There are no changes to any of the iShares models this week. Convertible bonds have reached the top of the Asset Class Group Scores (ACGS) fixed income rankings with an average group score of 4.88, the highest level it has ever reached; the group now ranks sixth out of all 135 groups in the ACGS system. Those who are interested to convertible bonds in light of their relative strength should consider the iShares Convertible Bond ETF ICVT.

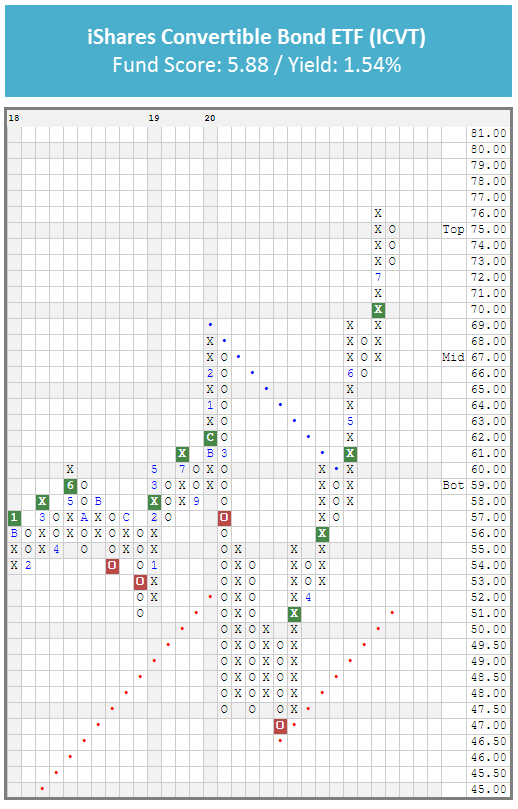

After reaching an all-time high of $76 in Monday’s (7/13) trading, ICVT reversed down on Tuesday and currently sits at $73 on its default chat. ICVT currently has a near-perfect 5.88 fund score and a positive 4.32 fund score direction. Since bottoming in at $47 in March, the fund has rebounded sharply and given four consecutive buy signals. Year-to-date (through 7/15) ICVT has gained 19.04% outperforming the S&P 500 SPX which has returned -0.13% and the iShares US Core Bond ETF AGG which has notched a price return of 5.62%. The fund currently yields 1.54%. Even with Monday’s reversal down, ICVT remains in overbought territory with a weekly overbought/oversold reading of 90%, so investors adding exposure may be best served to do so on a pullback or after prices have normalized at current levels. ICVT has most recently found support at $66.

This section of the report categorizes select iShares Fixed Income and Currency ETPs by their respective fund groups. Along with each group, you can view the Average Group Score, which is an average of the scores of all funds represented in that particular group. Those iShares ETFs that meet or exceed the Average Group Score will be highlighted in green in order to easily view those ETFs that have superior strength within their respective group. You want to focus on those ETFs that exhibit superior strength when looking to add new exposure to a particular group.

Inflation Protection Bonds

Symbol

Name

Score

Average Group Score: 4.8

TIP

iShares Barclays US Treasury Inflation Protected Securities

5.12

STIP

iShares Barclays 0-5 Year TIPS Bond ETF

4.59

Agency Bonds

Symbol

Name

Score

Average Group Score: 4.5

AGZ

iShares Barclays Agency Bond ETF

5.04

Treasury Bonds

Symbol

Name

Score

Average Group Score: 4.5

GBF

iShares Barclays Government Credit Bond ETF

5.43

GVI

iShares Barclays Intermediate Government/Credit Bond ETF

5.16

IEI

iShares Barclays 3-7 Year Treasury Bond ETF

5.11

IEF

iShares Barclays 7-10 Year Tres. Bond ETF

4.95

TLH

iShares Barclays 10-20 Year Treasury Bond ETF

4.90

SHY

iShares Barclays 1-3 Year Tres. Bond ETF

4.53

SHV

iShares Barclays Short Treasury Bond ETF

4.10

TLT

iShares Barclays 20+ Year Treasury Bond ETF

4.03

Municipal Bonds

Symbol

Name

Score

Average Group Score: 4.2

NYF

iShares New York Muni Bond ETF

4.50

MUB

iShares National Municipal Bond ETF

3.71

SUB

iShares Short-Term National Muni Bond ETF

3.10

CMF

iShares California Municipal Bond ETF

2.65

Broad Fixed Income

Symbol

Name

Score

Average Group Score: 4.0

IGIB

iShares Intermediate-Term Corporate Bond ETF

5.43

AGG

iShares US Core Bond ETF

4.93

IGLB

iShares Long-Term Corporate Bond ETF

4.66

MBB

iShares Barclays MBS Fixed-Rate Bond ETF

4.60

USIG

iShares Broad USD Investment Grade Corporate Bond ETF

4.25

Global Fixed Income

Symbol

Name

Score

Average Group Score: 3.7

ISHG

iShares S&P Citigroup 1-3 Year Intl. Treas. Bond ETF

4.92

EMB

iShares JP Morgan USD Emerging Markets Bond ETF

4.45

IGOV

iShares S&P Citigroup International Treasury Bond ETF

3.90

IPFF

iShares S&P International Preferred Stock ETF

0.95

Corporate Bonds

Symbol

Name

Score

Average Group Score: 3.6

LQD

iShares iBoxx $ Investment Grade Corp. Bond ETF

4.56

FLOT

iShares Floating Rate Note ETF

3.46

High Yield

Symbol

Name

Score

Average Group Score: 3.3

HYG

iShares iBoxx $ High Yield Corporate Bond ETF

2.84

The distribution curve places each ETF on a bell curve according to their respective degrees of overbought or oversold status using a 10-week distribution. ETFs that are statistically oversold will appear on the left-hand side of the bell curve, while those that have become statistically overbought will appear on the right-hand side of the bell curve. Perhaps the most useful attribute of this feature is that it displays the entire universe on the curve at one time with an "average level" to give us a general picture of whether the iShare ETF universe is generally overbought on a near-term basis, or generally oversold. Our best opportunities are to buy strong market ETFs that have regressed back toward mean conditions based on market weakness, or have become oversold based upon extreme market weakness.

Weekly Distribution is a short-term gauge that is most helpful in timing entry and exit points, while the longer-term information of trend and relative strength is a more controlling factor in the decision of whether to buy or sell. The Distribution Curve below displays those ETFs with positive RS in uppercase letters and those ETFs with poor RS versus the market in lowercase letters. As well, those ETFs that are on a Point & Figure Buy signal appear in Green letters, while those on Sell signals can appear in Red letters. Box Color indicates the Sector Status Rating. Green = Favored, Yellow = Average, and Red = Unfavored.

Average Level

44.41

| <--100 | -100--80 | -80--60 | -60--40 | -40--20 | -20-0 | 0-20 | 20-40 | 40-60 | 60-80 | 80-100 | 100-> | |||

|

||||||||||||||

This section of the report categorizes select iShares ETFs by their respective broad group. Along with each group, you can view the Average Group Score, which is an average of the scores of all funds represented in that particular group. Those iShares ETFs that meet or exceed the Average Group Score will be highlighted in green in order to easily view those ETFs that have superior strength within their respective group. You want to focus on those ETFs that exhibit superior strength when looking to add new exposure to a particular group.

| Large Cap Funds | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 3.5 | IWY | iShares Russell Top 200 Growth ETF | 5.70 |

| IVW | iShares S&P 500 Growth ETF | 5.62 | |

| OEF | iShares S&P 100 ETF | 5.45 | |

| IYY | iShares Dow Jones U.S. ETF | 4.47 | |

| IWL | iShares Russell Top 200 ETF | 4.44 | |

| IWB | iShares Russell 1000 ETF | 4.35 | |

| IVV | iShares S&P 500 Index | 4.18 | |

| IVE | iShares S&P 500 Value ETF | 2.07 | |

| IWD | iShares Russell 1000 Value ETF | 2.07 | |

| IWX | iShares Russell Top 200 Value ETF | 2.06 |

| Global Funds | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 3.3 | BKF | iShares MSCI BRIC ETF | 4.95 |

| EEM | iShares MSCI Emerging Markets ETF | 4.52 | |

| IEV | iShares Europe ETF | 2.53 | |

| EPP | iShares MSCI Pacific ex-Japan Index Fund | 2.11 | |

| ILF | iShares S&P Latin America 40 ETF | 1.97 | |

| JPXN | iShares JPX-Nikkei 400 ETF | 1.88 | |

| EFA | iShares MSCI EAFE ETF | 1.69 |

| Small Cap Funds | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 3.2 | IWO | iShares Russell 2000 Growth ETF | 5.49 |

| IJT | iShares S&P SmallCap 600 Growth ETF | 3.78 | |

| IWM | iShares Russell 2000 ETF | 2.79 | |

| IJR | iShares S&P SmallCap 600 Index Fund | 2.27 | |

| IJS | iShares S&P SmallCap 600 Value ETF | 2.24 | |

| IWN | iShares Russell 2000 Value ETF | 1.95 |

| Sector Funds | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 3.1 | ITB | iShares U.S. Home Construction ETF | 5.88 |

| IYW | iShares U.S. Tech. ETF | 5.70 | |

| SOXX | iShares PHLX Semiconductor ETF | 5.66 | |

| IGV | iShares North American Tech-Software ETF | 5.61 | |

| IBB | iShares NASDAQ Biotech ETF | 5.54 | |

| IHI | iShares U.S. Medical Devices ETF | 5.18 | |

| IYC | iShares U.S. Consumer Services ETF | 4.98 | |

| IAI | iShares U.S. Broker Dealers & Securities Exchanges ETF | 4.40 | |

| IAI | iShares U.S. Broker Dealers & Securities Exchanges ETF | 4.40 | |

| IYH | iShares U.S. Healthcare ETF | 4.25 | |

| IHF | iShares U.S. Healthcare Providers ETF | 4.24 | |

| IYM | iShares U.S. Basic Materials ETF | 4.11 | |

| IYJ | iShares U.S. Industrial ETF | 3.64 | |

| IYK | iShares U.S. Consumer Goods ETF | 3.38 | |

| IHE | iShares U.S. Pharmaceuticals ETF | 3.14 | |

| IDU | iShares U.S. Utilities ETF | 3.06 | |

| IYF | iShares U.S. Financial ETF | 2.94 | |

| IGN | iShares North American Tech-Multimedia Networking ETF | 2.88 | |

| IYT | iShares U.S. Transportation ETF | 2.57 | |

| IEZ | iShares U.S. Oil Equip. & Svcs. ETF | 1.92 | |

| IYZ | iShares U.S. Telecom ETF | 1.82 | |

| IGE | iShares North American Natural Resources ETF | 1.76 | |

| ITA | iShares U.S. Aerospace & Defense ETF | 1.40 | |

| IAT | iShares U.S. Regional Banks ETF | 1.06 | |

| IAK | iShares U.S. Insurance ETF | 0.93 | |

| IYE | iShares U.S. Energy ETF | 0.86 | |

| IEO | iShares U.S. Oil & Gas Exploration & Production ETF | 0.74 | |

| ICF | iShares Cohen & Steers Realty ETF | 0.71 |

| Mid Cap Funds | Symbol | Name | Score |

|---|---|---|---|

| Average Group Score: 3.1 | IWP | iShares Russell Midcap Growth ETF | 5.55 |

| IJK | iShares S&P MidCap 400 Growth ETF | 5.17 | |

| IWR | iShares Russell Midcap ETF | 3.95 | |

| IJH | iShares S&P MidCap 400 Index Fund | 2.66 | |

| IJJ | iShares S&P MidCap 400 Value ETF | 1.96 | |

| IWS | iShares Russell Midcap Value ETF | 1.74 |

Weekly Updates: No changes.

iShares Sector Rotation Model ISHRSECT

| ETF Name | Symbol | DWA Suggested Weighting | Yield | Date Added |

|---|---|---|---|---|

| iShares NASDAQ Biotech ETF | IBB | 11.111% | 0.2180 | 03/25/2020 |

| iShares North American Natural Resources ETF | IGE | 11.111% | 6.4510 | 05/06/2020 |

| iShares Expanded Tech Sector ETF | IGM | 11.111% | 0.4410 | 03/04/2009 |

| iShares North American Tech-Software ETF | IGV | 11.111% | 0.4310 | 11/07/2007 |

| iShares U.S. Consumer Services ETF | IYC | 11.111% | 0.8880 | 04/28/2010 |

| iShares U.S. Healthcare ETF | IYH | 11.111% | 1.1570 | 04/22/2020 |

| iShares U.S. Industrial ETF | IYJ | 11.111% | 1.3250 | 02/09/2011 |

| iShares U.S. Tech. ETF | IYW | 11.111% | 0.7090 | 03/04/2009 |

| iShares PHLX Semiconductor ETF | SOXX | 11.111% | 1.0980 | 06/18/2014 |

iShares Tactical Model ISHRTACTICAL

| ETF Name | Symbol | DWA Suggested Weighting | Yield | Date Added |

|---|---|---|---|---|

| iShares NASDAQ Biotech ETF | IBB | 12.500% | 0.2180 | 04/15/2020 |

| iShares North American Tech-Software ETF | IGV | 12.500% | 0.4310 | 01/27/2016 |

| iShares U.S. Consumer Services ETF | IYC | 12.500% | 0.8880 | 04/29/2010 |

| iShares U.S. Oil & Gas Exploration & Production ETF | IEO | 12.500% | 3.1800 | 06/10/2020 |

| iShares U.S. Oil Equip. & Svcs. ETF | IEZ | 12.500% | 4.4160 | 05/27/2020 |

| iShares U.S. Medical Devices ETF | IHI | 12.500% | 0.2980 | 01/20/2016 |

| iShares U.S. Home Construction ETF | ITB | 12.500% | 0.5020 | 05/20/2020 |

| iShares PHLX Semiconductor ETF | SOXX | 12.500% | 1.0980 | 08/28/2019 |

iShares International Model ISHRINTL

| ETF Name | Symbol | DWA Suggested Weighting | Yield | Date Added |

|---|---|---|---|---|

| iShares MSCI Switzerland ETF | EWL | 20.000% | 1.5320 | 03/11/2020 |

| iShares MSCI Netherlands ETF | EWN | 20.000% | 0.9610 | 03/04/2020 |

| iShares MSCI Taiwan ETF | EWT | 20.000% | 2.3860 | 12/04/2019 |

| iShares MSCI New Zealand ETF | ENZL | 20.000% | 2.6530 | 05/22/2019 |

| iShares Dow Jones U.S. ETF | IYY | 20.000% | 1.5770 | 08/29/2018 |

iShares Fixed Income Model ISHRFIXED

ETF Name

Symbol

DWA Suggested Weighting

Yield

Date Added

IShares Emerging Markets High Yield Bond ETF

EMHY

20.000%

6.0000

05/27/2020

iShares Barclays 7-10 Year Tres. Bond ETF

IEF

20.000%

1.5060

03/18/2020

iShares iBoxx $ Investment Grade Corp. Bond ETF

LQD

20.000%

2.9350

07/01/2020

iShares Barclays 3-7 Year Treasury Bond ETF

IEI

20.000%

1.5640

03/18/2020

iShares Preferred & Income Securities ETF

PFF

20.000%

5.6430

04/15/2020