There are no changes to any of the iShares models this week.

There are no changes to any of the iShares models this week. As discussed in Tuesday’s report, We have recently seen strength in emerging markets as the iShares Emerging Markets ETF EEM has outperformed the S&P 500 SPX over the last month and the average score of the emerging markets group has moved above 4.0. From a geographical perspective, Asian pacific countries have been one of the major drivers of the recent strength of emerging markets.

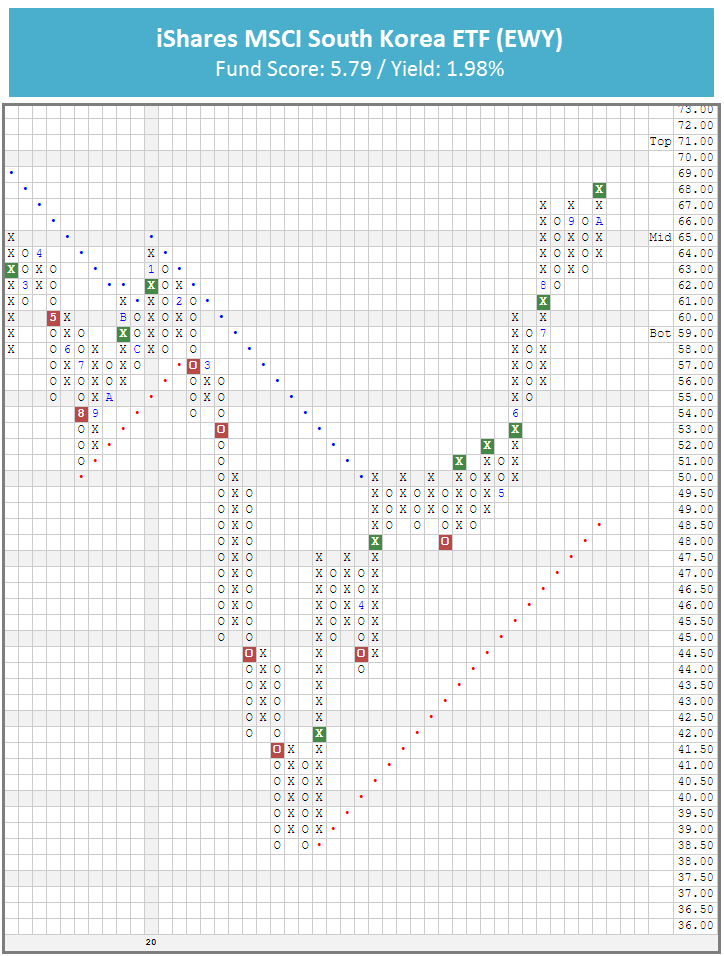

In trading earlier this month, the iShares MSCI South Korea ETF EWY gave a fifth consecutive buy signal when it broke a triple top at $68, marking a new 52-week high for the fund and a recent flip to positive weekly momentum is a positive sign of its potential for additional upside. EWY has a near-perfect 5.79 fund score, 2.46 points better than the average for all non-US equity funds, and a positive 3.66 fund score direction. Year-to-date (through 10/28) EWY has gained 6.18% on a price return basis. The fund also carries a 1.98% yield.

Despite sitting at a 52-week high, EWY remains well within actionable territory with a weekly overbought/oversold reading of 10%, so those interested in adding exposure may do so here. EWY has most recently found support at $63, with additional support found at $62.