India continues to gain relative strength amidst uncertainty from the broader international equity space.

International equities saw declining relative strength over the past week, leading the asset class to fall from second to third in our DALI rankings. This relative weakness was more a result of the rapid improvement in small caps than it was deterioration in foreign stocks, as we cover in today’s Major Index and DALI overview. Still, the relative strength picture for international equities is, at best, uncertain. We have seen the asset class remain close with commodities in our DALI rankings for weeks. The broader space has been unable to show further follow-through to the upside after brief periods of improvement. This makes it more important to focus on favorable areas within the asset class that have separated themselves from the field.

Once such area is India, which just moved back into the top ten ranked countries in our NDW Country Index Matrix Ranking this week for the first time since December 2022. We have also seen India sit near the top of all 134 groups on our Asset Class Group Scores (ACGS) rankings for several weeks (currently third), and it is the only non-US group with an average score north of 5.00.

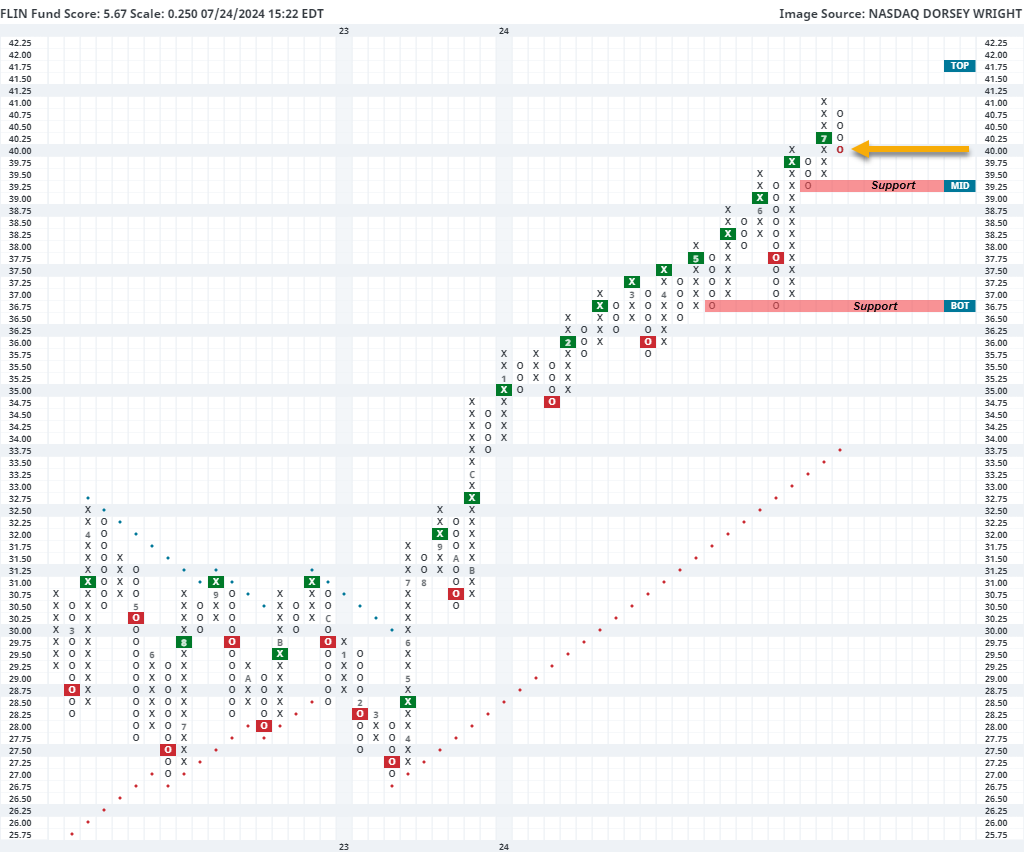

Most of the cap-weighted India funds have pulled back slightly from all-time highs over the past week, potentially offering an opportunity for those looking to add exposure. This includes the Franklin FTSE India ETF FLIN, which pulled back on its ¼ point chart from the all-time high of $41 down to $40, just above the mid-point of its trading band. This fund has shown consistent improvement for over a year and currently sits on two consecutive buy signals on the ¼ point chart after rising over 14% so far through 2024. Those looking to add exposure toward India may consider FLIN on this pullback, with initial support offered at $39.25. Further support may be seen at $36.25.