There are no changes to the ALPS Target Income Model this week. Over the past week, we closed the books on the third quarter of 2018. Please note that as of October 25th, this model and report will be discontinued.

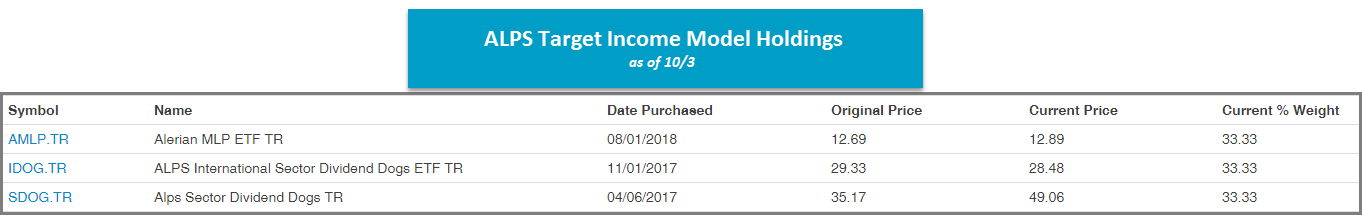

There are no changes to the ALPS Target Income Model this week. Please note that as of October 25th, this model and report will be discontinued. Over the past week, we closed the books on the third quarter of 2018. During that time, the Model was able to outpace both of its benchmarks, the iShares US Core Bond ETF Total Return AGG.TR and the SPDR MSCI ACWI ex-US ETF Total Return CWI.TR, as it was up 1.23% for the quarter while the AGG.TR posted a loss of -0.08% and the CWI.TR was up 0.92%. The Model experienced one change during the third quarter when the Cohen & Steers Global Realty Major TR GRI.TR was removed from the holdings. Due to these changes, the Model now offers exposure to MLPs AMLP, International Sector Dividend Dogs IDOG, and Sector Dividend Dogs SDOG.