Single stock volatility relative to index volatility reaches historically elevated levels, a tailwind for momentum strategies thus far in 2026.

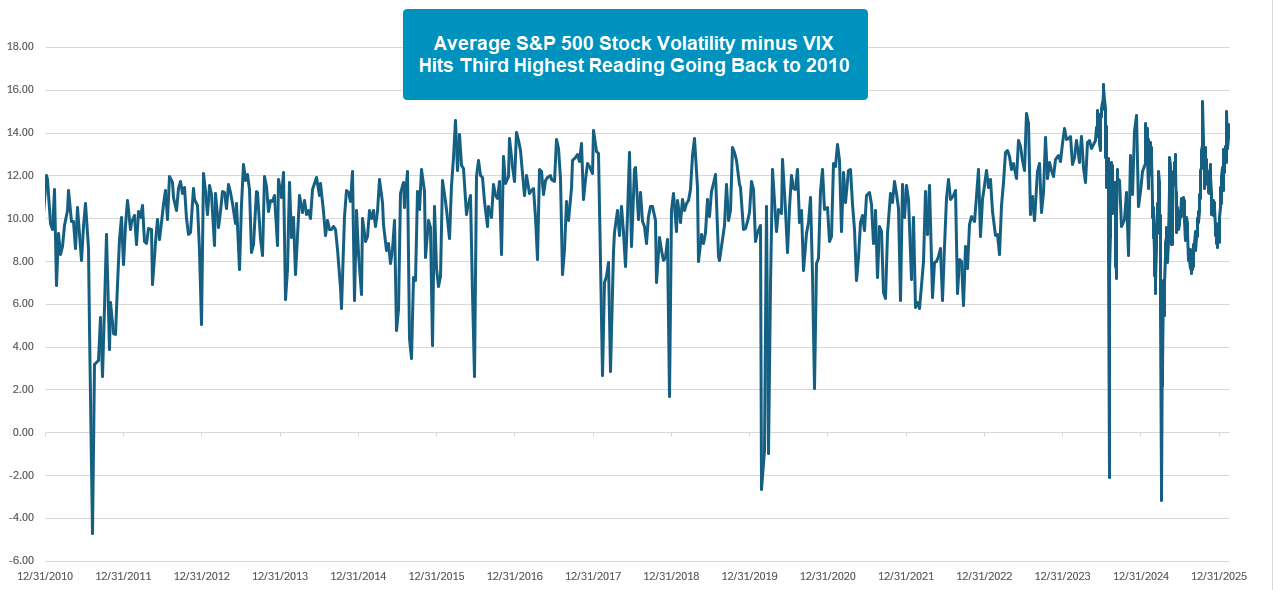

The broad market has taken a breather to start 2026 with the S&P 500 essentially flat on the year. However, underneath the surface on the single stock level there is plenty of movement to consider. While we often refer to dispersion in a momentum or relative strength framework, one of the biggest trades in Wall Street is the volatility dispersion trade which looks to take advantage of the difference in single-stock volatility compared to index volatility. One way to look at this difference in volatility is to compare the average single-stock implied volatility versus that of the CBOE Volatility Index (VIX). Historically, this spread is almost always positive, which is to be expected as single-stock volatility, even on average, is higher than that of the S&P 500. However, if the spread gets elevated to levels it is currently at, there is usually some absolute volatility expansion at the index level to “catch-up” to volatility of individual names. On the flip side, when the spread between stock and index volatility gets close to zero or turns negative, these have been historically great buying opportunities. In other words, volatility dispersion is mean reverting.

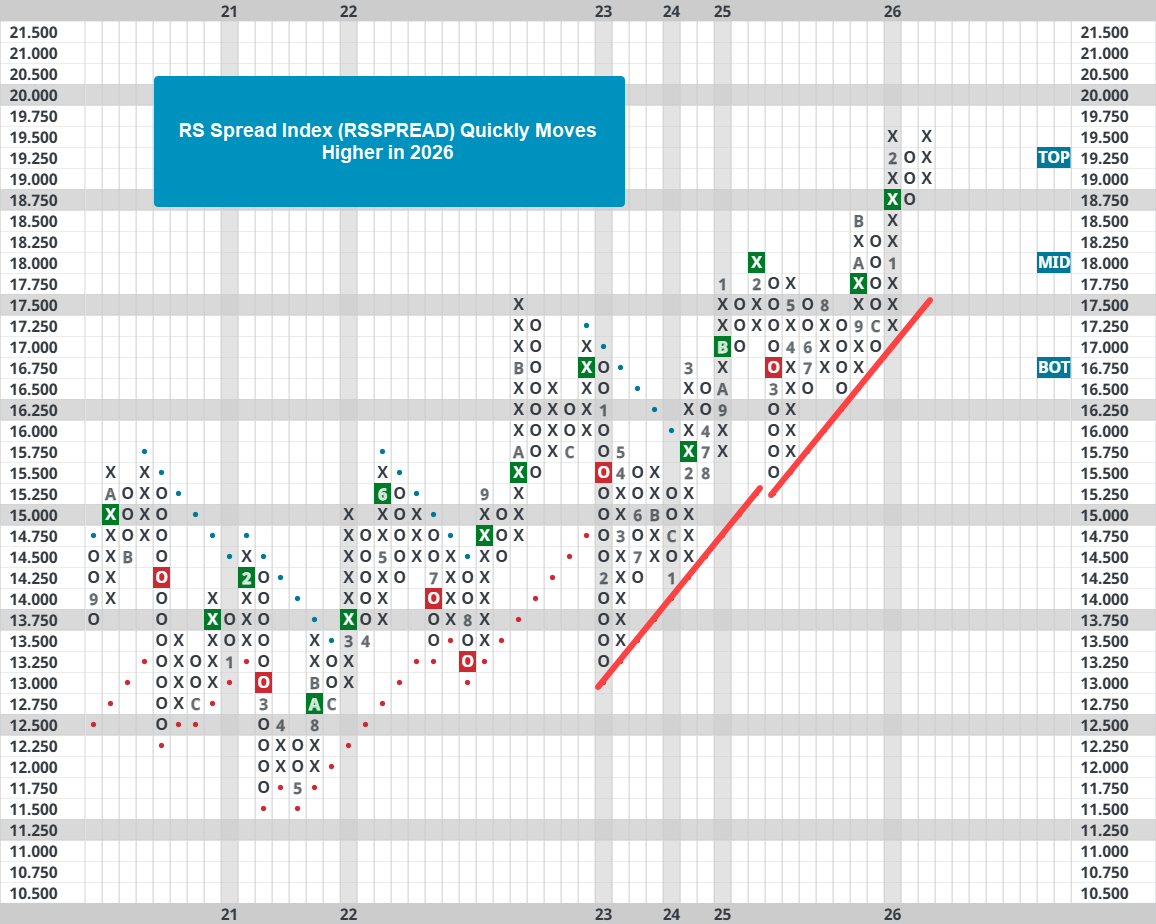

High single-stock volatility, relative to index volatility, can be a great environment for strategies that look to take advantage of differences in stock performance, like momentum. Winners can win big while losers can lose a lot. This is what we’ve experienced so far this year as relative stock volatility is high and high-momentum stocks have done well. One way we quantify the state of momentum is the RS Spread Index (RSSPREAD) which tracks the difference in performance between high and low momentum baskets of stocks. When RSSPREAD is rising, high momentum names are performing better than low momentum names with the opposite also being true. RSSPREAD quickly broke out to new all-time highs to start the year and continued to push higher through February. Fortunately, momentum strategies have been able to take advantage of the big movement in stocks to start their year.

Moving forward, it is hard to expect the difference between single stock and index volatility to stay as elevated as it has been. That doesn’t mean disaster is on the horizon, but some combination of lower stock volatility and higher index volatility is to be expected in the short term. This may lead to a slowdown in the exceptionally strong year for momentum. However, this is perfectly normal, and “slowdown” does not necessarily mean underperformance, it’s very possible momentum continues to do well just not at the level it has to start the year. Investing is full of ups and downs. It’s important to not only to have an investment process, but also a mental framework for dealing with those ups and downs - to stay even keel through both good and bad times.