There are no changes to the ALPS Target Income Model this week. Please note that as of October 25th, this model and report will be discontinued.

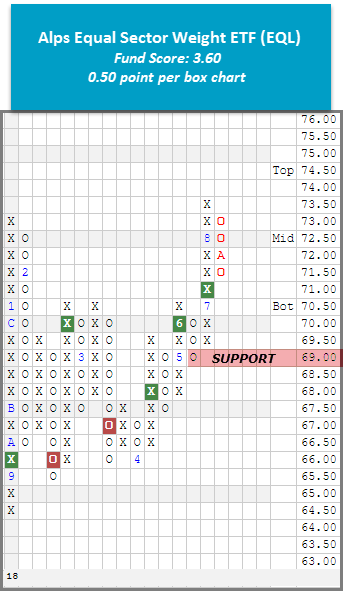

There are no changes to the ALPS Target Income Model this week. Please note that as of October 25th, this model and report will be discontinued. Today we want to spotlight the Alps Equal Sector Weight ETF EQL. As a refresher, the ALPS Equal Sector Weight ETF is an ETF of ETFs that delivers exposure to the US Large Cap Equity market by investing equal proportions in each of the 10 Select Sector SPDRs and rebalances quarterly. Looking at the more sensitive 0.50 chart below, we find that EQL gave a buy signal at $71 in mid-July and has since moved higher to $73.50, an all-time high. With yesterday’s action, the fund experienced a pullback to $71.50 yet still remains well above initial support that is offered at $69. EQL has a fund score of 3.60 with a positive score direction of 1.46, speaking to its improvement over the past six months. In addition, monthly momentum has been positive for three months, suggesting the potential for higher prices. Overall, the technical picture remains strong despite recent volatility. From here, the first sell signal comes with a move to $68.50.