There are two First Trust Models with changes this week; the First Trust Focus Five (FTRUST5) and First Trust Thematic Focus Five (Total Return) (FTTHEME5.TR) Models.

There are two First Trust Models with changes this week.

First Trust Focus Five Model

This marks the fifth change to the First Trust Focus Five Model (FTRUST5) since the start of 2025 as is removing the First Trust Utilities AlphaDEX Fund (FXU) due to the fund falling below the sell threshold within the Model’s relative strength matrix rankings. In its place, the First Trust NYSE Arca Biotechnology Index Fund (FBT) is being added, which is the highest fund not already owned within the Model’s matrix. The fund has maintained a positive trend since June last year and currently shows positive near and long-term relative strength against the market, leading the ETF to sustain a strong fund score of 5.52. With the change, the model will rebalance the five holdings to equally weighted at 20% and will now maintain exposure to the Internet (FDN), Financials (FXO), Semiconductors (FTXL), Aerospace & Defense (MISL), and Biotechnology (FBT).

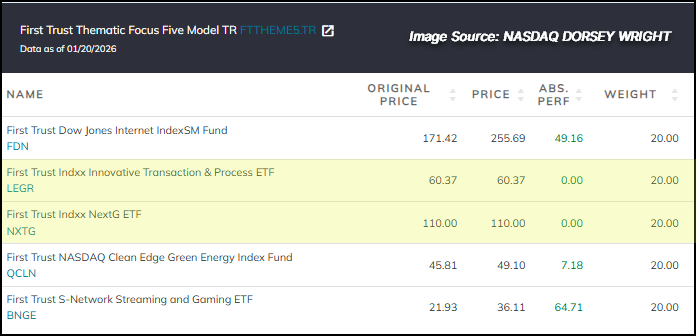

First Trust Thematic Focus Five Model

There are two changes to the First Trust Thematic Focus Five Model (Total Return) (FTTHEME5.TR) this week.

The change this week involves the removal of the First Trust Cloud Computing ETF (SKYY.TR) and the First Trust Nasdaq Cybersecurity ETF (CIBR.TR), as both fell below the sell threshold within the Model’s total return relative strength matrix. In its place, the Model is adding the First Trust Indxx Innovative Transaction & Process ETF (LEGR.TR) and the First Trust Indxx NextG ETF (NXTG.TR). LEGR and NXTG have maintained a positive trend on their default point and figure trend chart since May of last year and currently show positive near and long-term relative strength against the market, leading the ETFs to sustain strong fund scores of 5.55 and 5.47, respectively. With the change, the model will rebalance the five holdings to equally weighted at 20% and will now maintain exposure to the Internet (FDN.TR), S-Network Streaming and Gaming (BNGE.TR), Clean Energy (QCLN.TR), Transaction & Processing (LEGR.TR), and NextG (communications) (NXTG.TR).