There were no model changes. The focus fund is the Xtrackers Russell 1000 Comprehensive Factor ETF (DEUS)

There were no changes to any of the DWS models this week.

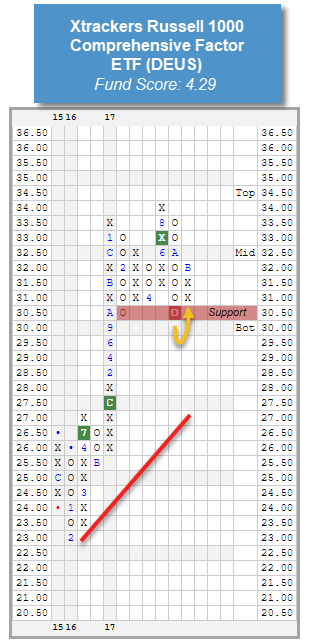

This week, we are going to take a look at the Xtrackers Russell 1000 Comprehensive Factor ETF DEUS. As a refresher, this fund seeks to follow the performance, before fees and expenses, of the Russell 1000 Comprehensive Factor Index, which filters through the Russell 1000 based on Quality, Value, Momentum, Low Volatility, and Size screens. This fund reached a new all-time high in August, before pulling back with the broader market in October, and ultimately finding support at the February low of $30.50. The fund has shown a rebound in early November with its reversal up into a column of Xs at $32. DEUS has been able to maintain a strong fund score throughout the market turbulence, most recently posting a score of 4.29. This is better than the average for Domestic Growth of 3.75 as well as the average for all US of 3.22. Weekly momentum also just flipped positive, indicating the potential for further price appreciation. Those looking to add domestic equity exposure can look to DEUS as an option to do so on this recent reversal upwards. Support can be found at $30.50.