With no changes to any of the iShares models this week we take a look at the iShares Convertible Bond ETF (ICVT).

There are no changes to any of the iShares models this week. Convertible bonds have reached the top of the Asset Class Group Scores (ACGS) fixed income rankings with an average group score of 4.88, the highest level it has ever reached; the group now ranks sixth out of all 135 groups in the ACGS system. Those who are interested to convertible bonds in light of their relative strength should consider the iShares Convertible Bond ETF ICVT.

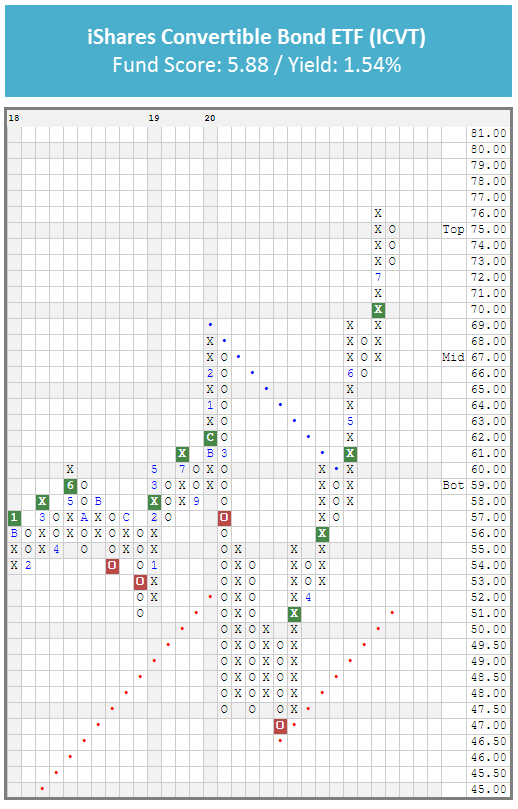

After reaching an all-time high of $76 in Monday’s (7/13) trading, ICVT reversed down on Tuesday and currently sits at $73 on its default chat. ICVT currently has a near-perfect 5.88 fund score and a positive 4.32 fund score direction. Since bottoming in at $47 in March, the fund has rebounded sharply and given four consecutive buy signals. Year-to-date (through 7/15) ICVT has gained 19.04% outperforming the S&P 500 SPX which has returned -0.13% and the iShares US Core Bond ETF AGG which has notched a price return of 5.62%. The fund currently yields 1.54%. Even with Monday’s reversal down, ICVT remains in overbought territory with a weekly overbought/oversold reading of 90%, so investors adding exposure may be best served to do so on a pullback or after prices have normalized at current levels. ICVT has most recently found support at $66.