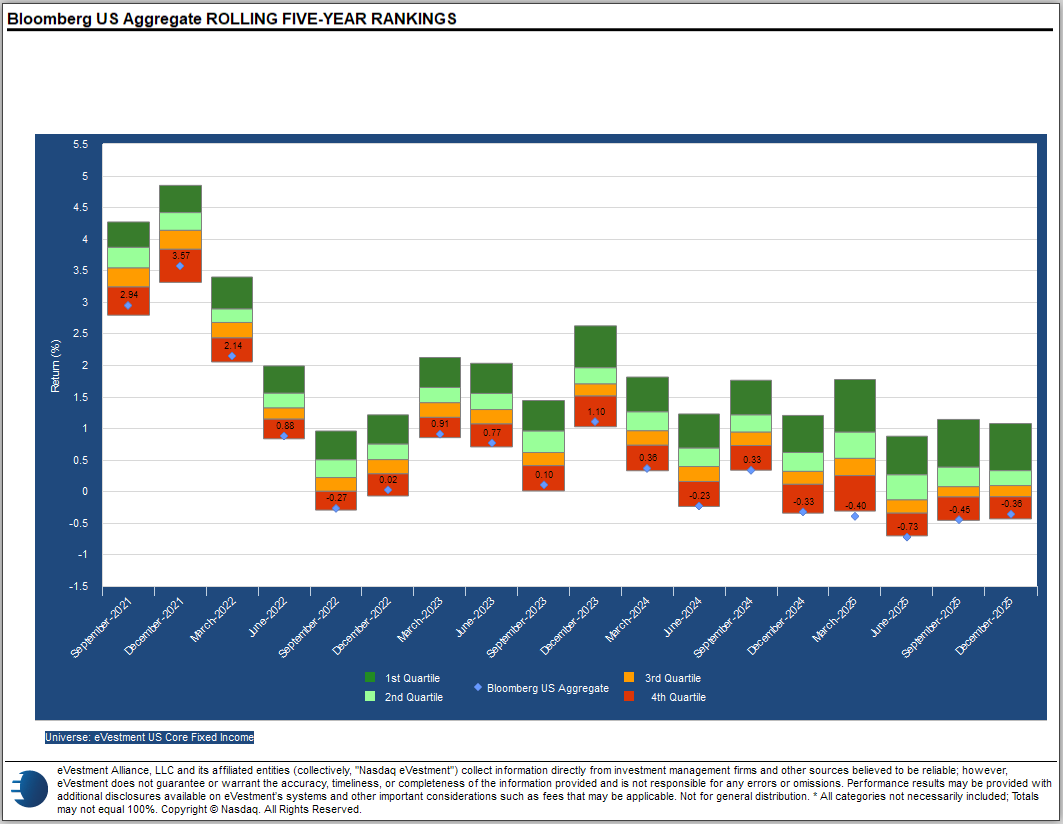

Active managers continue to outperform in fixed income markets.

Last week, we updated our review of active vs. passive management – a look at which management style has an advantage on a market-by-market basis. As regular readers of this report already know, our most recent review showed what has long been the case – of the various markets we reviewed, fixed income has had the most consistent bias favoring active management. If the performance advantage, in and of itself, was not reason enough to favor active over passive management in fixed income, there are other issues with passive bond indexes that may make active management a more suitable choice. The problems with passive fixed income provide a potential win for you as an advisor – informing your clients about the pitfalls of passive fixed, your plan to avoid them, and then selecting actively managed strategies for their portfolios in a market where the passive benchmark routinely underperforms most active managers.

For our discussion of the problems with passive fixed income, we will focus on the Bloomberg Barclays US Aggregate Bond Index (LBUSTRUU) as it is perhaps the most ubiquitous passive bond index in the world. However, the potential pitfalls discussed herein are not unique to the AGG Index and pertain to most, if not all, passive bond indices with similar construction methodologies.

Performance

As we’ve already mentioned, performance is one of the major drawbacks of passively managed fixed income. While the S&P 500 (SPX) has been a very difficult benchmark for stock pickers over the last decade, the US Agg has consistently lagged most active fixed income managers, meaning that investors who have chosen an Agg-tracking fund over a passive strategy have likely sacrificed performance.

Your Exposure Can Materially Change Without You Doing Anything

Unlike the major equity indices, which usually have stable constituencies from year to year, the composition of bond indices changes much more frequently. Whereas the S&P 500 and the Russell 1000 (RUI) are updated quarterly and annually, respectively, the composition of the Bloomberg Barclays US Aggregate Index changes monthly. The iShares Core U.S. Aggregate Bond ETF (AGG), for instance, had a turnover of 81% for the 12-month period ending February 28, 2025; meanwhile, the SPDR S&P 500 ETF (SPY) had a turnover of just 3% for the 12 months ending 9/20/25.

Why should the average investor care about the more frequent rebalances and higher turnover of fixed income indices? With about 7% of the holdings in the Aggregate Bond ETF changing every month on average, exposure a fixed income portfolio can change quickly and it can happen under the surface, i.e., without an advisor or client seeing any trades in the portfolio. While this is often viewed as a primary benefit of the ETF product structure, it may not be as advantageous if you don’t realize it’s happening or understand the impact of the changes. Unless the client is looking at the exposure breakdown of the index every month, they could find that the exposure in the indexed bond ETF they bought six months ago looks very different than the exposure it brings to the portfolio today.

The “Bums” Problem

The fast-changing nature of fixed income indices we discussed above also contributes to the “bums” problem. As with equity indices, many fixed income indices are essentially market cap weighted. In equity indices, market cap weighting means that the most historically successful companies (at least in terms of increasing their market value) become the most heavily weighted. In a market cap-weighted fixed income index, the most heavily weighted entities are those that have issued the most debt. This presents a problem for the buyer of a cap-weighted fixed income index, as they will be most heavily exposed to the most debt-laden and not necessarily the most creditworthy of issuers. Apple (AAPL) has been a star of the US equity market for two decades and maintained an enviable credit rating for many years but only had its first bond issuance in 2013. As such, despite being one of the largest companies in the world, AAPL couldn’t have been included in fixed income funds before that time.

Furthermore, unlike equity indices which typically include only corporations, issuers within fixed income indices can include corporations, states and municipalities, and sovereign governments. Heavily indebted sovereign governments present a unique challenge as they can (and at various points have) simply dec.de to cease payments on their notes, leaving debtholders with limited recourse.

The “bums” problem can be mitigated by utilizing another weighting schema, e.g., equal weighting, but this can introduce new problems, such as a heavier weighting toward thinly traded, illiquid issues. And so, many bond funds employ some form of market cap weighting, and the impacts of this are quite different than we find within the US equities.

Passive Bond Indexes Can Become Riskier at the Worst Time

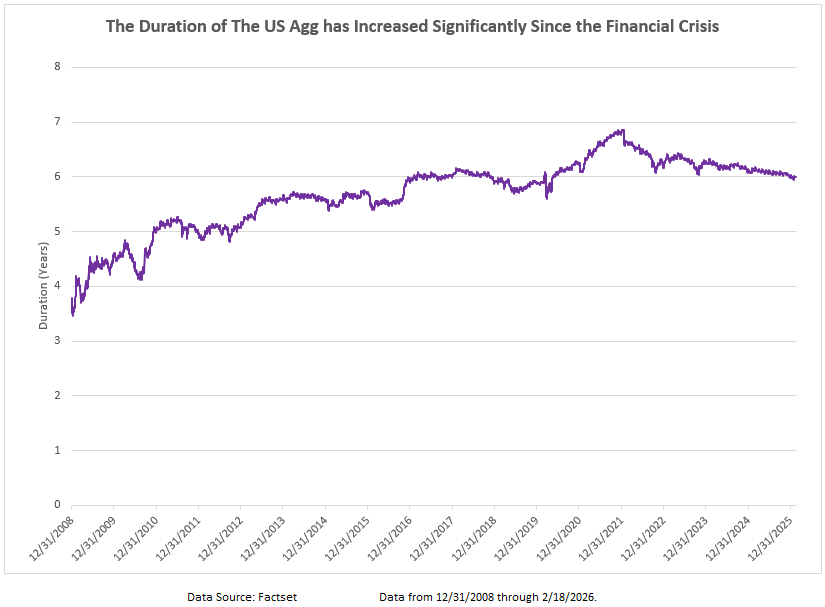

You’re undoubtedly aware that prior to 2022 we had been in an ultra-low interest rate environment for many years and a declining rate environment for far longer still. That trend has shifted, but among the effects of the years of low-interest rates is that the bond market itself has become riskier.

Since 2009, the duration of the US AGG Index has increased from around 3.5 years to around six years. For the bond aficionados out there, this suggests that a 1% move higher in the yield curve today would cause a corresponding decline in bond valuations of about 2.5% more than a similar rate move back in 2009.

This is caused, again, by passive bond portfolios investing in a market that hasn’t itself remained “passive”. Although the duration risk of the AGG has improved moderately in the last couple of years as higher interest rates have pushed coupons higher and made long-term debt less attractive, the core market remains significantly more sensitive to rate movements than it was prior to the financial crisis and this shift in risk happened under the surface of AGG-tracking funds. While there are additions to deletions to equity indexes, if you own SPY you probably have a pretty good idea of what your exposure is, even if you haven’t recently reviewed a holdings list. However, in the case of a passive fixed income fund, the exposure could have materially shifted since you added it to your client’s portfolio.

Developing a Strategy

In our estimation, a market like fixed income - where active management has a record of outperformance and the exposure of passive funds can change under the surface – is an ideal environment for a tactical approach. Currently, the fixed income rankings in the Asset Class Group Scores favor convertible bonds and non-US exposure while many “core” groups (which comprise the US Agg) sit toward the bottom of the rankings. But this is not a static situation. There will almost certainly come point when long-term yields decline, rewarding the duration exposure of the core, and if that decline is due to a slowing economy, segments of the market with high credit risk, like high yield corporates could experience significant declines. Tactical strategies will attempt to navigate these potential shifts by allocating toward strength in the market.

Tactical fixed income strategies are available both as separately managed accounts and guided models on the NDW platform. If you would like to discuss tactical managed account solutions please contact Andy Hyer at AndyH@dorseymm.com or (626)535-0630.

If you are interested in implementing a guided model we have several options available on the platform including:

- The First Trust Fixed Income Model (FTFIXINC.TR)

- The iShares Fixed Income Model (ISHRFIXED.TR)

- The NDW Tactical + Ladders Fixed Income Model (LADDERS.TR)

Each of these models are rules-based, relative strength-guided methodologies capable of providing rotation within the fixed income asset class. Each model employs a unique investment inventory that dictates both the boundaries by which it may concentrate exposure and the markets it may utilize. Collectively, they offer solutions for fixed income sleeves within a larger portfolio or can be part of a core-satellite strategy that uses low-cost indexing as well.