With no changes to any of the Invesco models, we take a look at the Invesco Dynamic Building & Construction Portfolio (PKB).

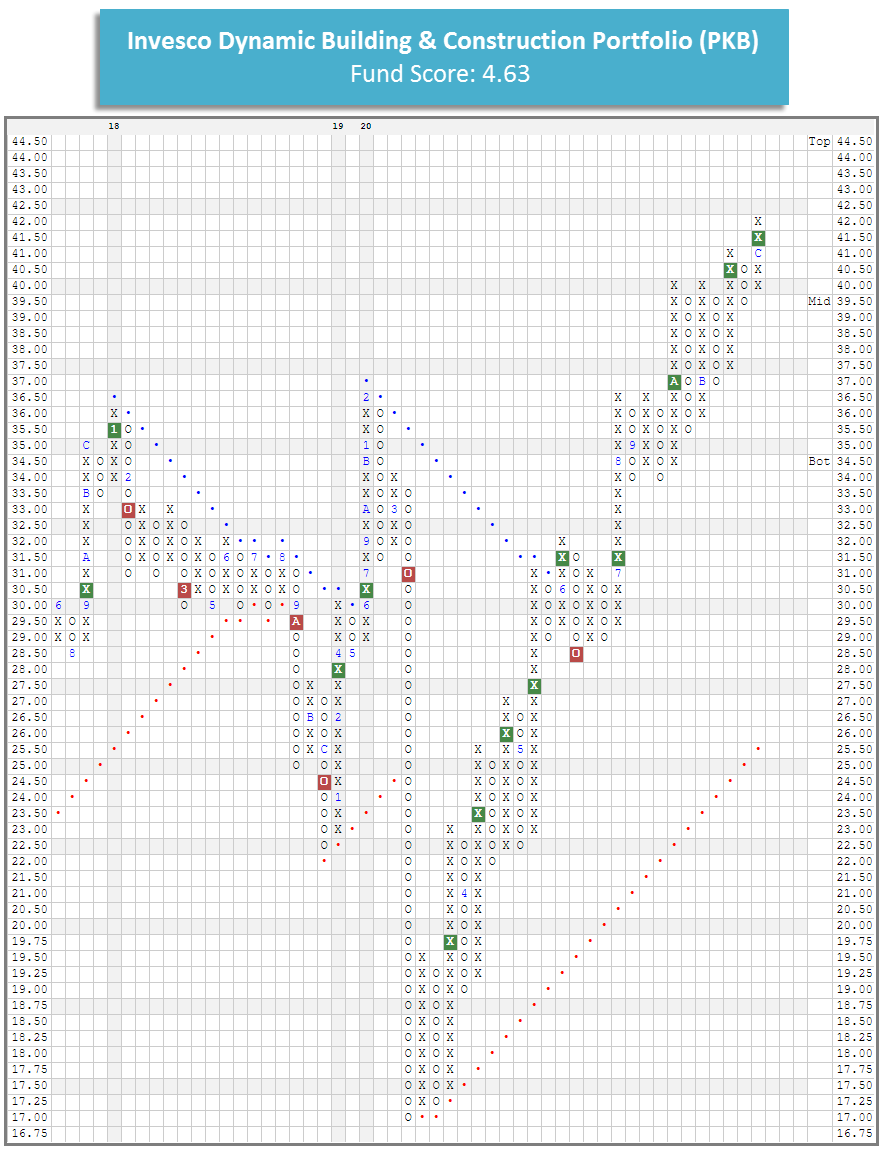

There are no changes to any of the Invesco models this week. In trading earlier this month, the Invesco Dynamic Building & Construction Portfolio PKB gave a fourth consecutive buy signal when it completed a bullish catapult at $41.50, also marking a new all-time high for the fund. PKB currently has a favorable 4.63 fund score, which is 0.95 points better than the average for all infrastructure funds. PKB tracks an index that is comprised of securities of 30 US building and construction companies. These are companies that are primarily engaged in providing construction and related engineering services for building and remodeling residential properties, commercial or industrial buildings, or working on large-scale infrastructure projects, such as highways, tunnels, bridges, dams, power lines, and airports (Source: Invesco). Year-to-date (through 12/24) PKB has gained 25.86% on a price return basis, outpacing the S&P SPX which is up 14.62% over the same period.

Despite sitting at an all-time high on its default chart, PKB remains in actionable territory with a weekly overbought/oversold (OBOS) reading of 44%, so those interested in adding exposure may be do so here. PKB has most recently found support at $39.50, with multiple additional levels of support in the $30s.