The pullback in equities has had a much higher impact on the cap-weighted S&P 500 Index ([SPX]) than its equal-weighted counterpart.

Weekly Size and Style Update Video (7:06)

Weekly Asset Class Group Score Update Video (4:13)

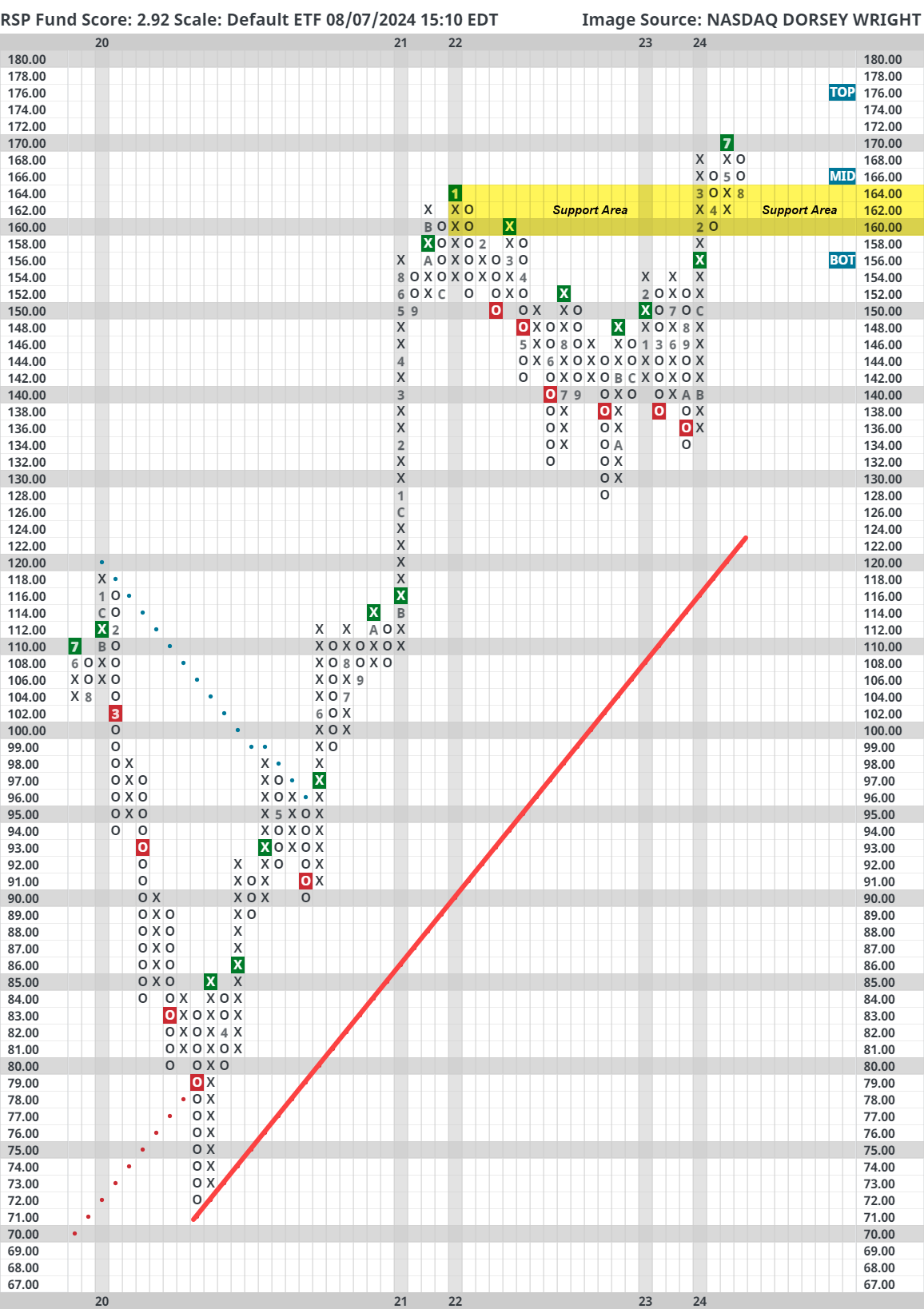

The pullback in equities has had a much higher impact on the cap-weighted S&P 500 Index (SPX) than its equal-weighted counterpart. The Invesco S&P 500 Equal Weight ETF (RSP) is still a relative strength laggard compared to SPY, but the fact that it held up better than SPY should be noted. RSP saw its fund score drop back below the 3.0 threshold as it has oscillated around this score for months. However, RSP remains on two consecutive buy signals on its default chart and is trading near an area of major support. Right now, RSP is charting at $164 which was its prior all-time high from 2022 and support from April at $160. This is a key area for the equal-weight representative to hold and keep the recent improvement in breadth going strong. A failure to hold this area would be a significant negative development for the market.