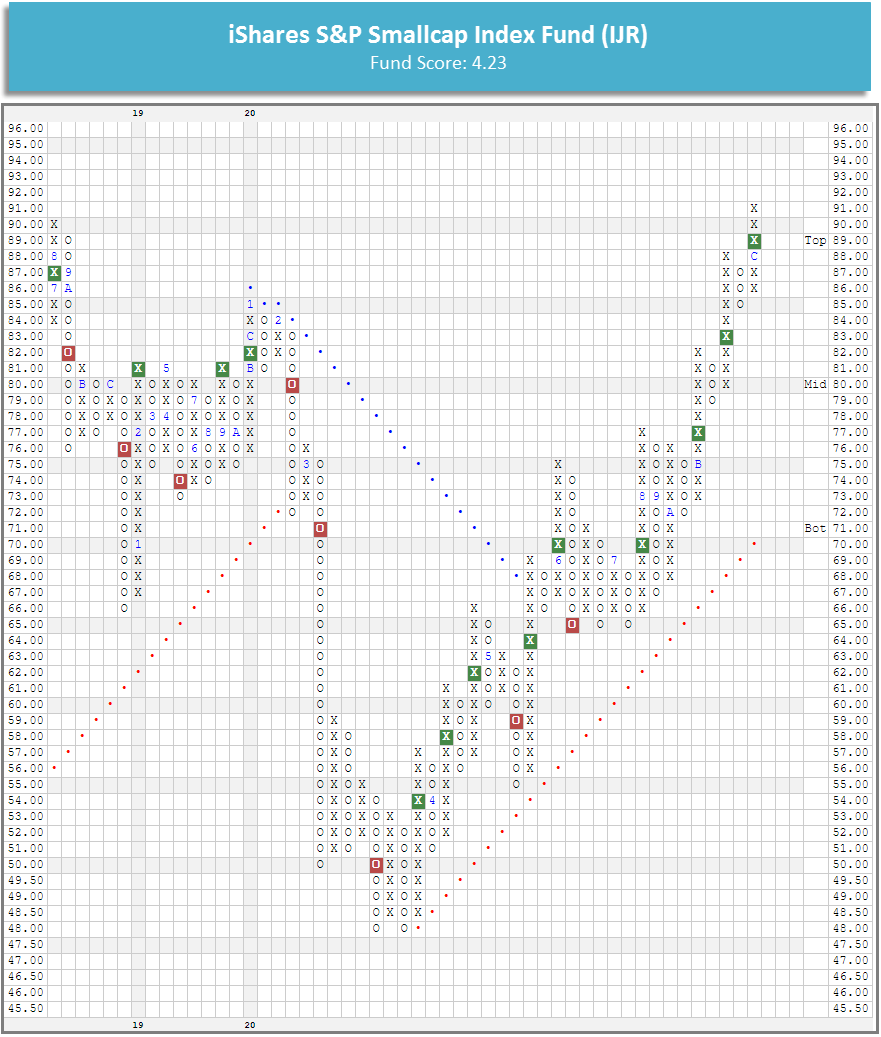

With no changes to any of the iShares models this week, we take a look at the iShares S&P Smallcap 600 Index Fund (IJR).

There are no changes to any of the iShares models this week. We have discussed several times recently the resurgence of small cap domestic equities, which have outperformed their large cap counterparts over the last few months. Earlier this week, the iShares S&P Smallcap 600 Index Fund IJR reached a new all-time high at $91, eclipsing the high it reached in 2018. IJR has a strong 4.23 fund score and a positive 2.65 score direction. On its default chart, the fund has given four consecutive buy signals. Year-to-date (through 12/16) IJR has produced a total return of 9.98%; the fund currently yields 1.4%. IJR currently sits in heavily-overbought territory with a weekly overbought/oversold (OBOS) reading of 118%, so those interested in adding exposure may wish to do so on a pullback. IJR has most recently found support at $85, with further support at $79.