There are two First Trust Models with changes this week.

First Trust Focus Five Model

This marks the fifth change to the First Trust Focus Five Model (FTRUST5) since the start of 2025 as is removing the First Trust Utilities AlphaDEX Fund (FXU) due to the fund falling below the sell threshold within the Model’s relative strength matrix rankings. In its place, the First Trust NYSE Arca Biotechnology Index Fund (FBT) is being added, which is the highest fund not already owned within the Model’s matrix. The fund has maintained a positive trend since June last year and currently shows positive near and long-term relative strength against the market, leading the ETF to sustain a strong fund score of 5.52. With the change, the model will rebalance the five holdings to equally weighted at 20% and will now maintain exposure to the Internet (FDN), Financials (FXO), Semiconductors (FTXL), Aerospace & Defense (MISL), and Biotechnology (FBT).

First Trust Thematic Focus Five Model

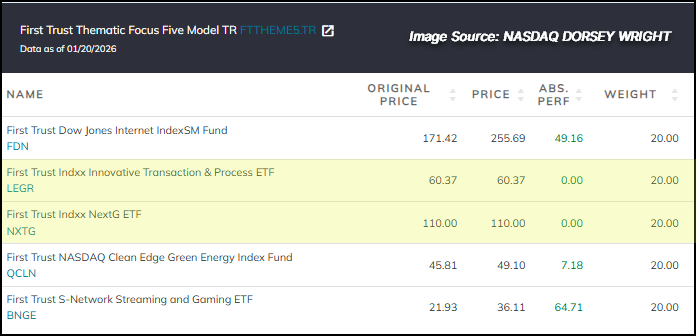

There are two changes to the First Trust Thematic Focus Five Model (Total Return) (FTTHEME5.TR) this week.

The change this week involves the removal of the First Trust Cloud Computing ETF (SKYY.TR) and the First Trust Nasdaq Cybersecurity ETF (CIBR.TR), as both fell below the sell threshold within the Model’s total return relative strength matrix. In its place, the Model is adding the First Trust Indxx Innovative Transaction & Process ETF (LEGR.TR) and the First Trust Indxx NextG ETF (NXTG.TR). LEGR and NXTG have maintained a positive trend on their default point and figure trend chart since May of last year and currently show positive near and long-term relative strength against the market, leading the ETFs to sustain strong fund scores of 5.55 and 5.47, respectively. With the change, the model will rebalance the five holdings to equally weighted at 20% and will now maintain exposure to the Internet (FDN.TR), S-Network Streaming and Gaming (BNGE.TR), Clean Energy (QCLN.TR), Transaction & Processing (LEGR.TR), and NextG (communications) (NXTG.TR).

This weekly overview is designed to be used as a "radar" screen to bring your attention to potentially important technical changes that may require your attention and potential action. When evaluating the Fund Score, the strongest issues have scores of 4 or higher while those ETFs with scores below a 3 are no longer considered solid citizens.

Symbol

Name

Price

Fund Score

PnF Signal

RS Col.

PnF Trend

Weekly Mom

AIRR

First Trust RBA American Industrial Renaissance ETF

111.70

5.89

Buy

X

Positive

+

6W

DDIV

First Trust Nasdaq Dorsey Wright Momentum & Dividend ETF

42.20

3.94

Buy

X

Positive

-

1W

DTRE

First Trust Alerian Disruptive Technology Real Estate ETF

39.90

1.61

Sell

O

Positive

+

2W

EMLP

First Trust North American Energy Infrastructure Fund

39.07

3.78

Buy

O

Positive

+

2W

FAB

First Trust Multi Cap Value AlphaDEX Fund

92.08

4.23

Buy

O

Positive

+

10W

FAD

First Trust Multi Cap Growth AlphaDEX Fund

168.06

5.38

Buy

X

Positive

+

6W

FAN

First Trust Global Wind Energy ETF

21.48

5.81

Buy

X

Positive

+

5W

FBT

First Trust NYSE Arca Biotechnology Index Fund

212.13

5.52

Buy

X

Positive

-

6W

FCG

First Trust Natural Gas ETF

23.63

2.47

Buy

O

Positive

-

6W

FDD

First Trust STOXX European Select Dividend Index Fund

17.58

5.74

Buy

X

Positive

-

1W

FDL

First Trust Morningstar Dividend LeadersSM Index Fund

45.81

3.33

Buy

O

Positive

+

11W

FDM

First Trust Dow Jones Select MicroCap IndexSM Fund

81.96

5.59

Buy

X

Positive

-

3W

FDN

First Trust Dow Jones Internet IndexSM Fund

255.69

3.23

Buy

O

Positive

-

2W

FEX

First Trust Large Cap Core AlphaDEX Fund

121.63

4.14

Buy

X

Positive

+

8W

FGD

First Trust Dow Jones Global Select Dividend Index Fund

30.63

4.54

Buy

X

Positive

-

3W

FIW

First Trust Water ETF

113.22

3.68

Buy

O

Positive

+

3W

FNX

First Trust Mid Cap Core AlphaDEX Fund

132.75

4.27

Buy

X

Positive

+

8W

FPX

First Trust US Equity Opportunities ETF

166.21

4.71

Buy

O

Positive

-

3W

FRI

First Trust S&P REIT Index Fund

28.14

2.58

Sell

O

Negative

+

2W

FTA

First Trust Large Cap Value Opportunities AlphaDEX Fund

87.96

3.26

Buy

O

Positive

+

11W

FTC

First Trust Large Cap Growth Opportunities AlphaDEX Fund

162.74

5.10

Buy

X

Positive

+

6W

FTDS

First Trust Dividend Strength ETF

58.60

3.41

Buy

O

Positive

+

11W

FTGC

First Trust Global Tactical Commodity Strategy Fund

24.28

3.25

Buy

O

Positive

+

2W

FTRI

First Trust Indxx Global Natural Resources Income ETF

17.23

4.83

Buy

X

Positive

+

8W

FVD

First Trust Value Line Dividend Index Fund

47.10

2.81

Buy

O

Positive

+

3W

FXD

First Trust Consumer Discretionary AlphaDEX Fund

69.79

4.88

Buy

X

Positive

-

1W

FXG

First Trust Consumer Staples AlphaDEX Fund

64.30

1.95

Sell

O

Negative

+

3W

FXH

First Trust Health Care AlphaDEX Fund

116.11

3.77

Buy

X

Positive

-

5W

FXL

First Trust Technology AlphaDEX Fund

170.88

4.92

Buy

X

Positive

-

1W

FXN

First Trust Energy AlphaDEX Fund

17.02

3.52

Buy

X

Positive

+

1W

FXO

First Trust Financials AlphaDEX Fund

60.18

4.96

Buy

X

Positive

-

2W

FXR

First Trust Industrials/Producer Durables AlphaDEX Fund

85.41

5.26

Buy

X

Positive

+

8W

FXU

First Trust Utilities AlphaDEX Fund

46.13

4.10

Sell

X

Positive

+

2W

FXZ

First Trust Materials AlphaDEX Fund

72.17

4.53

Buy

X

Positive

+

8W

FYX

First Trust Small Cap Core AlphaDEX Fund

119.32

5.51

Buy

X

Positive

+

8W

MDIV

Multi-Asset Diversified Income Index Fund

16.06

2.02

Buy

O

Positive

+

3W

QABA

First Trust NASDAQ ABA Community Bank Index Fund

58.51

2.77

Buy

O

Positive

-

3W

QCLN

First Trust NASDAQ Clean Edge Green Energy Index Fund

49.10

4.97

Buy

O

Positive

+

5W

QQEW

First Trust Nasdaq-100 Select Equal Weight ETF

138.57

4.21

Buy

X

Positive

-

3W

QQXT

First Trust NASDAQ-100 Ex-Technology Sector IndexSMFund

99.43

3.33

Sell

O

Positive

-

1W

QTEC

First Trust NASDAQ-100-Technology Sector IndexSMFund

232.46

4.79

Buy

X

Positive

-

3W

RBLD

First Trust Alerian US NextGen Infrastructure ETF

77.75

3.95

Buy

X

Positive

+

3W

TDIV

First Trust NASDAQ Technology Dividend Index Fund

96.78

4.67

Sell

X

Positive

-

1W

The ETFs with the most relative strength buy signals (suggesting outperformance) versus the others in the group are listed at the top. These ETFs should be overweighted in the portfolio. Those ETFs with the least amount of relative strength buy signals versus the others in the group are listed at the bottom. These ETFs should be underweighted in the portfolio.

The First Trust ETF Portfolios are designed to identify major sector themes in the market place through the use of the Point & Figure relative strength tools. For more information on the portfolio construction and back testing, see the model info file on the models page. To enter a portfolio amount and see shares to be purchased as well as modify the portfolio to your specifications, click here. (Note: The First Trust ETF Portfolios will be updated Wednesday mornings by 9:30 am EST)

Weekly Changes: There are two First Trust Models with changes this week; the First Trust Focus Five (FTRUST5) and First Trust Thematic Focus Five (Total Return) (FTTHEME5.TR) Models.

First Trust Sector Model FTRUST

| ETF Name | Symbol | NDW Suggested Weighting | Yield | Date Added |

|---|---|---|---|---|

| First Trust NYSE Arca Biotechnology Index Fund | FBT | 14.286% | 0.0000 | 11/25/2025 |

| First Trust Dow Jones Internet IndexSM Fund | FDN | 14.286% | 0.0000 | 06/13/2023 |

| First Trust Utilities AlphaDEX Fund | FXU | 14.286% | 2.2885 | 04/01/2025 |

| First Trust Global Wind Energy ETF | FAN | 14.286% | 1.3395 | 06/17/2025 |

| First Trust NASDAQ Clean Edge Green Energy Index Fund | QCLN | 14.286% | 0.2548 | 09/23/2025 |

| First Trust Nasdaq Semiconductor ETF | FTXL | 14.286% | 0.2841 | 07/01/2025 |

| First Trust Nasdaq Bank ETF | FTXO | 14.286% | 1.9185 | 11/12/2024 |

* - Dates prior to 1/9/2008, which is when the First Trust Sector ETF Model Portfolio became available in the First Trust Weekly ETF Report, are representative of when the position was added to the backtested model.

First Trust Focus Five Model FTRUST5

| ETF Name | Symbol | NDW Suggested Weighting | Yield | Date Added |

|---|---|---|---|---|

| First Trust NYSE Arca Biotechnology Index Fund | FBT | 20.000% | 0.0000 | 01/20/2026 |

| First Trust Dow Jones Internet IndexSM Fund | FDN | 20.000% | 0.0000 | 06/06/2023 |

| First Trust Financials AlphaDEX Fund | FXO | 20.000% | 1.7791 | 12/10/2024 |

| First Trust Nasdaq Semiconductor ETF | FTXL | 20.000% | 0.2841 | 11/11/2025 |

| First Trust Indxx Aerospace & Defense ETF | MISL | 20.000% | 0.3996 | 12/09/2025 |

* - The next evaluation date for the Focus Five Model is Wednesday, February 11th, 2026. Dates prior to 10/20/2009, which is when the First Trust Focus Five ETF Model Portfolio became available in the First Trust Weekly ETF Report, are representative of when the position was added to the backtested model.

First Trust Thematic Focus Five Model TR FTTHEME5.TR

| ETF Name | Symbol | NDW Suggested Weighting | Yield | Date Added |

|---|---|---|---|---|

| First Trust Indxx NextG ETF | NXTG.TR | 20.000% | 1.5620 | 01/20/2026 |

| First Trust NASDAQ Clean Edge Green Energy Index Fund TR | QCLN.TR | 20.000% | 0.2548 | 12/09/2025 |

| First Trust Dow Jones Internet IndexSM Fund TR | FDN.TR | 20.000% | 0.0000 | 09/05/2023 |

| First Trust S-Network Streaming and Gaming ETF TR | BNGE.TR | 20.000% | 0.8853 | 09/05/2023 |

| First Trust Indxx Innovative Transaction & Process ETF TR | LEGR.TR | 20.000% | 1.8367 | 01/20/2026 |

* - The next evaluation date for the Thematic Focus Five Model is Wednesday, February 11th, 2026. Dates prior to 9/13/2023, which is when the First Trust Thematic Focus Five ETF Model Portfolio became available in the First Trust Weekly ETF Report, are representative of when the position was added to the backtested model.

First Trust International Model FTRUSTINTL

| ETF Name | Symbol | NDW Suggested Weighting | Yield | Date Added |

|---|---|---|---|---|

| First Trust Europe AlphaDEX Fund | FEP | 20.000% | 3.3320 | 12/16/2025 |

| First Trust China AlphaDEX Fund | FCA | 20.000% | 2.6621 | 12/03/2024 |

| First Trust United Kingdom Alphadex Fund | FKU | 20.000% | 2.8890 | 01/16/2024 |

| First Trust Germany AlphaDEX Fund | FGM | 20.000% | 0.6633 | 06/17/2025 |

| First Trust Eurozone AlphaDEX Fund | FEUZ | 20.000% | 2.8131 | 03/04/2025 |

* - The next evaluation date for the International Focus Five Model is Wednesday, February 4th, 2026. Dates prior to 2/22/2012, which is when the First Trust International Focus Five ETF Model Portfolio became available in the First Trust Weekly ETF Report, are representative of when the position was added to the backtested model.

First Trust Size and Style Model FTSIZESTYLE

| ETF Name | Symbol | NDW Suggested Weighting | Yield | Date Added |

|---|---|---|---|---|

| First Trust Large Cap Growth Opportunities AlphaDEX Fund | FTC | 33.333% | 0.2002 | 06/20/2023 |

| First Trust Large Cap Core AlphaDEX Fund | FEX | 33.333% | 1.0986 | 10/24/2023 |

| First Trust Mid Cap Growth AlphaDEX Fund | FNY | 33.333% | 0.0326 | 06/24/2025 |

First Trust Income Model FTINCOME

| ETF Name | Symbol | NDW Suggested Weighting | Yield | Date Added |

|---|---|---|---|---|

| First Trust STOXX European Select Dividend Index Fund | FDD | 20.000% | 3.9920 | 04/01/2025 |

| First Trust Dow Jones Global Select Dividend Index Fund | FGD | 20.000% | 5.6170 | 01/06/2026 |

| First Trust North American Energy Infrastructure Fund | EMLP | 20.000% | 3.1812 | 04/12/2022 |

| First Trust NASDAQ Technology Dividend Index Fund | TDIV | 20.000% | 1.4053 | 08/12/2025 |

| First Trust Rising Dividend Achievers ETF | RDVY | 20.000% | 1.1133 | 01/13/2026 |

First Trust Fixed Income Model (TR) FTFIXINC.TR

| ETF Name | Symbol | NDW Suggested Weighting | Yield | Date Added |

|---|---|---|---|---|

| First Trust Tactical High Yield ETF TR | HYLS.TR | 25.000% | 6.3905 | 07/22/2025 |

| First Trust Preferred Securities and Income ETF TR | FPE.TR | 25.000% | 5.8123 | 10/21/2025 |

| First Trust SSI Strategic Convertible Securities ETF TR | FCVT.TR | 25.000% | 1.9694 | 12/09/2025 |

| First Trust Emerging Markets Local Currency Bond ETF TR | FEMB.TR | 25.000% | 5.6807 | 04/22/2025 |

Am I better off owning the managed mutual fund or the unmanaged ETF? The table below will help you answer that question. For each of the nine major asset classes and sectors, see the Top 20 mutual funds in NAV compared to the First Trust Universe of ETFs. The results are ordered by Fund Score, from highest to lowest. The Fund Score is a snapshot of the overall health of the fund based upon relative strength versus the broad market, relative strength versus its peers, and other trend measures. Those ETFs and Funds with a score above 3 are considered solid citizens with those having scores of 4 and above ideal candidates for purchase. Those ETFs and Funds with a score below 3 should be examined closer from a technical basis as they are not holding their ground versus the market and their peer group.

| Large Cap Value | Large Cap Blend | Large Cap Growth |

| Mid Cap Value | Mid Cap Blend | Mid Cap Growth |

| Small Cap Value | Small Cap Blend | Small Cap Growth |

| Sectors | ||

(Click any link above to see the Fund Score of the First Trust ETFs and the funds with the largest Net Assets in that category)