at $60. This is the third consecutive sell signal on the chart for this 3 for 5’er, confirming that demand is in control. Monthly momentum just flipped negative, suggesting the potential for further upside from here. Avoid as the weight of the evidence is skewed negative. The next level of support is at $57 while resistance is at $64. |

Daily Option Ideas for May 11, 2017

New Recommendations

| Name | Option Symbol | Action | Stop Loss |

|---|---|---|---|

| Qorvo Inc. - $66.97 | O:QRVO 17K62.50D17 | Buy the November 62.50 calls at 9.50 | 61.00 |

Follow Ups

| Name | Option | Action |

|---|---|---|

| Global Payments Inc. ( GPN) | Aug. 75.00 Calls | Raise the option stop loss to 10.80 (CP: 12.80) |

| Global Payments Inc. ( GPN) | Aug. 75.00 Calls | Raise the option stop loss to 10.80 (CP: 12.80) |

New Recommendations

| Name | Option Symbol | Action | Stop Loss |

|---|---|---|---|

| Express Scripts, Inc. - $60.53 | O:ESRX 17V65.00D20 | Buy the October 65.00 puts at 6.00 | 68.00 |

Follow Up

| Name | Option | Action |

|---|---|---|

| National Retail Properties, Inc. (NNN) | Jun. 45.00 Puts | Raise the option stop loss to 4.80 (CP: 6.80) |

| Macy's Inc. (M) | Aug. 35.00 Puts | Raise the option stop loss to 7.10 (CP: 9.10) |

New Recommendations

| Name | Option Sym. | Call to Sell | Call Price | Investment for 500 Shares | Annual Called Rtn. | Annual Static Rtn. | Downside Protection |

|---|---|---|---|---|---|---|---|

| Lumentum Holdings Inc $52.80 | O:LITE 17I55.00D15 | Sep. 55.00 | 6.40 | $2,316.75 | 50.51% | 36.07% | 11.15% |

Still Recommended

| Name | Action |

|---|---|

| Micron Technology, Inc. (MU) - 29.32 | Sell the July 29.00 Calls. |

| Momo Inc (China) ADR (MOMO) - 38.22 | Sell the October 40.00 Calls. |

| T-Mobile US Inc. (TMUS) - 66.00 | Sell the August 67.50 Calls. |

| TTM Technologies, Inc. (TTMI) - 16.44 | Sell the September 17.50 Calls. |

| Dish Network Corporation (DISH) - 61.67 | Sell the September 62.50 Calls. |

| Tutor Perini Corporation (TPC) - 27.65 | Sell the October 30.00 Calls. |

| The Chemours Company (CC) - 42.29 | Sell the October 44.00 Calls. |

The Following Covered Write are no longer recommended

| Name | Covered Write |

|---|---|

|

|

|