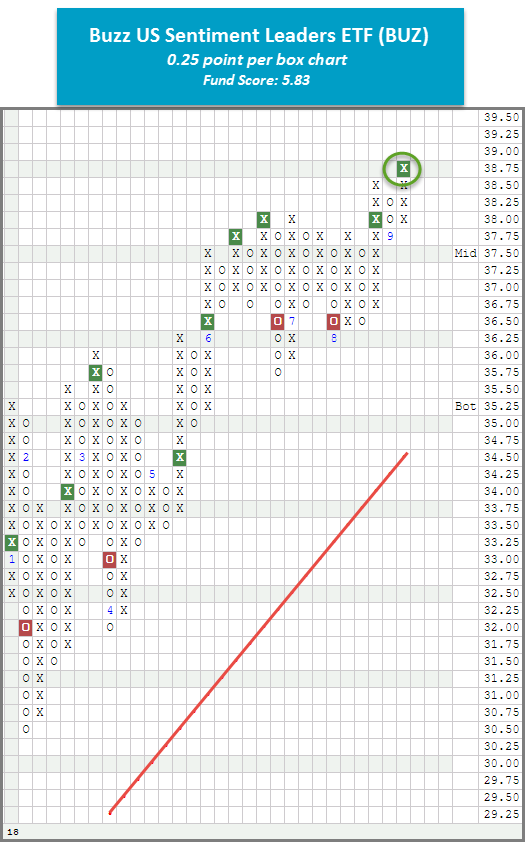

There are no changes to the ALPS ETF Model this week. The next evaluation will be Thursday, October 4th. With action last week, the more sensitive 0.25 point per box chart chart of the Buzz US Sentiment Leaders ETF [BUZ] completed a bullish catapult pattern with a move to $38.75.

There are no changes to the ALPS ETF Model this week. The next evaluation will be Thursday, October 4th. With action last week, the more sensitive 0.25 point per box chart of the Buzz US Sentiment Leaders ETF BUZ completed a bullish catapult pattern with a move to $38.75. This is a new all-time high for the fund, as well as the second consecutive buy signal, confirming that demand is in control. BUZ has a near-perfect fund score of 5.83 with a positive score direction of 1.26, speaking to the fund’s improvement over the past six months. Additionally, monthly momentum has been positive for two months and has a price target of $42.75, both suggesting the potential for higher prices. Year-to-date, BUZ has posted an impressive gain of 21.35%, outpacing the return for the S&P 500 SPX by just over 12.50%. Overall, the weight of the evidence is positive for BUZ however, at this time, the fund is 59% overbought so those looking to initiate new positions may look to wait for a potential pullback. From here, the first sell signal comes with a move to $37.50. The bullish support line, which has been intact for over two years, lies at $34.75.