Today we highlight a change in the DALI broad asset class rankings and a change in the DWA Yield Portfolio, as well as provide webinar registration information.

Introducing the BMO Elkhorn DWA MLP SelectTM Index ETN

Join us Tuesday, December 13th at 12:00 pm ET for a live webcast as we discuss the upcoming BMO Elkhorn DWA MLP SelectTM Index ETN (BMLP), the first Dorsey Wright MLP strategy tracking the DWA MLP SelectTM Index. We will discuss both the advantages of the ETN structure as it relates to MLP exposure and why it's particularly appropriate for Dorsey Wright's MLP solution.

Learn the methodology behind the DWA MLP SelectTM Index, which employs a rules-based rotation in an effort to deliver positive excess returns versus its peers, while currently offering an index yield of 7.42%. Registration is required and the password for the webinar is pnfpnf.

- Date: Tuesday, December 13th, 2016

- Time: 12:00 PM ET

- Register Now

DALI Change: International Equities moves ahead of Fixed Income

We wanted to make you aware of a change in the broad asset class rankings within DALI that occurred following yesterday's market action. International Equities overtook Fixed Income based upon the asset classes' buy signal tally history. As a result, International Equities ranks third for the first time since August 19, 2015. Fixed Income now holds the fourth position while Commodities remain in the second position. Domestic Equities continue to lead the way with over 310 buy signals in its favor. This broad asset class ranking change has caused the Conservative Tactical Tilt strategy to adjust to provide exposure to International Equities at the expense of Fixed Income.

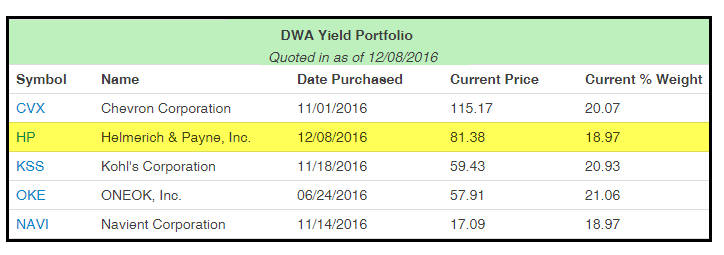

DWA Yield Portfolio Change

There was a change in the DWA Yield Portfolio SPX500YLD because the technical attribute score for Garmin Ltd. GRMN fell to an unacceptable rating of 2. The Portfolio has purchased Helmerich & Payne, Inc. HP in its place, which meets all of the buy criteria. The DWA Yield Portfolio has five holdings with an average yield of 3.73%. Note, this change is just a replacement since the collar was not triggered.